Ola Electric Mobility Ltd.'s stock rose over 3% during early trade on Tuesday after the Bhavish Aggarwal-led company settled all dues with Rosmerta Group, which then withdrew the insolvency petitions against the EV maker.

Ola Electric has amicably settled all outstanding dues between its wholly owned subsidiary, Ola Electric Technologies Pvt. Ltd., and the Rosmerta Group, according to an exchange filing.

The Rosmerta Group has filed the memo for withdrawal of the petitions filed before the National Company Law Tribunal, Bengaluru.

"With the receipt of INR 26,75,24,339/-, which consists of the entire claim raised before the NCLT, Rosmerta Group companies are withdrawing its petitions before the NCLT, Bengaluru," according to a media statement.

No further cause of action exists between Rosmerta Group and Ola Electric.

Last week, the Ola Electric stock fell to an all-time low after Rosmerta Group sought the initiation of insolvency proceedings over pending dues.

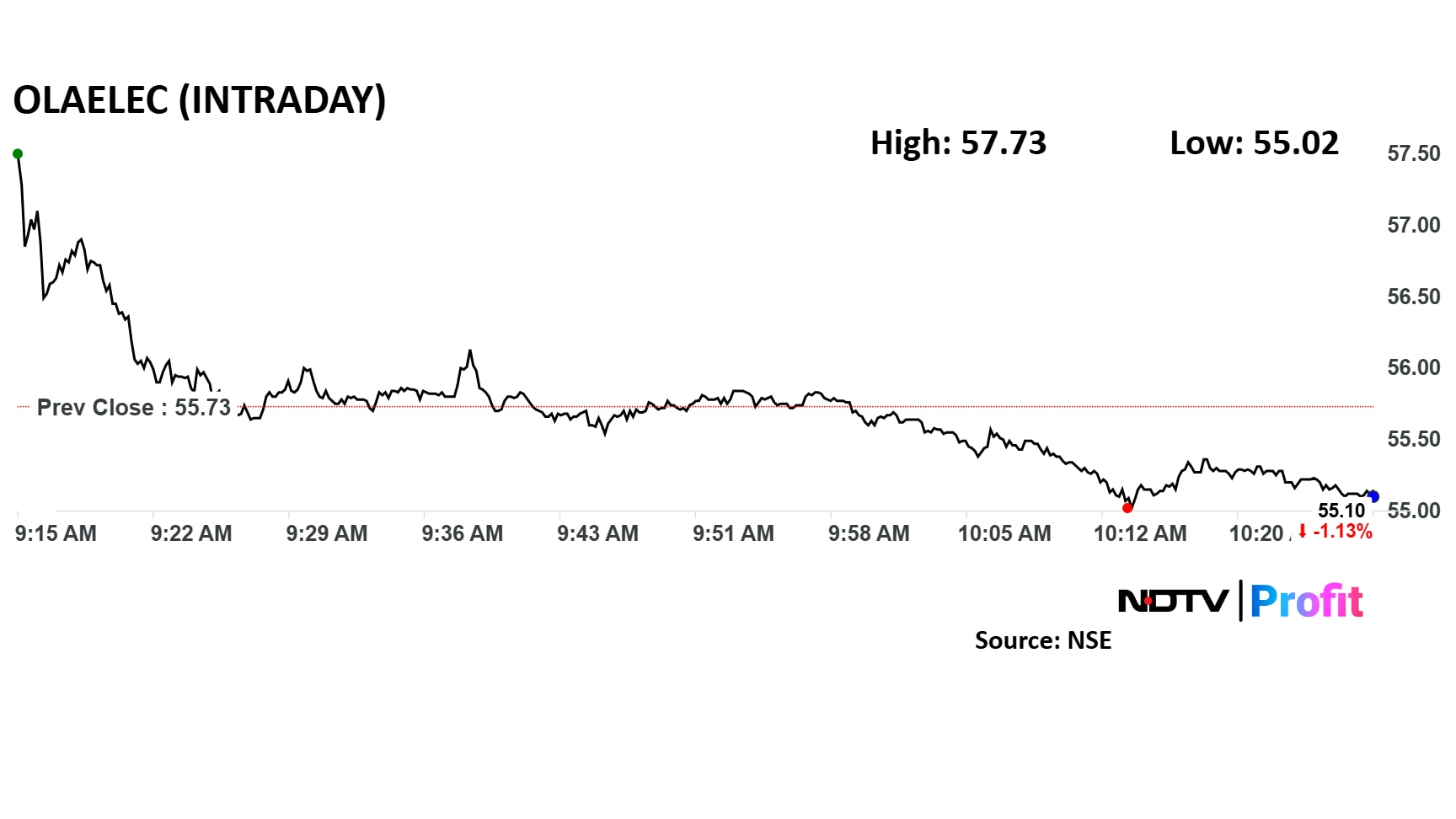

Ola Electric Share Price Movement

The shares of Ola Electric rose 3.6% intraday to Rs 57.73 apiece.

The shares of Ola Electric rose 3.6% intraday to Rs 57.73 apiece. However, the stock soon gave up gains to trade 1.1% lower by 10:25 a.m. This compares to a 0.7% advance in the NSE Nifty 50 Index.

The scrip has fallen 28% since listing in August and 36% year-to-date. The relative strength index was at 45.

Out of eight analysts tracking the company, four maintain a 'buy' rating, two recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 30%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.