Quant Mutual Fund has 100% exposure to silver but none in gold because of an imminent short-term correction in the bullion. However, from a long-time perspective, the asset manager remains positive on the yellow metal, said Sandeep Tandon, founder and chief investment officer of Quant Capital Markets.

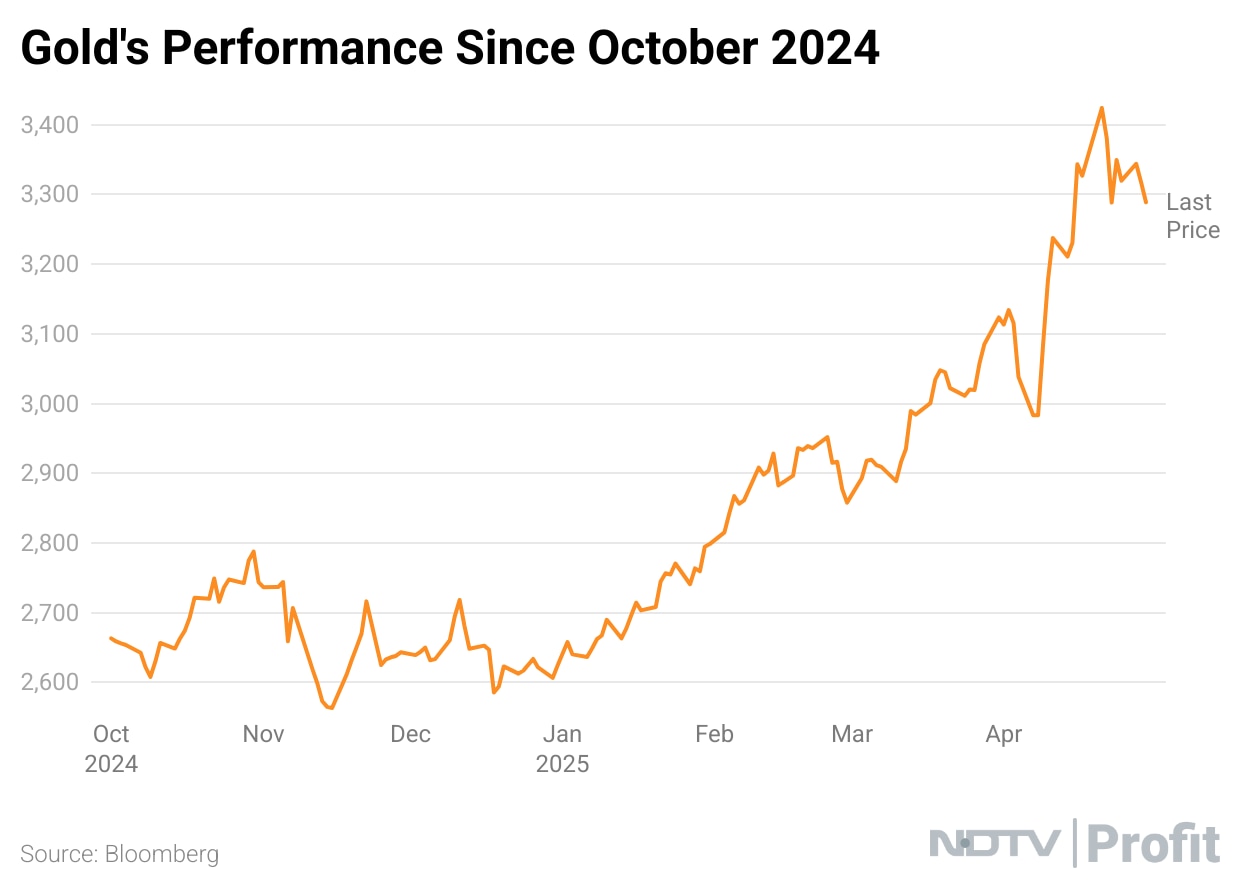

The gold rally has peaked out and now a 10-12% correction is on the cards. With long-term perspective in mind, investors may adjust for short-term corrections, he said in an interview with NDTV Profit.

Tandon emphasised on the importance of tracking macroeconomic fundamentals to detect inflection points to hedge one's portfolio.

