.jpg?downsize=773:435)

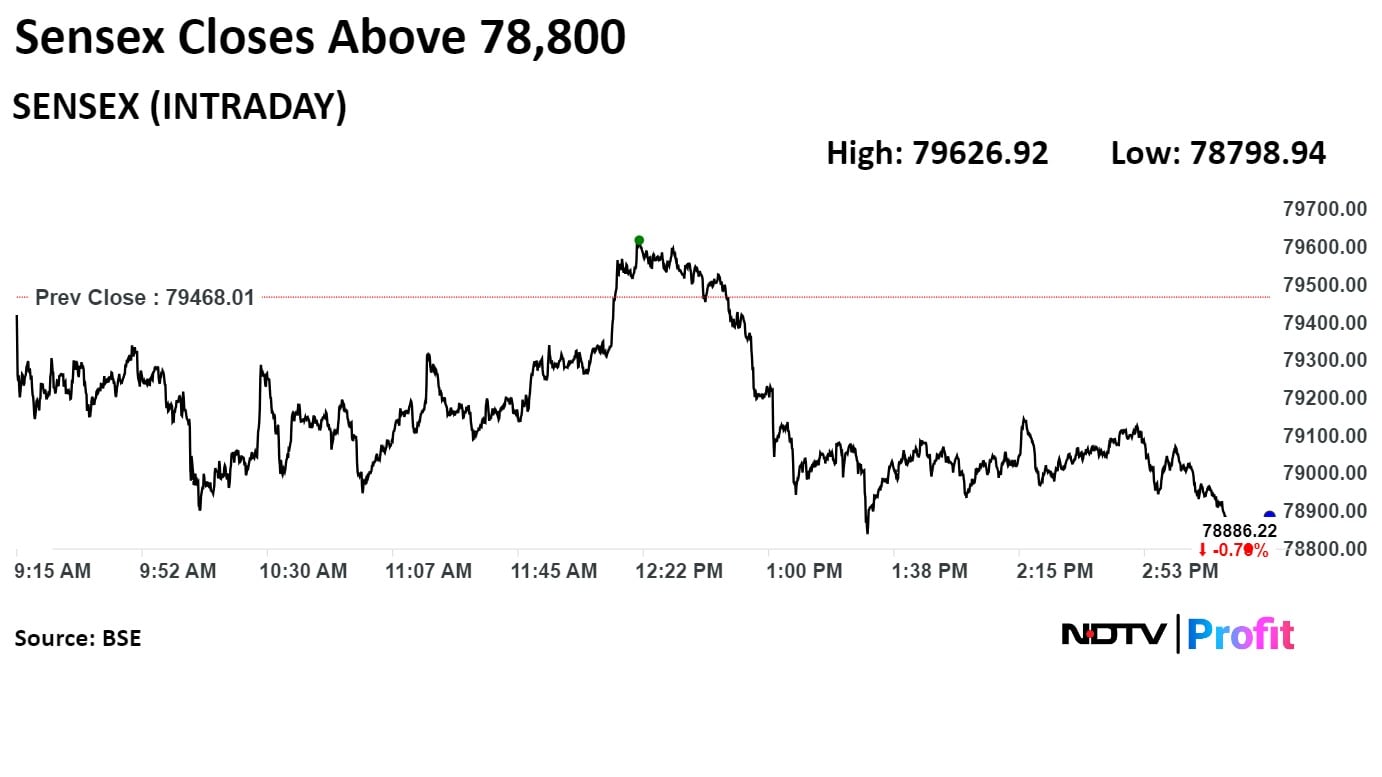

The benchmark equity indices erased initial gains on Thursday after the RBI monetary policy committee maintained status quo and ended lower as Governor Shaktikanta Das' commentary was hawkish, while also tracking European markets and some Asian indices that closed with losses.

The NSE Nifty 50 ended 180.50 points or 0.74%, lower at 24,177 and the S&P BSE Sensex closed 581.79 points or 0.73%, lower at 78,886.22. During the day, the Nifty fell as much as 0.90% and the Sensex fell 0.84%.

"The index (Nifty) is oscillating in a wide range, where the downside seems to be protected at 23,965 near the 50-day moving average, while the higher side is capped at 24,330, a bearish gap zone. A breakout on either side is a must for a clear picture," Aditya Gaggar, director of Progressive Share Brokers, said.

