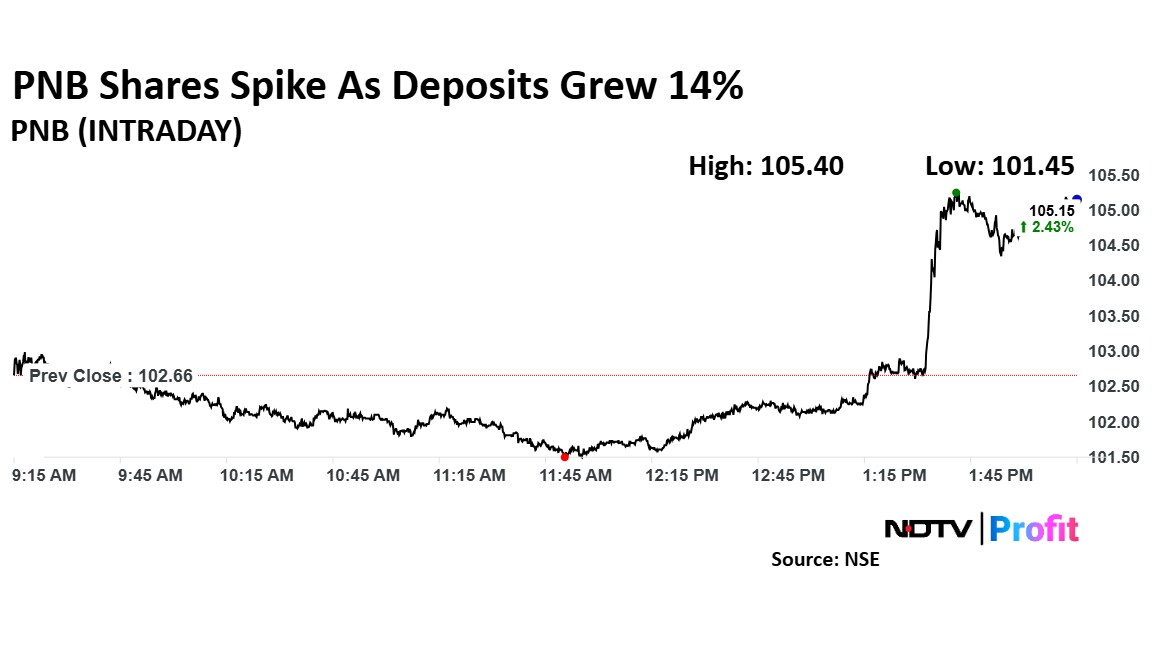

Shares of Punjab National Bank advanced over 2% on Thursday after the lender reported strong deposit growth in the third quarter, amid the broader deposit shortage and decreasing deposit accounts among Indian banks.

The state-run bank on Thursday said that its total deposits as of Dec. 31, 2024 stood at Rs 13.3 lakh crore, growing 14.4% compared to previous year. In comparison, in the year-ago period, the lender's deposits were at Rs 12.9 lakh crore, according to the bank's provisional quarterly business updates filed with stock exchanges.

The public sector bank's total advances rose 14% to Rs 9.4 lakh crore. Last fiscal, as on Dec. 31, its gross advances stood at Rs 9.3 lakh crore.

The global advances for the lender rose 15.7% in the third quarter while the global deposits advanced 15.6 in the December quarter compared to the year ago period.

In terms of overall business performance, PNB reported domestic business growth of 14.3%%, totalling Rs 25.3 lakh crore, while global business rose by 15.3%, reaching Rs 26.4 lakh crore.

Indian banks are poised to remain vulnerable to margin pressure, amid the deposit shortage and decreasing deposit accounts, Nuvama Institutional Equities said in an earlier note. However, ICICI Bank Ltd., State Bank of India and HDFC Bank Ltd. are "better placed" to face the shortage of deposits, it said.

PNB's stock rose as much as 2.67% during the day to Rs 105.4 apiece on the NSE. It was trading 2.17% higher at Rs 104.8 apiece, compared to a 1.63% advance in the benchmark Nifty 50 as of 2:05 a.m.

It has advanced 8% during the last 12 months. The relative strength index was at 52.

Eight out of the 18 analysts tracking the company have a 'buy' rating on the stock, five suggest a 'hold' and five has a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.