Shares of Nestle India Ltd. rose on Thursday after the board approved a bonus issue in a meeting. This will be the first ever issue by the FMCG giant.

The company approved a bonus issue of equity shares in 1:1 ratio. The record date for the bonus will be announced in due course, the company said in an exchange filing. The Maggie maker added that the bonus is to be credited within two months of approval by the board of directors, that is, on or before Aug. 25.

The company's promoters Maggi Enterprises Ltd., which holds 27.5 crore shares or a 28.48% stake in the company, and Nestle SA, which holds 33.1 crore shares or a 34.28% stake in the firm, are expected to benefit from the bonus issue.

Nestle's retail investors who hold up to 9 crore shares and 9.33% shareholding may also stand to profit from this move.

Nestle in January 2024 had carried out a stock split. The company had split one share with a face value of Rs 10 into 10 shares, with face value of Rs 1 each. This indicated that shareholders that had 10 stocks pre-split would have 100 shares. However, the face value of the shares remained the same.

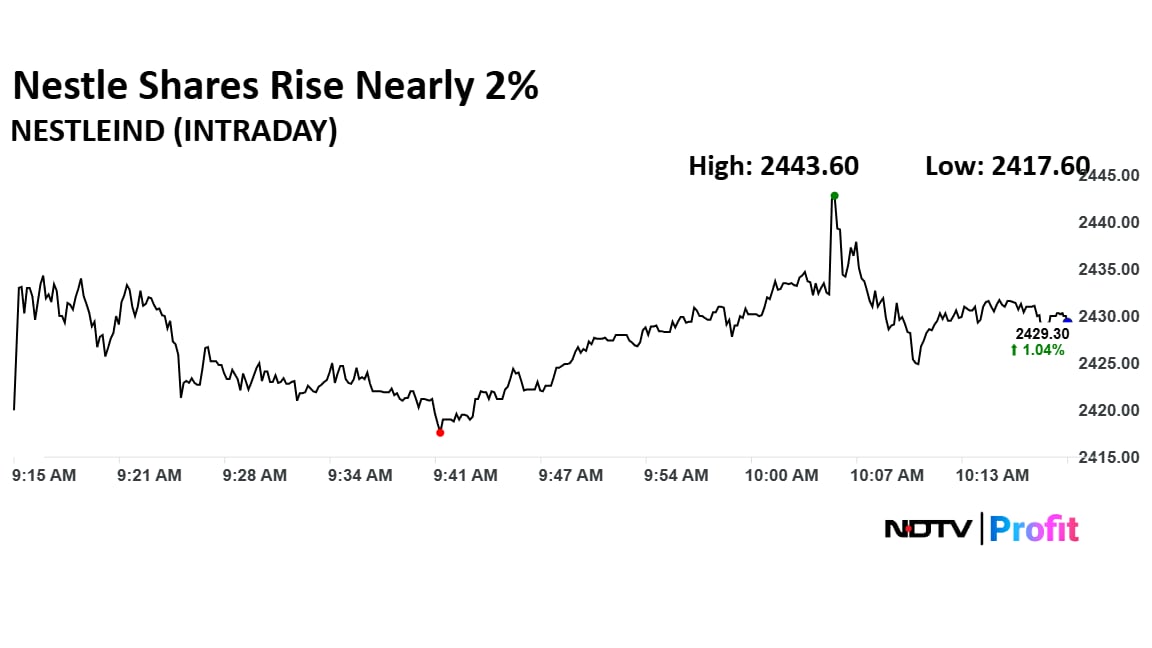

Nestle Share Price Today

Shares of Nestle rose as much as 1.27% to Rs 2,435 apiece, the highest level since June 24. They pared gains to trade 0.47% higher at Rs 2,426.90 apiece, as of 9:55 a.m. This compares to a 0.59% advance in the NSE Nifty 50.

The stock has fallen 4.14% in the last 12 months and risen 11.97% year-to-date. Total traded volume so far in the day stood at 1.09 times its 30-day average. The relative strength index was at 57.72.

Out of 40 analysts tracking the company, 11 maintain a 'buy' rating, 18 recommend a 'hold' and 12 suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 0.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.