(Bloomberg) -- Nomura Holdings Inc. expects the yen to strengthen against the dollar later this year, according to the firm's head of trading and investment banking.

“We think it should head back toward 140,” said Christopher Willcox in an interview Thursday with Bloomberg TV. A stronger yen would be “primarily driven by the force of the Fed easing further down the road and somewhat tighter Japan policy.”

The yen hit a 34-year low on Wednesday, prompting Japanese officials to warn they might take measures to stem the slide. The yen approached 152 yen to the dollar, a level that many market observers said could trigger intervention.

“Central banks tend to intervene when they can surprise the market,” said Willcox. “We're all talking about it right now, so I think they'll prefer to talk than to act, but obviously you never know.”

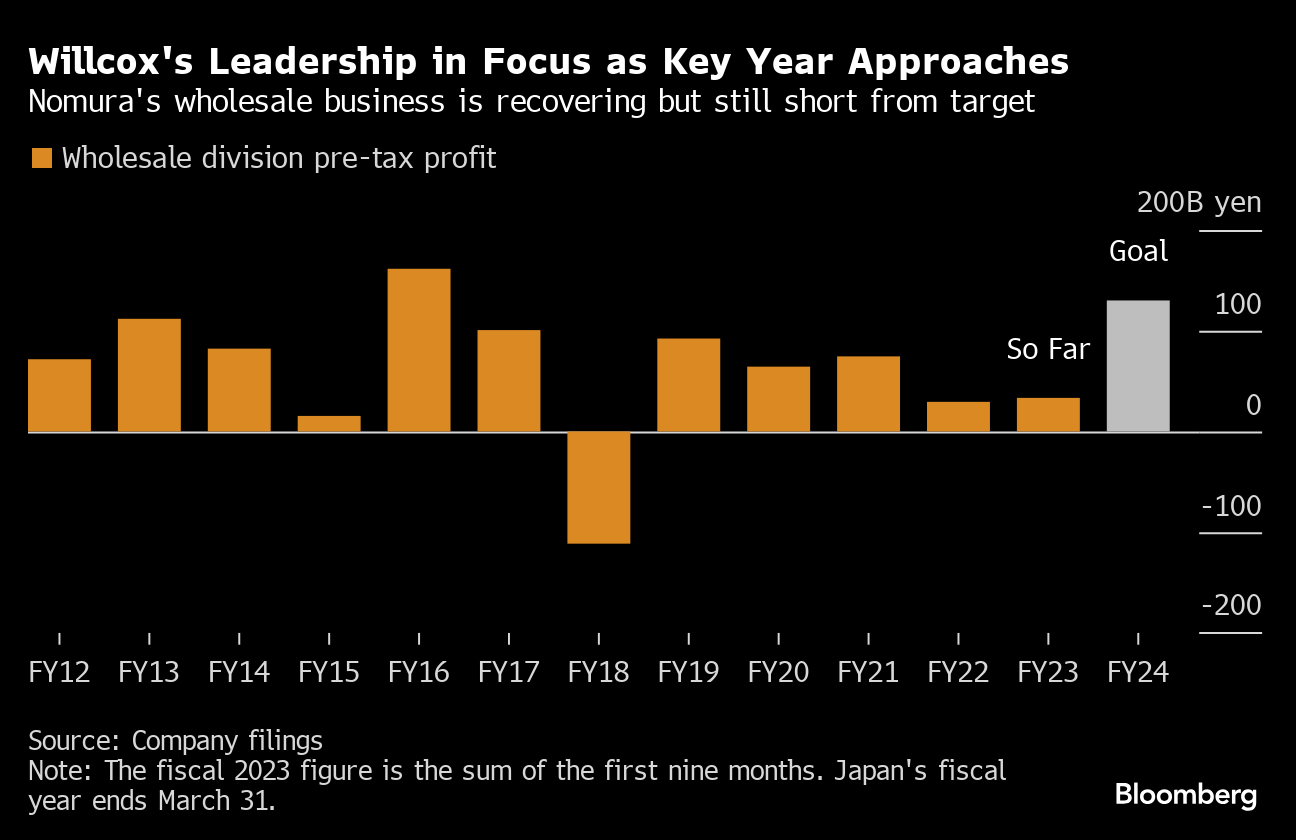

Willcox is spearheading a drive to turnaround trading and investment banking profit after joining Nomura in 2021 amid one of the most tumultuous periods in the firm's history. The wholesale division which he heads is undertaking a slew of steps to lift revenue, including bolstering the US private credit business, and accelerating cost cuts.

“We have incrementally improved the performance of all of those businesses quarter on each quarter for five quarters in a row,” he said. Willcox sees headcount for the division staying the same next year.

The wholesale division earned 33 billion yen ($218 million) in pre-tax profit during the first nine months of Japan's fiscal year, exceeding the previous year's total, according to filings. It's a key area for Japan's largest brokerage, making up roughly half of its overall revenues. Willcox signaled confidence in meeting the company's 130 billion yen target for next fiscal year.

