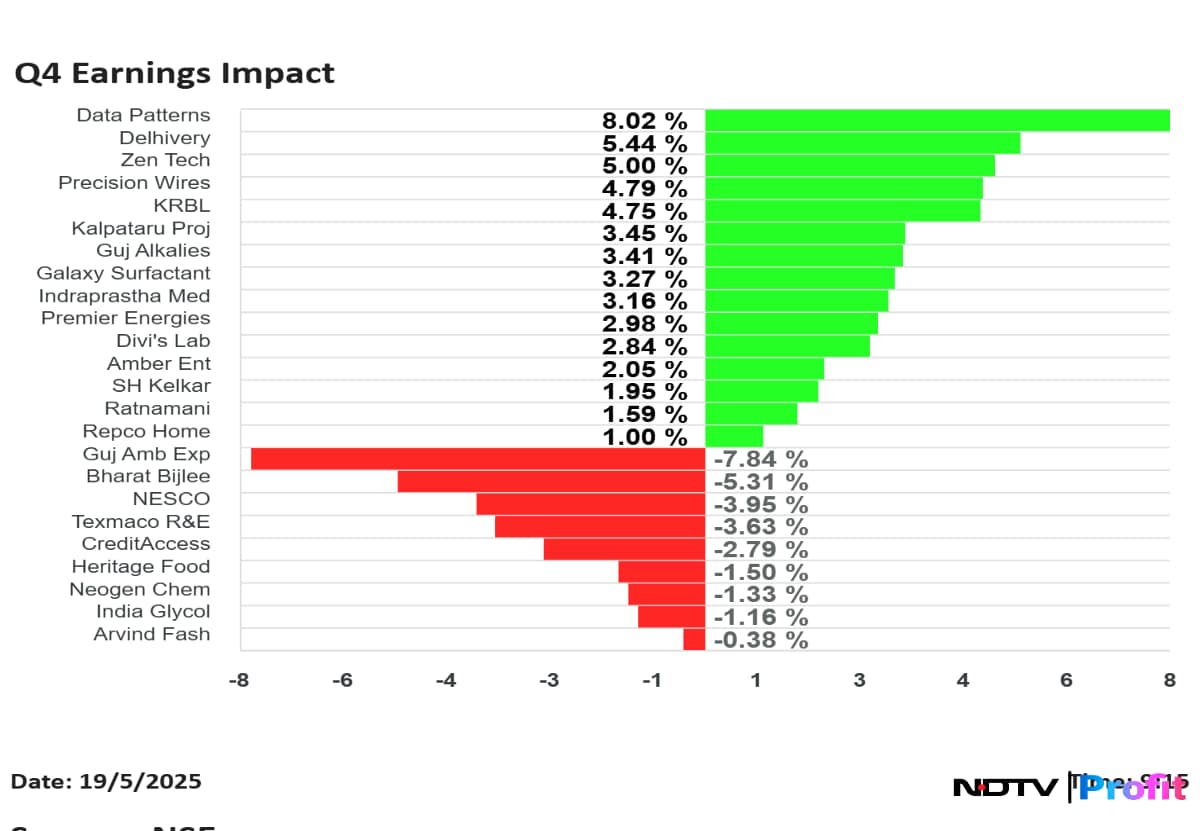

Shares of Zen Technologies Ltd., Premier Energies Ltd. and Kalpataru Projects Ltd. were in focus on Monday, after the companies announced their fourth quarter results.

Precision Wires Ltd. shares rose the most, while Gujarat Abuja Exports Ltd. fell the most, among the companies that announced their results for quarter ended March.

Texmaco Rail & Engineering Q4 FY25 Highlights (Consolidated, YoY)

Share price fell 3.95% at Rs 156.80.

Revenue up 17.6% at Rs 1,346 crore versus Rs 1,145 crore.

Ebitda up 16.7% at Rs 97.6 crore versus Rs 83.6 crore.

Margin at 7.2% versus 7.3%.

Net profit down 12.2% at Rs 39.7 crore vs Rs 45 crore.

What led to dip in net profit?

Other income down 14.7% at Rs 166.6 crore.