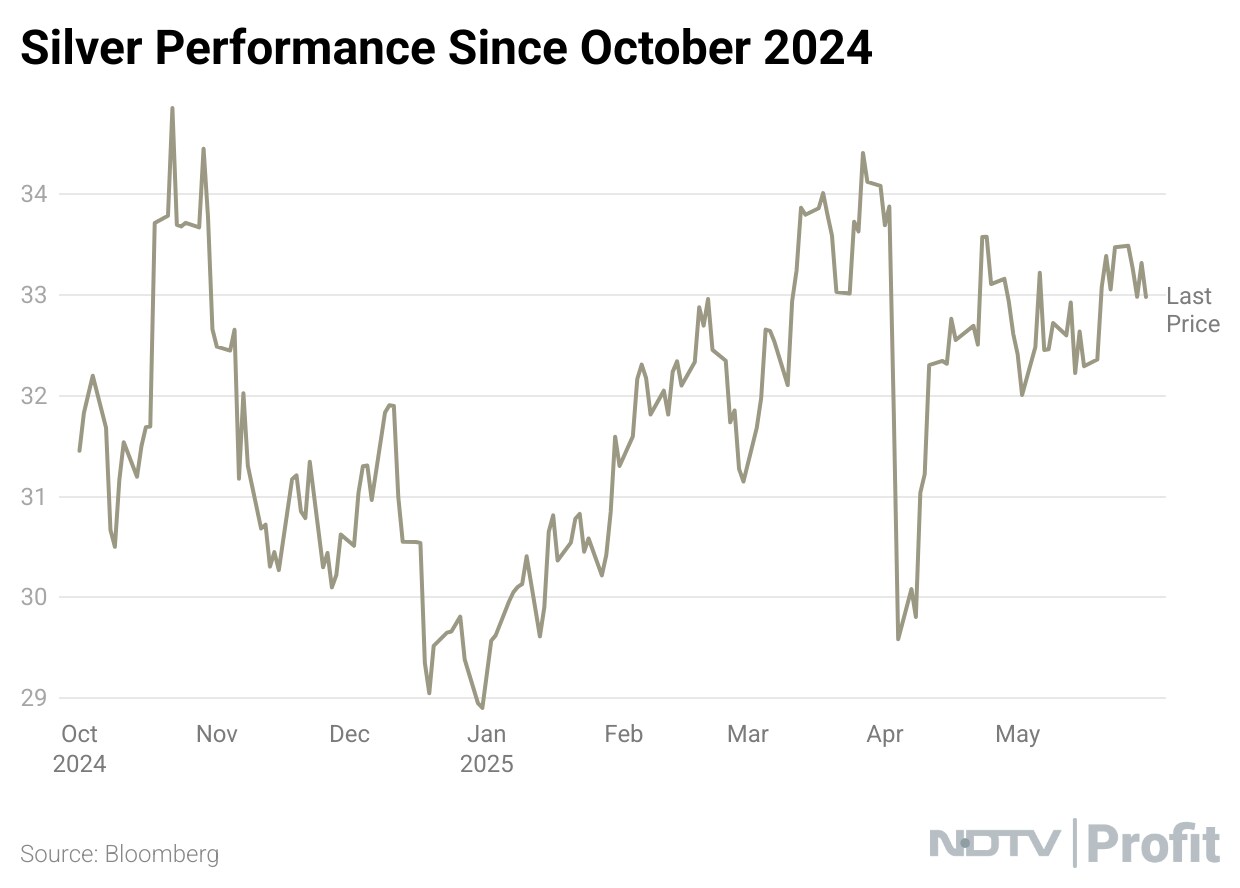

In multi-cap funds, Quant Capital has to maintain a 10% precious metal exposure. As there are less options, the firm has shifted to silver from gold, he said.

As of now, the asset management firm has 100% exposure in silver. This portfolio adjustment is playing out great. These small considerations are helpful in generating alpha and protecting downside risks, Tandon said.

Geopolitical volatility will remain high for a long time. The battle appears to be of trade between the US and China, but in reality, both countries are fighting for their supremacy on multiple fronts. The US is worried that China is at a better position to demonstrate their supremacy, he said.

At present, US President Donald Trump has threatened China a number of times, but China has not budged. The US has to surrender to avoid the inflation crisis knocking at their door. It is a battle which people should look at with a broader perspective, Tandon said.

India A Safe Place Amid Global Turmoil

US and China are in trouble. The liquidity indicators are showing that money is shifting from the US markets. The cycle of extraordinary cross-border flow to the US has peaked out. The risk appetite cycle has also peaked out, which means that money will flow to low-risk assets from high-risk assets, he said.

Asia-centric emerging markets will attract flows leading to a decoupling process, Tandon said. India has entered into a proper risk-on phase from mild risk-on mode, while the global environment exudes risk-off sentiment, Tandon said.

From a global perspective, India is a safer place amid current turmoil, according to Quant Capital. The asset manager has a 'buy on dips' view on Indian markets. The perception for India has changed for long-term perspective—a three-decade opportunity, he said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.