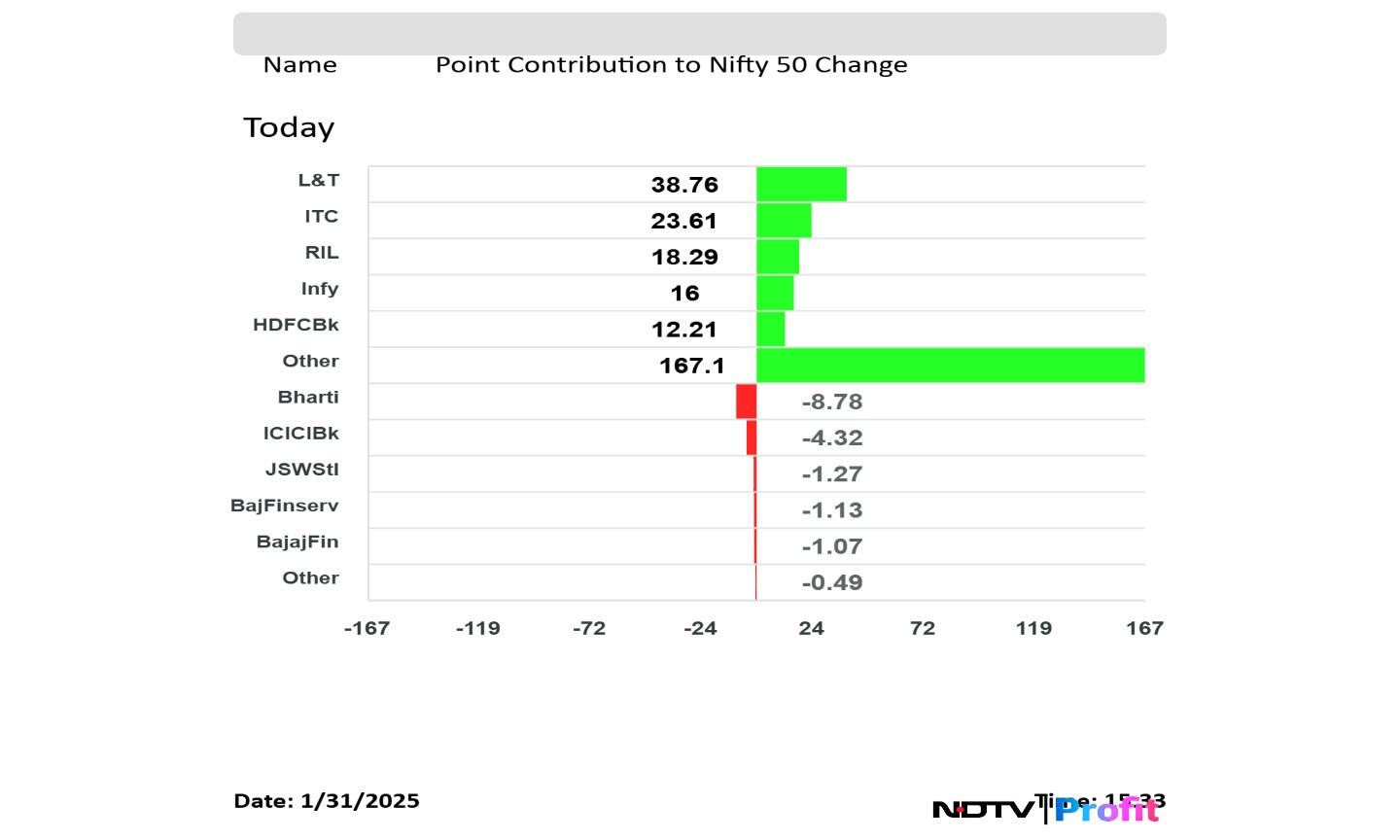

Shares of Larsen & Toubro Ltd., ITC Ltd., Reliance Industries Ltd., Infosys Ltd. and HDFC Bank Ltd. were the top gainers among the NSE Nifty 50 stocks on Friday.

Among the losers were shares of Bharti Airtel Ltd., ICICI Bank Ltd., JSW Steel Ltd., Bajaj Finance Ltd. and Bajaj Finserv Ltd.

The benchmark indices extended their gains to the fourth day, while energy and consumer goods sectors led the sectoral advances. The NSE Nifty 50 advanced as much as 1.11% to 23,508.4, and the BSE Sensex rose 0.97% to 77,500.57.

Meanwhile, Sensex and Nifty ended the fourth straight month of losses in January, the longest losing streak in 23 years.

Indian stocks are likely to see a bounce-back soon after witnessing the second longest of the 10 corrections in the last decade, if the Reserve Bank of India takes a pro-growth stance along with no tax surprise in the upcoming Budget, according to Jefferies.

Top Gainers

Larsen & Toubro Ltd. was the top gainer on Friday, after it reported a 14% rise in consolidated net profit for the third quarter of the current financial year. Revenue from operations increased by 17.3% to Rs 64,668 crore, compared to Rs 55,128 crore in the same period last year.

ITC and Reliance Industries closed higher by 2.59% and 0.96%, respectively.

Top Losers

Bharti Airtel was the top loser, with the stock falling as much as 4.05% during the day to Rs 1,574.2 apiece on the NSE. ICICI Bank scrip also fell and closed 0.22% lower, while JSW Steel ended 0.62% lower.

The benchmark Nifty should bottom out before Feb. 7, assuming no tax surprise in the Budget and a pro-growth RBI, Jefferies said. Rate sensitive stocks should do well in the expected near-term rally, it said. However, the 12-month outlook depends on FPI flows.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.