Tax expense up 34.1% at Rs 33.56 crore.

Gujarat Alkalies and Chemicals Q4 FY25 Highlights (Consolidated, YoY)

Share price rose 4.35% at Rs 680.75.

Revenue up 7.4% at Rs 1,075.5 crore versus Rs 1,002 crore.

Ebitda at Rs 114 crore versus Rs 28.8 crore.

Margin at 10.6% versus 2.8%.

Net profit at Rs 8.8 crore versus loss of Rs 46.2 crore.

To pay dividend of Rs 15.8 per share.

What led to higher net profit?

Other income stood at Rs 24.4 crore versus Rs 2.54 crore.

Lower loss in joint venture of Rs 12.5 crore versus Rs 25.0 crore.

Changes in inventories.

Delhivery Q4 FY25 Highlights (Consolidated, YoY)

Share price up 6.98% at Rs 343.25.

Revenue up 5.6% at Rs 2,191.5 crore versus Rs 2,075.5 crore.

Ebitda at Rs 119 crore versus Rs 45.8 crore.

Margin at 5.4% versus 2.2%.

Net profit at Rs 72.6 crore versus loss of Rs 68.5 crore.

Heritage Foods Q4 Highlights (Consolidated, YoY)

Share price 3.89% higher at Rs 413.70.

Revenue up 10.3% at Rs 1,048 crore versus Rs 950.5 crore.

Ebitda up 14% at Rs 79.8 crore versus Rs 70.1 crore.

Margin at 7.6% versus 7.4%.

Net profit down 5.7% at Rs 38.1 crore versus Rs 40.4 crore.

CreditAccess Grameen Q4 FY25 Highlights (YoY)

Share price falls 5.70% at Rs 1,136.

Total Income down 3.5% at Rs 1,408 crore versus Rs 1,459 crore.

Net profit down 88% at Rs 47 crore versus Rs 397 crore.

India Glycols Q4 FY25 Highlights (Consolidated, YoY)

Share price down 2.87% at Rs 1,705.30.

Revenue up 6.8% at Rs 863 crore versus Rs 926 crore.

Ebitda up 39% at Rs 146 crore versus Rs 105 crore.

Margin at 16.9% versus 11.3%.

Net profit up 52% at Rs 64 crore versus Rs 42 crore.

To pay dividend of Rs 10 per share.

Repco Home Finance Q4FY25 Highlights (YoY)

Share price 1.82% higher at Rs 425.90.

Total income up 9.5% at Rs 435 crore versus Rs 397 crore.

Net profit up 6.3% at Rs 115 crore versus Rs 108.1 crore.

To pay dividend of Rs 4 per share

Indraprastha Medical Corp. Q4 FY25 Highlights (Consolidated, YoY)

Share price up 3.61% at Rs 456.15.

Revenue at Rs 333.75 crore versus Rs 314.73 crore, up 6.04%.

Ebitda at Rs 61.32 crore versus Rs 48.44 crore, up 26.58%.

Margin at 18.37% versus 15.39%, up 298 bps.

Net profit at Rs 41 crore versus Rs 31 crore, up 32.25%.

Kalpataru Projects International Q4FY25 Highlights (Consolidated, YoY)

Share price rises 3.85% at Rs 1,135.95.

Revenue up 18% at Rs 7,067 crore versus Rs 5,971 crore.

Ebitda up 19% at Rs 538 crore versus Rs 452 crore.

Margin flat at 7.6%.

Net profit up 37% at Rs 225.4 crore versus Rs 164.4 crore.

Ratnamani Metals & Tubes Q4FY25 Highlights (Consolidated YOY)

Share price 3.45% higher at Rs 2,936.20.

Revenue up 14.71% at Rs 1,715 crore versus Rs 1,495 crore.

Ebitda up 23.04% at Rs 302.29 crore versus Rs 245.67 crore.

Margin up 119 bps at 17.62% versus 16.43%.

Net profit up 5.19% at Rs 203.15 crore versus Rs 193.11 crore.

Bharat Bijlee Q4FY25 Highlights (Standalone, YOY)

Share price fell 8.72% at Rs 3,155.60.

