Jefferies has upgraded Prestige Estates Projects Ltd. to a "Buy" rating from "Underperform," citing expected operational improvements and strong demand for upcoming projects. The brokerage has set a new price target of Rs 1,600, up from the previous Rs 1,420.

Jefferies notes that Prestige Estates' expansion into new geographies had led to launch delays and a 38% decline in pre-sales over the first nine months. This is likely to see a turnaround soon. Projects worth Rs 30,000 crore are in advanced stages of approval and are expected to attract strong demand, particularly in the mid-income segment.

Despite a miss in the third-quarter profit estimates, with net profit falling 91% quarter-on-quarter and 85% year-on-year to Rs 20 crore, Jefferies remains optimistic. Revenues for the quarter were Rs 1,650 crore, down 28% QoQ and 8% YoY, primarily due to limited deliveries impacting real estate segment revenues. However, Ebitda margins improved to 35.7%, driven by a higher lease income mix, resulting in a 7% YoY increase in Ebitda to Rs 590 crore.

Jefferies' upgrade reflects confidence in Prestige Estates' ability to overcome recent challenges and capitalise on upcoming opportunities in the real estate market.

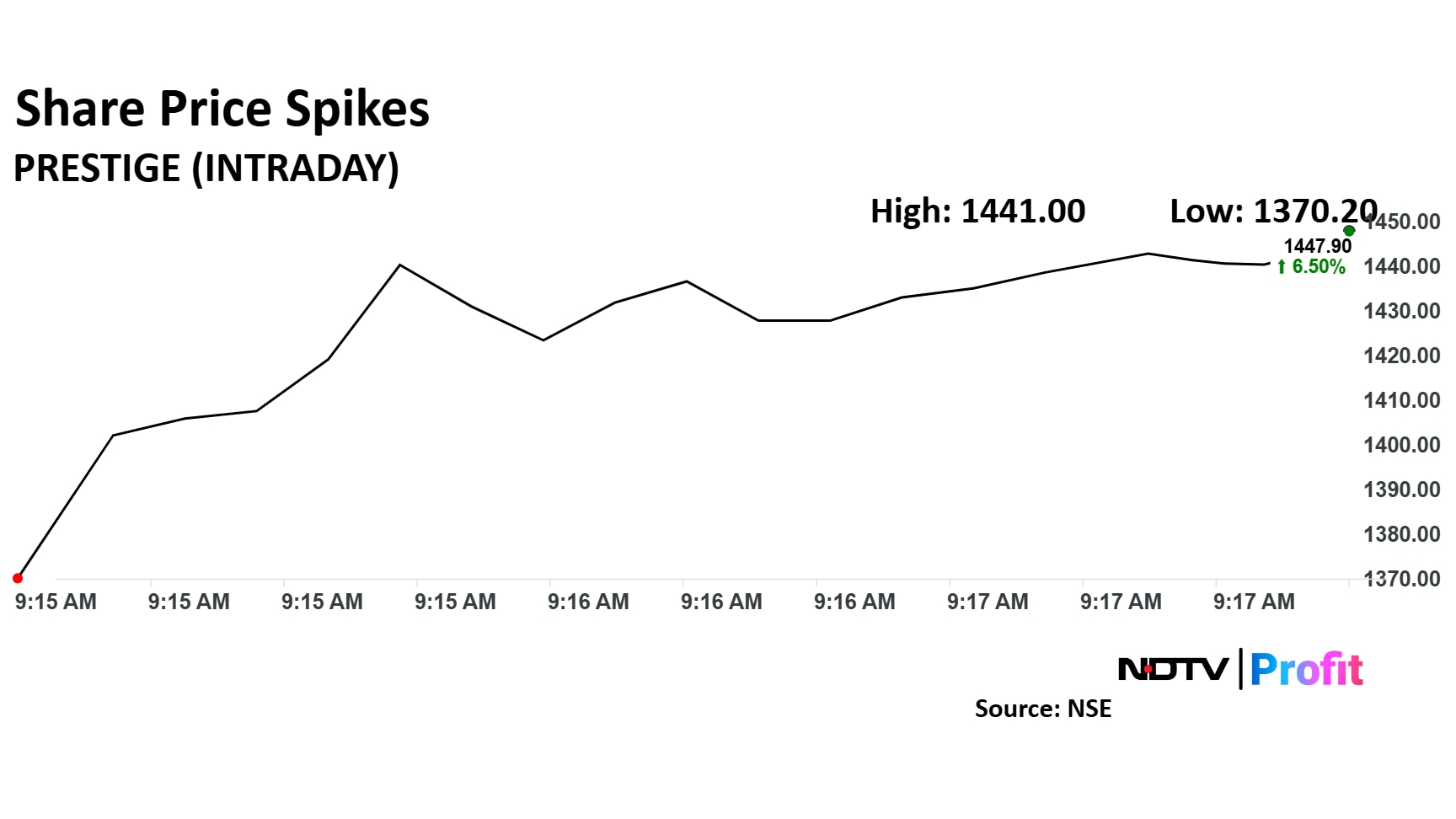

Prestige Estates share price rose as much as 8.86% to 1.479.95% apiece. It pared gains to trade 8.69% higher at Rs 1,477.65 apiece, as of 09:21 a.m. This compares to a 1.07% advance in the NSE Nifty 50 index.

It has risen 19% in the last 12 months. Total traded volume so far in the day stood at 0.51 times its 30-day average. The relative strength index was at 52.

Out of 20 analysts tracking the company, 17 maintain a 'buy' rating, and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 41.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.