.jpeg)

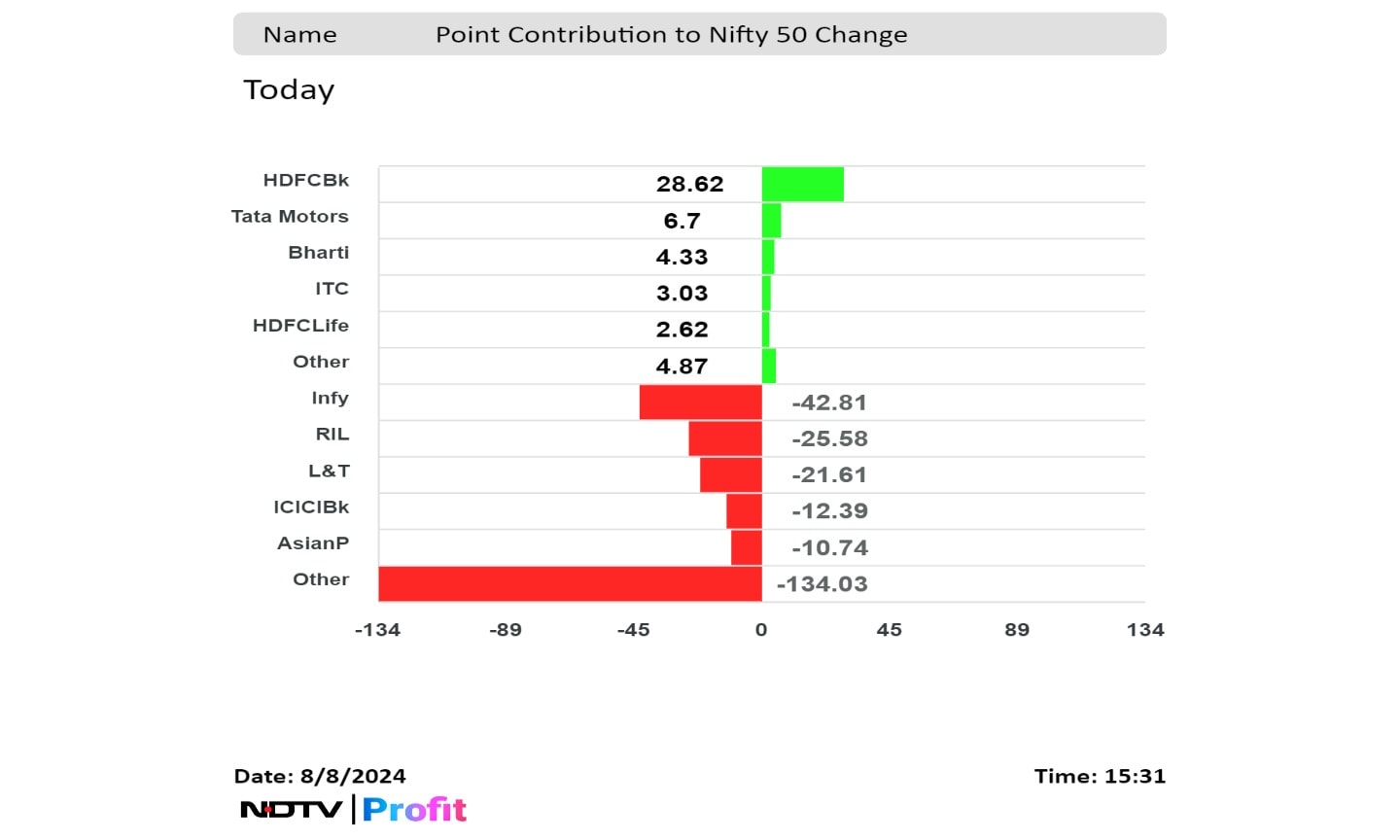

Shares of Infosys Ltd., Reliance Industries Ltd., Larsen & Toubro Ltd., ICICI Bank Ltd., and Asian Paints Ltd. pulled the Nifty lower.

HDFC Bank Ltd., Tata Motors Ltd., Bharti Airtel Ltd., HDFC Life Insurance Co., and ITC Ltd. cushioned the fall.

