Shares of Aurobindo Pharma Ltd., Brianbees Solutions Ltd. and KEC International Ltd. were in focus on Tuesday, after the companies announced their fourth quarter results.

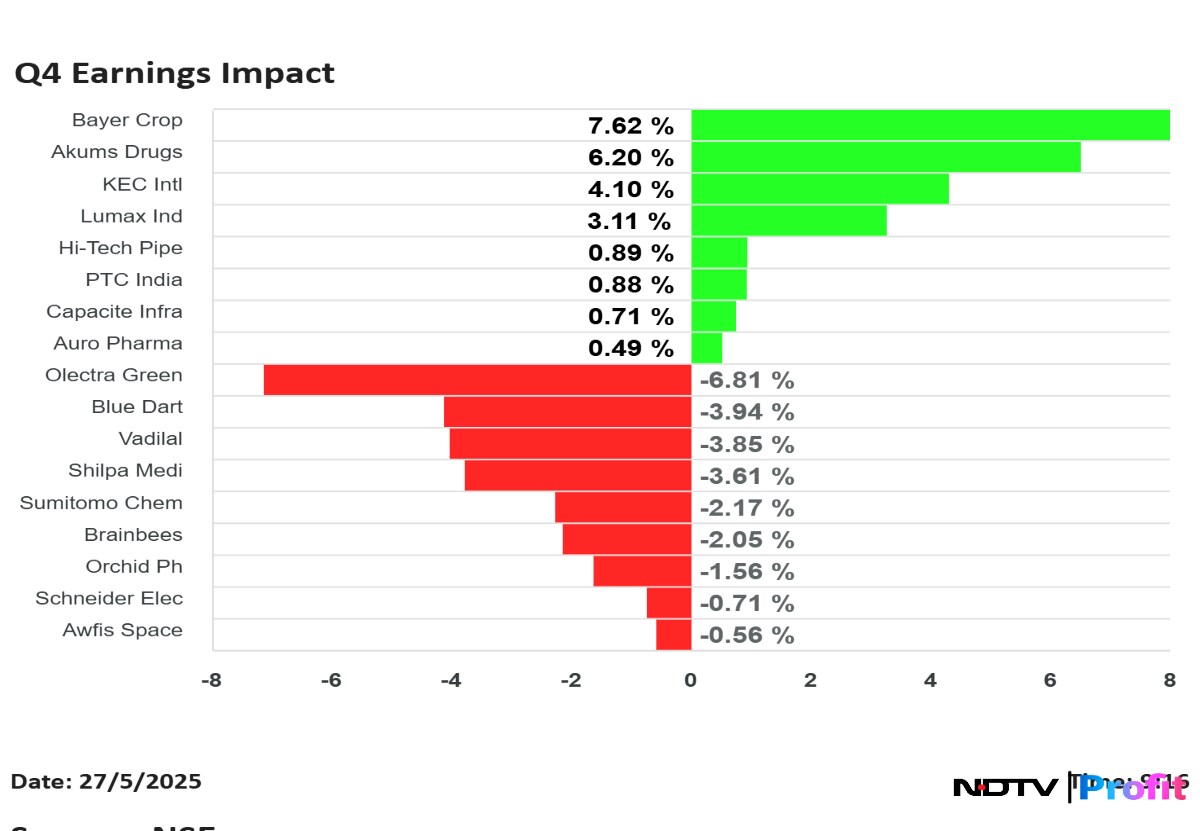

Bayer Corp. shares rose the most, while Olectra Greentech Ltd. fell the most, among the companies that announced their results for quarter ended March.

Aurobindo Pharma Q4 FY25 Highlights (Consolidated, YoY)

Share price rose 1.79% at Rs 1,202.

Revenue up 10.6% to Rs 8,382 crore versus Rs 7,580 crore (Bloomberg estimate: Rs 8,197 crore).

Ebitda up 7% at Rs 1,792 crore versus Rs 1,673 crore (Estimate: Rs 1,827 crore).

Margin narrows to 21.4% versus 22% (Estimate: 22.3%).

Net profit down 0.6% to Rs 903.5 crore versus Rs 909 crore (Estimate Rs 1,013 crore).

Brainbees Solutions Q4 FY25 Highlights (Consolidated, YoY)

Share price fell 4.03% at Rs 360.05.

Revenue up 15.84% at Rs 1,930 crore versus Rs 1,666 crore.

Ebitda down 51.51% at Rs 16 crore versus Rs 33 crore.

Ebitda margin down 115 bps at 0.82% versus 1.98%.

Net loss at Rs 76.7 crore versus loss of Rs 51.7 crore.

Exceptional loss of Rs 36.7 crore.

Hi-Tech Pipes Q4 FY25 Highlights (Consolidated, YoY)

Share price rises 1.75% at Rs 96.34.

Revenue up 7.7% to Rs 733.7 crore versus Rs 681 crore.

Ebitda down 1.1% to Rs 34.9 crore versus Rs 35.3 crore.

Margin at 4.8% versus 5.2%.

Net profit up 58.5% to Rs 17.6 crore versus Rs 11.1 crore.

Schneider Electric Q4 FY25 Highlights (YoY)

Share price falls 2.45% at Rs 662.05.

Revenue up 24.4% to Rs 586.9 crore versus Rs 471.8 crore.

Ebitda up 18.5% to Rs 86.7 crore versus Rs 73.1 crore.

Margin at 14.8% versus 15.5%.

Net Profit at Rs 54.6 crore versus Rs 3.3 crore.

