Shares of Oberoi Realty Ltd. hit an all-time high on Wednesday morning as Nomura has initiated coverage on the company with a 'buy' rating and a target price of Rs 2,500, signaling a potential upside of 19%. The brokerage cited robust growth prospects in pre-sales, annuity income, and business development as drivers for its optimistic outlook.

This comes on the heels of UBS initiating coverage on Oberoi Realty on Tuesday, albeit with a 'neutral' call. UBS had given the company a target price of Rs 2,230 apiece, indicating a 9% upside.

Oberoi Realty's pre-sales are projected to grow at a compound annual growth rate of 40% said Nomura, reaching Rs 11,500 crore in the next two fiscals.

Key contributors include ready inventory from projects like 360 West, Eternia, and Enigma, alongside new launches in Sky City (Borivali), Elysian (Goregaon), and OGC Thane, as per the note.

Residential projects are expected to sustain Ebitda margins above 50%. Premium pricing and strategic land acquisitions have historically enabled Oberoi Realty to generate superior returns, noted the brokerage.

Oberoi Realty's Financials Forecast

Nomura also forecasts the cumulative annuity and hotel revenues to grow at a CAGR of 35%, reaching Rs 1,800 crore by financial year 2027. Operating cash flows are expected to remain strong at Rs 3,000-4,000 crore annually until fiscal 2027.

With a net debt-to-equity ratio of just 0.02x, Oberoi Realty is positioned for aggressive business development, said Nomura, including potential investments in new land acquisitions. The company's strategic positioning and execution capability are expected to drive sustained growth.

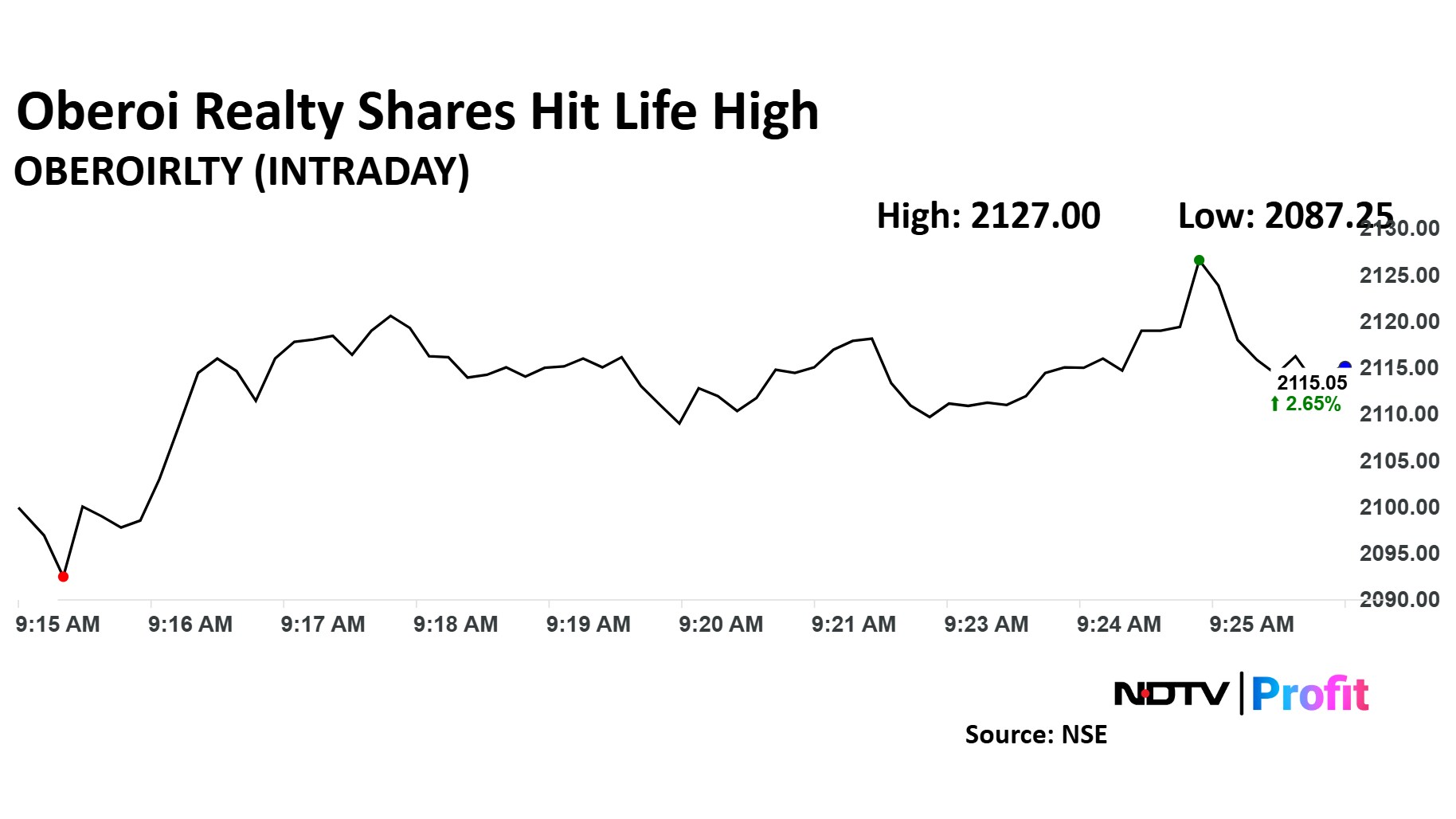

Oberoi Realty Share Price Today

The scrip rose as much as 3.09% to Rs 2,123.95 apiece, hitting an all-time high. It pared gains to trade 2.12% higher at Rs 2,104 apiece, as of 09:17 a.m. This compares to a 0.19% advance in the NSE Nifty 50 Index.

It has risen 46.99% on a year-to-date basis. The relative strength index was at 65.95.

Out of 26 analysts tracking the company, nine maintain a 'buy' rating, 12 recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 2.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.