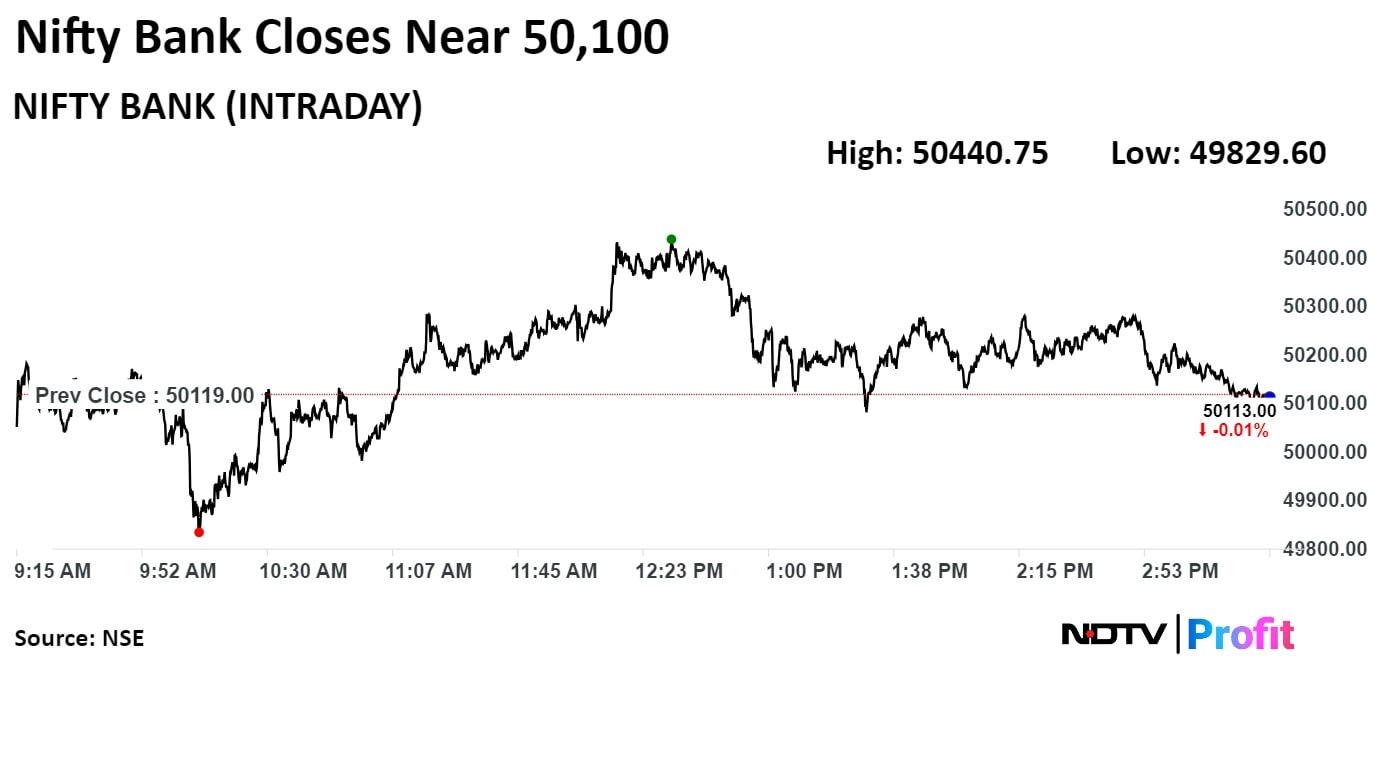

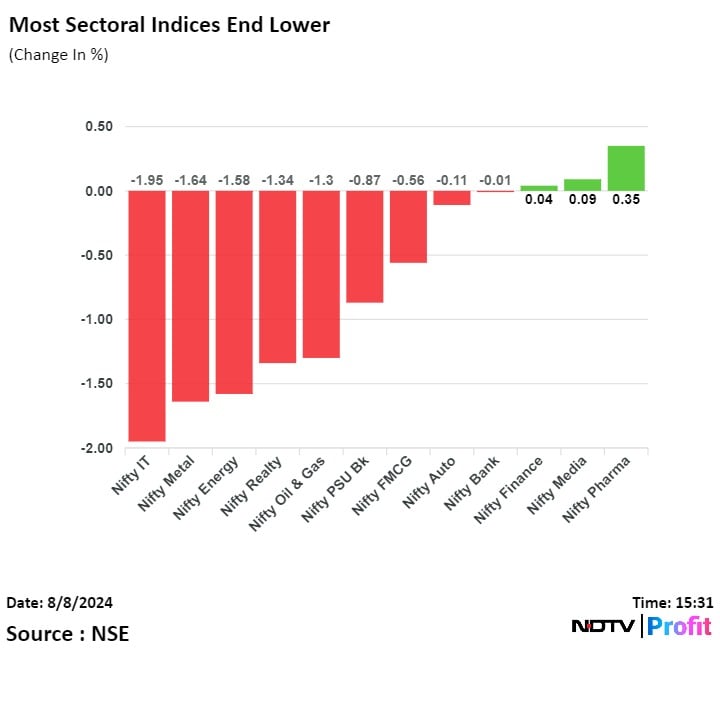

Most sectoral indices on the NSE were lower, with the Nifty IT being the top loser.

The broader markets outperformed the benchmark indices, as the BSE MidCap and the SmallCap ended 0.44% and 0.16% lower, respectively.

On the BSE, all sectoral indices ended lower, except healthcare. BSE Metal declined the most and was the worst-performing sector.

Market breadth was skewed in favour of sellers. Around 2,113 stocks declined, 1,787 stocks rose, and 107 stocks remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.