.png?downsize=773:435)

Power Mech Projects Ltd. saw its share price move significantly on Tuesday following the announcement of a substantial order worth Rs 164.63 crore from Bharat Heavy Electricals Ltd.

The order encompasses the main supply, including design and engineering, mandatory spares, and civil works, as well as erection and commissioning (E&C) for the 2 x 800 MW DVC Koderma TPS Phase-II EPC project.

Power Mech Projects Ltd., a leading infrastructure construction company, specialises in providing comprehensive services in the power sector, including erection, testing, and commissioning of power plants. The company has a strong track record of executing large-scale projects and is known for its expertise in mechanical, electrical, and civil engineering services.

Bharat Heavy Electricals Limited (BHEL), a Maharatna company, is one of India's largest engineering and manufacturing enterprises in the energy and infrastructure sectors. BHEL's portfolio includes a wide range of products and services for power generation, transmission, and distribution. The company has been instrumental in the development of India's power infrastructure and continues to play a pivotal role in the country's energy sector.

The new order from BHEL is expected to bolster Power Mech's project pipeline and enhance its revenue visibility.

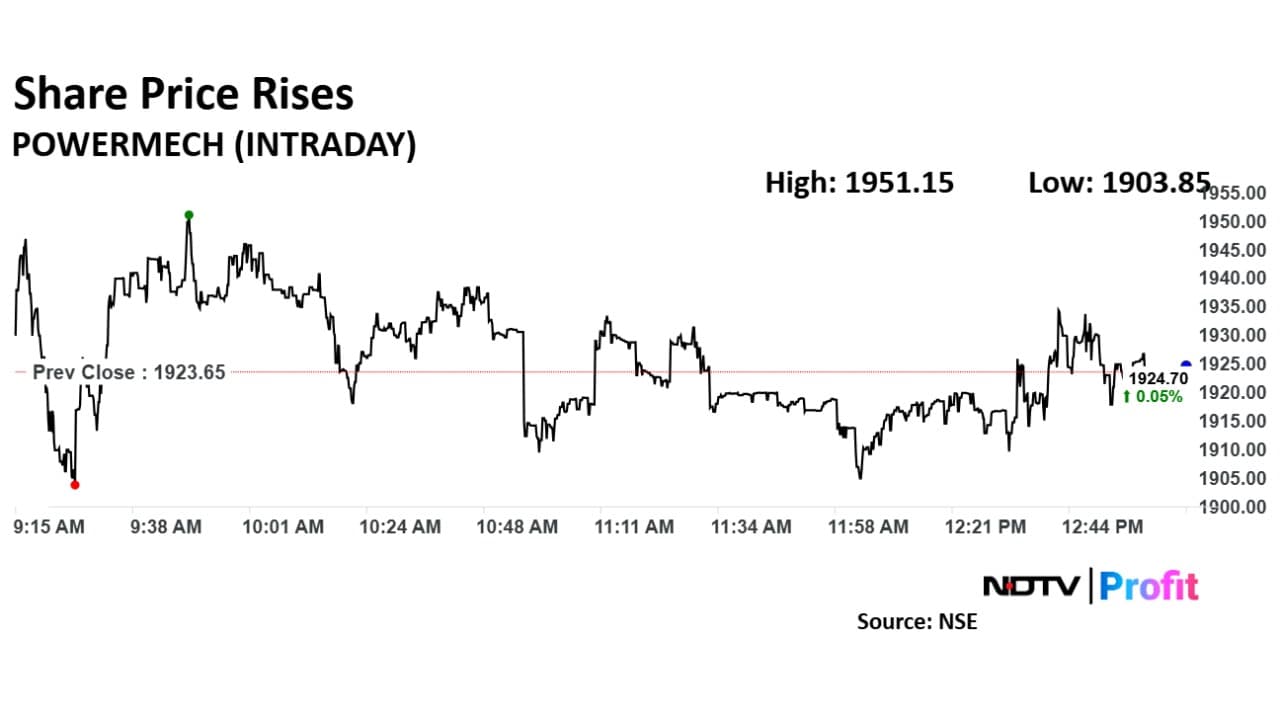

The scrip rose as much as 1.43% to Rs 1,951.15 apiece. It later gave up gains to trade 0.10% lower at Rs 1,921.80 apiece, as of 1:03 p.m. This compares to a 0.10% advance in the NSE Nifty 50 Index.

It has fallen 26.19% in the last 12 months. The relative strength index was at 26.

Only one analyst is tracking the company, and they maintain a 'buy' rating on the stock, according to Bloomberg data. The average 12-month consensus price target implies an upside of 32.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.