Shilpa Medicare Q4 FY25 Highlights (Consolidated, YoY)

Share price falls 4.81% at Rs 847.45.

Revenue up 13.4% to Rs 330.8 crore versus Rs 291.7 crore.

Ebitda up 9.5% to Rs 76.8 crore versus Rs 70.1 crore.

Margin at 23.2% versus 24%.

Net profit down 40.8% to Rs 14.5 crore versus Rs 24.5 crore.

Exceptional Loss of Rs 28.08 crore.

Sumitomo Chemical Q4 FY25 Highlights (Consolidated, YoY)

Share price falls 3.60% at Rs 514.85.

Revenue up 1% to Rs 679 crore versus Rs 674 crore.

Ebitda down 14.7% to Rs 120 crore versus Rs 140 crore.

Margin at 17.6% versus 20.8%.

Net profit down 9.2% to Rs 99.6 crore versus Rs 109.7 crore.

Akums Drugs Q4 FY25 Highlights (Consolidated, YoY)

Share price rises 7.05% at Rs 622.95

Revenue up 11.8% to Rs 1,056 crore versus Rs 944.2 crore.

Ebitda at Rs 93.8 crore versus Rs 2.9 crore.

Margin at 8.9% versus 0.3%.

Net profit at Rs 147.6 crore versus loss of Rs 41.3 crore.

Vadilal Industries Q4 FY25 Highlights (Consolidated, YoY)

Share price falls 5.69% at Rs 5,532.

Revenue up 9.2% to Rs 274.5 crore versus Rs 251.5 crore.

Ebitda down 15.3% to Rs 38.8 crore versus Rs 45.8 crore.

Margin at 14.1% versus 18.2%.

Net profit down 20.3% to Rs 22 crore versus Rs 27.6 crore.

KEC International Q4 FY25 Highlights (Consolidated, YoY)

Share price rises 6.21% at Rs 914.95.

Revenue up 11.5% to Rs 6,872 crore versus Rs 6,165 crore.

Ebitda up 38.9% to Rs 538.8 crore versus Rs 388 crore.

Margin at 7.8% versus 6.3%.

Net profit up 76.8% to Rs 268.2 crore versus Rs 151.7 crore.

Orchid Pharma Q4 FY25 Highlights (Consolidated, YoY)

Share price down 5% at Rs 704.20.

Revenue up 9.4% to Rs 237.5 crore versus Rs 217.1 crore.

Ebitda down 3.3% to Rs 28 crore versus Rs 28.9 crore.

Margin at 11.8% versus 13.3%.

Net profit down 32.4% to Rs 22.3 crore versus Rs 33 crore.

Awfis Space Solutions Q4 FY25 Highlights (Consolidated, YoY)

Share price fell 1.67% at Rs 650.90.

Revenue up 46.2% to Rs 340 crore versus Rs 232 crore.

Ebitda up 72.7% to Rs 116 crore versus Rs 67 crore.

Margin at 34% versus 29%.

Net profit at Rs 11.23 crore versus Rs 1.37 crore.

PTC India Q4 FY25 Highlights (Consolidated, YoY)

Share price rose 1.98% at Rs 189.65.

Revenue down 14.3% to Rs 3,006 crore versus Rs 3,507 crore.

Ebitda down 16.5% to Rs 210 crore versus Rs 251 crore.

Net profit at Rs 343 crore versus Rs 91.3 crore.

Olectra Greentech Q4 FY25 Highlights (Consolidated, YoY)

Share price falls 13.77% at Rs 1,160.10.

Revenue up 55.4% to Rs 449 crore versus Rs 289 crore.

Ebitda up 64% to Rs 56.5 crore versus Rs 34.5 crore.

Margin at 12.6% versus 12%.

Net profit up 53.2% to Rs 21 crore versus Rs 13.7 crore.

Capacite Infraprojects Q4 FY25 Highlights (Consolidated, YoY)

Share price up 2.53% at Rs 354.30.

Revenue up 12% to Rs 671 crore versus Rs 599 crore.

Ebitda down 22.7% to Rs 85.7 crore versus Rs 111 crore.

Margin at 12.8% versus 18.5%.

Net profit up 1.5% to Rs 52.5 crore versus Rs 51.7 crore.

Other income aided PAT, Other Income at Rs 33.5 crore versus Rs 9.9 crore.

Blue Dart Express Q4 FY25 Highlights (Consolidated, YoY)

Share price falls 5.86% at Rs 6,765.50.

Net profit down 29% at Rs 55.2 crore versus Rs 77.8 crore.

Revenue up 7% at Rs 1,417 crore versus Rs 1,323 crore.

Ebitda down 5.7% at Rs 213 crore versus Rs 226 crore.

Margin at 15% versus 17%.

Bayer Crop Q4 FY25 Highlights (Consolidated, YoY)

Share price rises 10.88% at Rs 5,689.

Revenue up 32.1% to Rs 1,046 crore versus Rs 792 crore.

Ebitda up 75.4% to Rs 170.8 crore versus Rs 97.4 crore.

Margin at 16.3% versus 12.3%.

Net profit up 49.3% to Rs 143.3 crore versus Rs 96 crore.

Lumax Industries Q4 FY25 Highlights (Consolidated, YoY)

Share price rises 4.32% at Rs 3,009.90.

Revenue up 24.3% to Rs 923.4 crore versus Rs 742.7 crore.

Ebitda up 20.4% to Rs 79.3 crore versus Rs 65.9 crore.

Margin at 8.6% versus 8.9%.

Net profit up 21.7% to Rs 43.9 crore versus Rs 36.1 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.