Shares of Oberoi Realty Ltd., PNB Housing Finance Ltd., AGI Greenpac Ltd. and Havells India Ltd. on Tuesday reacted after the companies announced their first-quarter results.

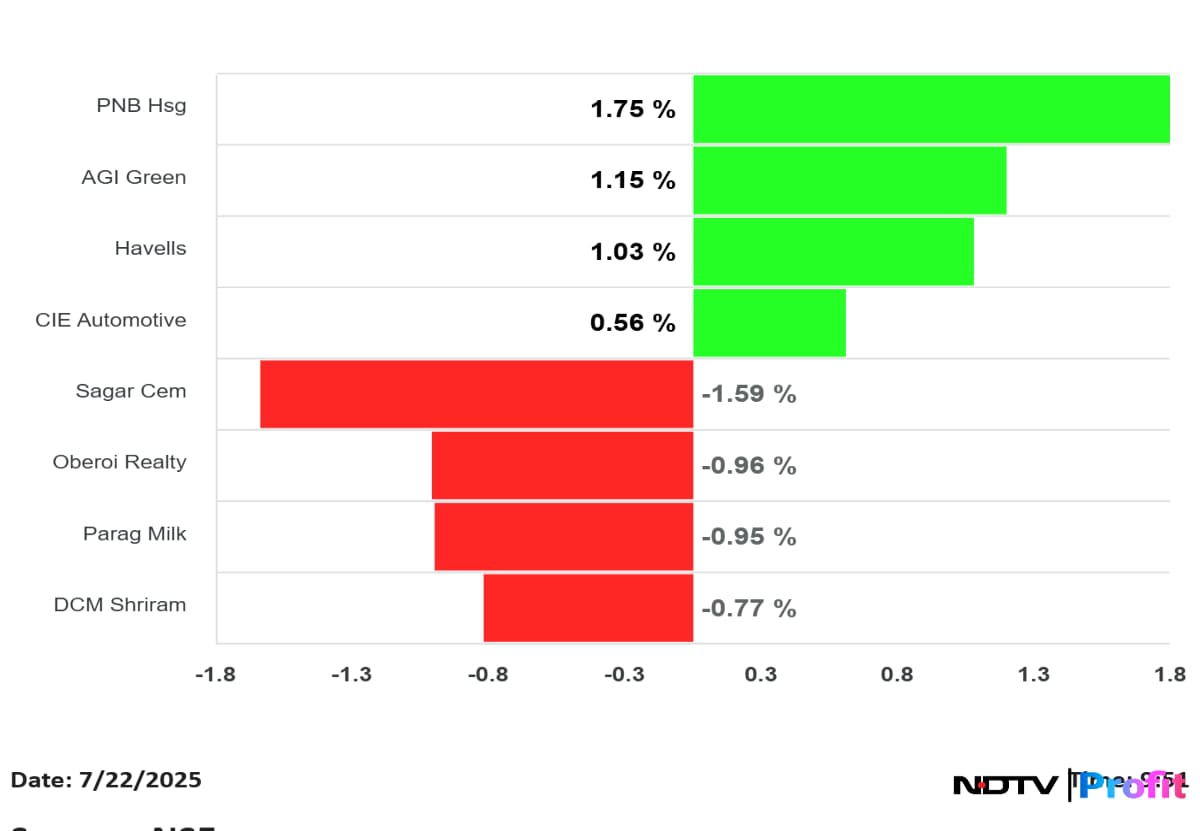

PNB Housing, AGI Greenpac, Havells India, and CIE Automotive shares traded higher early in the session. On the other hand, Sagar Cement, Oberoi Realty, Parag Milk and DCM Shriram fell.

Gainers and losers after Q1 results.

Earnings Post Monday Market Hours

Sagar Cements Q1FY26 Highlights (Consolidated, YoY)

Revenue up 19.6% at Rs 671 crore versus Rs 561 crore.

Ebitda at Rs 121 crore versus Rs 46.8 crore.

Margin at 18.1% versus 8.3%.

Net Profit at Rs 1.2 crore versus loss of Rs 28.3 crore.

CIE Automotive Q1FY26 Highlights (Consolidated, YoY)

Revenue up 3.3% at Rs 2,369 crore versus Rs 2,293 crore.

Ebitda down 6.4% at Rs 337 crore versus Rs 360 crore.

Margin at 14.2% versus 15.7%.

Net Profit down 6.1% at Rs 204 crore versus Rs 217 crore.

AGI Greenpac Q1FY26 Highlights (Consolidated, QoQ)

Revenue down 2.4% at Rs 688 crore versus Rs 705 crore.

Ebitda down 7.9% at Rs 142 crore versus Rs 154 crore.

Margin at 20.7% versus 21.9%.

Net Profit down 7.1% at Rs 88.9 crore versus Rs 95.6 crore.

Oberoi Realty Q1FY26 Highlights (Consolidated, YoY)

Revenue down 29.7% at Rs 988 crore versus Rs 1,405 crore.

Ebitda down 36.2% at Rs 520 crore versus Rs 815 crore.

Margin at 52.7% versus 58%.

Net Profit down 27.9% at Rs 421 crore versus Rs 585 crore.

DCM Shriram Q1FY26 Highlights (Consolidated, YoY)

Revenue up 13.4% at Rs 3,262 crore versus Rs 2,876 crore.

Ebitda up 22.9% at Rs 305 crore versus Rs 248 crore.

Margin at 9.3% versus 8.6%.

Net Profit up 13% at Rs 113 crore versus Rs 100 crore.

PNB Housing Finance Q1FY26 Highlights (Standalone, YoY)

Net interest income up 16% to Rs 733.57 crore versus Rs 631.25 crore.

Net Profit down 6.2% at Rs 531.73 crore versus Rs 567.11 crore.

Total income up 13.6% at Rs 2,070.61 crore versus Rs 1,822.01 crore.

Parag Milk Foods Q1 FY26 (Consolidated, YoY)

Revenue up 12.26% at Rs 851 crore versus Rs 758 crore.

Ebitda up 2.32% at Rs 57.3 crore versus Rs 56 crore.

Ebitda margin down 65 bps at 6.73% versus 7.38%.

Net Profit up 0.73% at Rs 27.5 crore versus Rs 27.3 crore

Havells India Q1FY26 Highlights (Consolidated, YoY)

Revenue down by 6% at Rs 5,455 crores versus Rs 5,806 crores

EBITDA down 9.9% at Rs. 516 crores versus Rs 572 crores

Margin at 9.5% vs 9.9%.

Net Profit down 14.8% at Rs 348 crores versus Rs 408 crores

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.