Revenue at Rs 619.1 crore versus Rs 587.47 crore, up 5.38%.

Ebitda at Rs 63.87 crore versus Rs 62.28 crore, up 2.55%.

Margin at 10.31% versus 10.6%, down 28 bps.

Net profit at Rs 50.31 crore versus Rs 48.53 crore up 3.66%.

IOL Chemicals and Pharmaceuticals Q4FY25 Highlights (Consolidated, YoY)

Share price rose 2.97% at Rs 82.62.

Revenue up 4.76% at Rs 528 crore versus Rs 504 crore.

Ebitda up 26.34% at Rs 62.97 crore vs Rs 49.84 crore.

Margin up 203 bps at 11.92% versus 9.88%.

Net profit up 13.75% at Rs 31.42 crore versus Rs 27.62 crore.

Shipping Corp. of India Q4FY25 Highlights (Consolidated, YoY)

Share price rose 3.14% at Rs 194.70.

Revenue down 6.17% at Rs 1,325 crore versus Rs 1,412 crore.

Ebitda down 10.65% at Rs 363.8 crore versus Rs 407.13 crore.

Margin down 137 bps at 27.45% versus 28.83%.

Net profit down 39.73% at Rs 185 crore versus Rs 307 crore.

S H Kelkar and Co. Q4 FY25 Highlights (Consolidated, YoY)

Share price 3.12% higher at Rs 207.95.

Revenue up 10.5% at Rs 567 core versus Rs 513 crore.

Ebitda down 18% at Rs 73.4 crore versus Rs 89.5 crore.

Margin at 12.9% versus 17.4%.

Net profit at Rs 102.5 crore versus Rs 33.9.

One-time gain of Rs 59 crore in Q4 FY25.

To pay final dividend of Rs 1 per share.

KRBL Q4FY25 Highlights (Consolidated, YoY)

Share price rose 7.39% at Rs 347.90.

Revenue 9.4% at Rs 1,442 crore versus Rs 1,318 crore.

Ebitda 25.4% higher at Rs 224 crore versus Rs 178 crore.

Margin at 15.5% versus 13.5%.

Net profit 35% at Rs 154.2 crore versus Rs 114.1 crore.

To pay final dividend of Rs 3.5 per share.

Galaxy Surfactants Q4FY25 Highlights (Consolidated, YoY)

Share price up 5.74% at Rs 2,378.40.

Revenue up 23% at Rs 1,145 crore versus Rs 929 crore.

Ebitda rose 25% at Rs 127 crore versus Rs 102 crore.

Margin at 11.1% vs 10.9%.

Net profit down 2% at Rs 75.9 crore versus Rs 77.5 crore.

To pay final dividend of Rs 4 per share.

Nava Q4FY25 Highlights (Consolidated, YoY)

Share price fell 1.31% at Rs 467.85.

Revenue up 10% at Rs 1,018 crore versus Rs 924 crore.

Ebitda flat at Rs 382 crore.

Ebitda margin at 37% vs 41%.

Net profit up 13.5% at Rs 234 crore versus Rs 206 crore.

Nesco Q4 FY25 Highlights (Consolidated, YoY)

Share price down 4.88% at Rs 935.90.

Revenue up 1.6% at Rs 192 crore versus Rs 189 crore.

Ebitda down 9% at Rs 107 crore versus Rs 117 crore.

Margin at 55.6% versus 62%.

Net profit down 15.7% at Rs 88.6 crore versus Rs 105 crore.

Divi's Labs Q4 Highlights (Consolidated, YoY)

Share price rose 3.34% at Rs 6,489.

Revenue up 12% to Rs 2,585 crore versus Rs 2,303 crore.

Ebitda up 21% to Rs 886 crore versus Rs 731 crore.

Margin at 34.3% versus 31.7%.

Net profit up 23% to Rs 662 crore versus Rs 538 crore.

To pay final dividend of Rs 30 per share.

Board appoints Venkatesa Perumallu Pasumarthy as Chief Financial Officer.