“There are a number of parts of our business we have restructured and re-engineered to set us up for success in the medium-term, including next year,” he said. “Predictions are always dangerous but we feel very confident.”

Willcox's revival plan involves expanding credit markets and its foreign exchange business in the US using its Asian operations as a model. Nomura has also made a push into the European equities business.

Alongside the business push, Willcox has also implemented a broader review of the business model to reduce costs. He expects the structural changes to lower the firm's cost base over the next two to five years.

Nomura is pressing ahead with Chief Executive Officer Kentaro Okuda's flagship policy to expand beyond public markets, Willcox said, citing his team's focus on leveraged financing and other services.

“Private markets is the big growth story,” Willcox said. “If you are not talking about Japan, you are probably talking about private markets.”

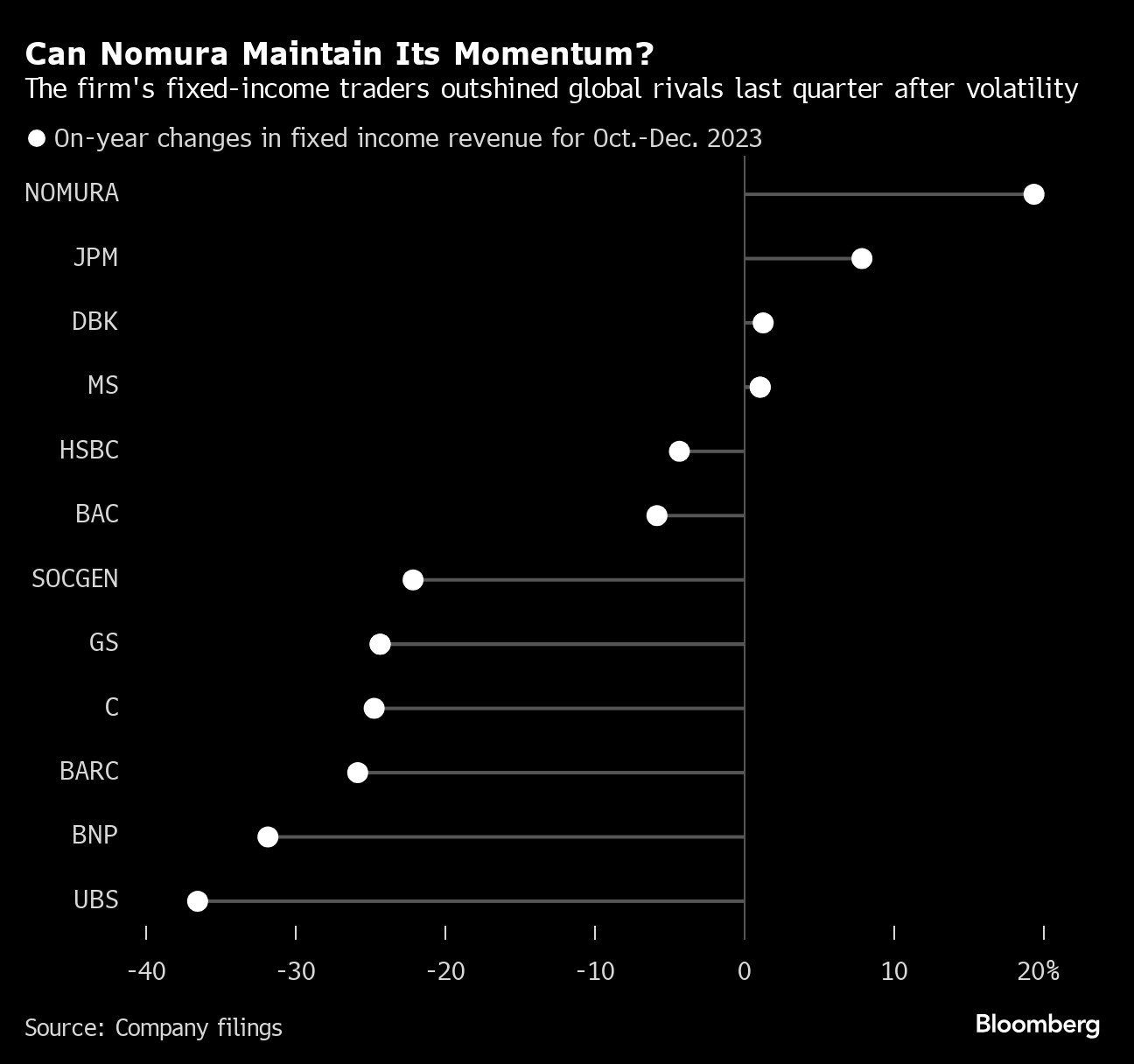

The outlook for Nomura's trading business brightened last week when Japan's central bank dialed back stimulus, liberating the debt market from its tight control and boosting the outlook for bond transactions. Fixed income trading generates roughly a quarter of the company's revenue.

“Japan has been the most exciting market on the globe in the last year,” said Willcox. “I can get any meeting I want right now to talk about Japan, because most people in the world have an interest in this market.”

--With assistance from Joyce Koh.

(adds comments from Willcox)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.