The shares of Power Mech Projects Ltd. rose to one-month high on Monday after the company secured a contract worth Rs 579 crore from Bharat Heavy Electricals Ltd. The order is for civil structural and architectural works for the 2x800 MW DVC Koderma (KTPS) Phase-II in Jharkhand.

The project involves leveling and grading of the entire power block area, including the transformer yard and flue gas desulfurisation, as well as land leasing and preparation for labour hutments. Additionally, the project includes the construction of restrooms for operation and maintenance workers and sheds for construction workers.

The project also involves the installation of various utility and support systems, including a rooftop solar system within the power block area, sewage water lines within the power generation area, and civil works for low pressure piping and firefighting systems. Moreover, the project includes the construction of pipe racks and cable racks, buried cables and wires duct civil works, and other essential infrastructure.

Power Mech is expected to complete the project in under three years. The company had won another order last month for the Koderma project.

The Hyderabad-based engineering and infrastructure-construction company has an orderbook of Rs 4,242 crore as of December quarter. It specialises in providing comprehensive services in the power sector, including erection, testing, and commissioning of power plants.

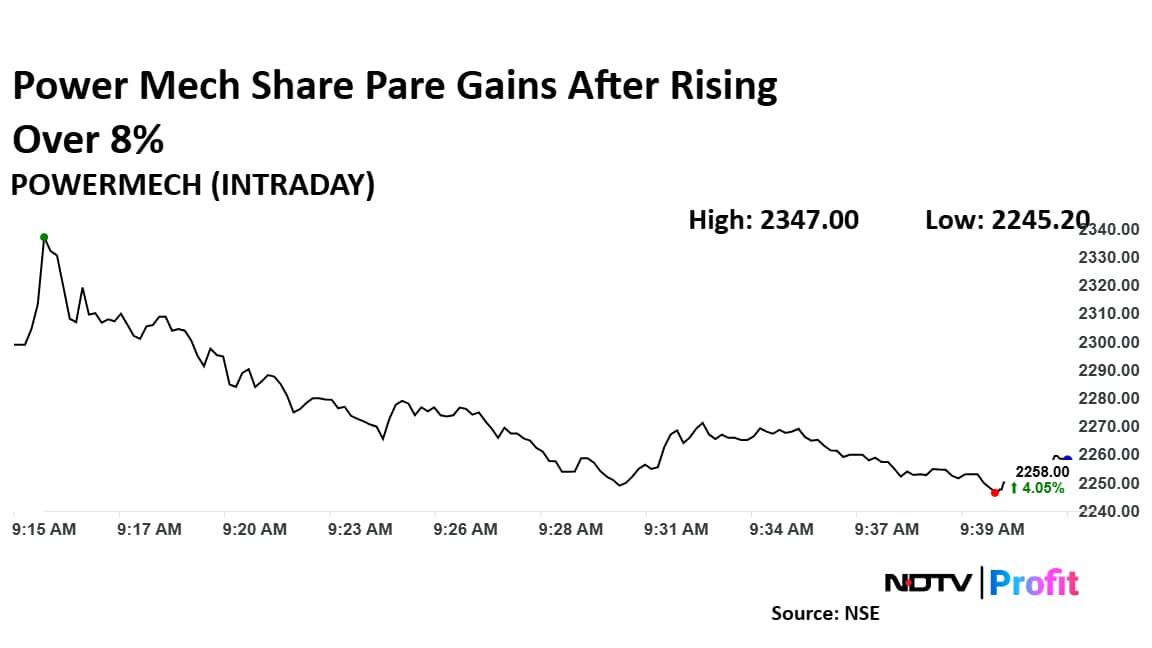

Power Mech Share Price Rises

The shares of Power Mech rose as much as 8.15% to Rs 2,347 apiece, the highest level since Feb. 1. The stock pared gains to trade 4.49% higher at Rs 2,267.45 apiece, as of 9:38 a.m. This compares to a 0.47% advance in the NSE Nifty 50 Index.

It has fallen 4,84% in the last 12 months and 16.37% year-to-date. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 68.

The one analysts tracking the company maintains a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.