Zen Technologies Q4 Highlights (Consolidated, YoY)

Share price up 5% at Rs 1,884.50.

Revenue at Rs 325 crore versus Rs 141 crore.

Ebitda at Rs 138 crore versus Rs 50.4 crore.

Margin at 42.5% versus 35.7%.

Net profit at Rs 101 crore versus Rs 35 crore.

Data Patterns (India) Q4 Highlights (YoY)

Share price rose 9.54% at Rs 3,141.70.

Revenue to Rs 396 crore versus Rs 182 crore.

Ebitda up 60.7% to Rs 149.5 crore versus Rs 93 crore.

Margin at 37.7% versus 51%.

Net profit up 60.5% to Rs 114 crore versus Rs 71 crore.

Happy Forgings Q4 Highlights (Consolidated, YoY)

Share price falls 1.85% at Rs 833.

Revenue up 2.5% to Rs 352 crore versus Rs 343 crore.

Ebitda up 5.3% to Rs 102 crore versus Rs 97 crore.

Margin at 29.1% versus 28.3%.

Net profit up 2.8% to Rs 67.6 crore versus Rs 65.8 crore.

Arvind Fashions Q4 Highlights (Consolidated, YoY)

Share price down 2.25% at Rs 458.10.

Revenue up 8.7% to Rs 1,189 crore versus Rs 1,094 crore.

Ebitda up 17.4% to Rs 158.7 crore versus Rs 135.1 crore.

Margin at 13.3% versus 12.4%.

Net loss at Rs 93.15 crore versus profit of Rs 24.32 crore.

Gujarat Ambuja Q4 Highlights (Consolidated, YoY)

Share price down 5.43% at Rs 118.

Revenue 6% lower at Rs 1,267 crore versus Rs 1,346 crore.

Ebitda down 44% to Rs 62.3 crore versus Rs 111.4 crore.

Margin at 4.9% versus 8.3%.

Net profit down 65% to Rs 32 crore versus Rs 91.4 crore.

Precision Wires Q4 Highlights (YoY)

Share price rose 10.11% at Rs 182.60.

Revenue up 19% to Rs 1,046 crore versus Rs 878 crore.

Ebitda up 36% to Rs 50.6 crore versus Rs 37.3 crore.

Margin at 4.8% versus 4.2%.

Net profit up 35% to Rs 29.6 crore versus Rs 22 crore.

Premier Energies Q4 Highlights (Consolidated, QoQ)

Share price up 3.37% at Rs 1,163.90.

Revenue down 5% to Rs 1,621 crore versus Rs 1,713 crore.

Ebitda up 3% to Rs 529 crore versus Rs 514 crore.

Margin at 32.6% versus 30%.

Net profit up 9% to Rs 278 crore versus Rs 255 crore.

Won orders worth Rs 3,100 crore – up 40%.

Amber Enterprises Q4 Highlights (Consolidated, YoY)

Share price rises 3.05% at Rs 6,599.

Revenue up 34% to Rs 3,754 crore versus Rs 2,806 crore.

Ebitda up 33% to Rs 295 crore versus Rs 222 crore.

Margin at 7.9% versus 7.9%.

Net profit up 23% to Rs 116 crore versus Rs 95 crore.

Consumer durables revenue up 28% YoY to Rs 2,860 crore due to strong primary air conditioner sales.

Electronics segment revenue grew 74% to Rs 840 crore; fiscal 2025 revenue up 77%, surpassing 55% guidance.

Railway sub-systems and mobility revenue grew 2% to Rs 130 crore.

Neogen Chemical Q4 Highlights (Consolidated, QoQ)

Share price up 2.38% at Rs 1,508.

Revenue up 0.7% to Rs 203 crore versus Rs 201 crore.

Ebitda up 5% to Rs 36.4 crore versus Rs 34.7 crore.

Margin at 17.9% versus 17.2%.

Net profit down 75% to Rs 2.4 crore versus Rs 10 crore.

Exceptional loss of Rs 14 crore pulled net profit lower.

Fire incident caused estimated damage of Rs 363 crore; company expects Rs 349 crore insurance recovery. Balance shown as exceptional loss.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.