NBCC Ltd. saw a surge in its stock price after the company announced the receipt of multiple work orders valued at approximately Rs 368.75 crore. These orders span several high-profile infrastructure projects, further bolstering the company's business portfolio.

The first order involves the construction of the Mehta Family School of Data Science and Artificial Intelligence at IIT Roorkee, Uttarakhand, valued at Rs 24.38 crore. This project includes a comprehensive range of development works, including internal electrical installations, HVAC, firefighting systems, lifts, audio-visual systems, CCTV, and Building Management System (BMS) installations.

The second major project is the development of the Jawaharlal Nehru Commercial Complex (JLNCC) in Varanasi, Uttar Pradesh, awarded by the Varanasi Development Authority (VDA). This self-sustaining model project is worth Rs 300 crore, reflecting NBCC's role in the redevelopment of key commercial infrastructure.

Lastly, NBCC has secured a Rs 44.37 crore contract for the construction and furnishing of a 500-bed multi-storey Vishram Sadan at AIIMS Gorakhpur, Uttar Pradesh. This order is awarded by Power Grid Corporation of India Ltd. and will contribute significantly to the healthcare infrastructure in the region.

The total value of the contracts, Rs 368.75 crore, is expected to have a positive impact on NBCC's financials.

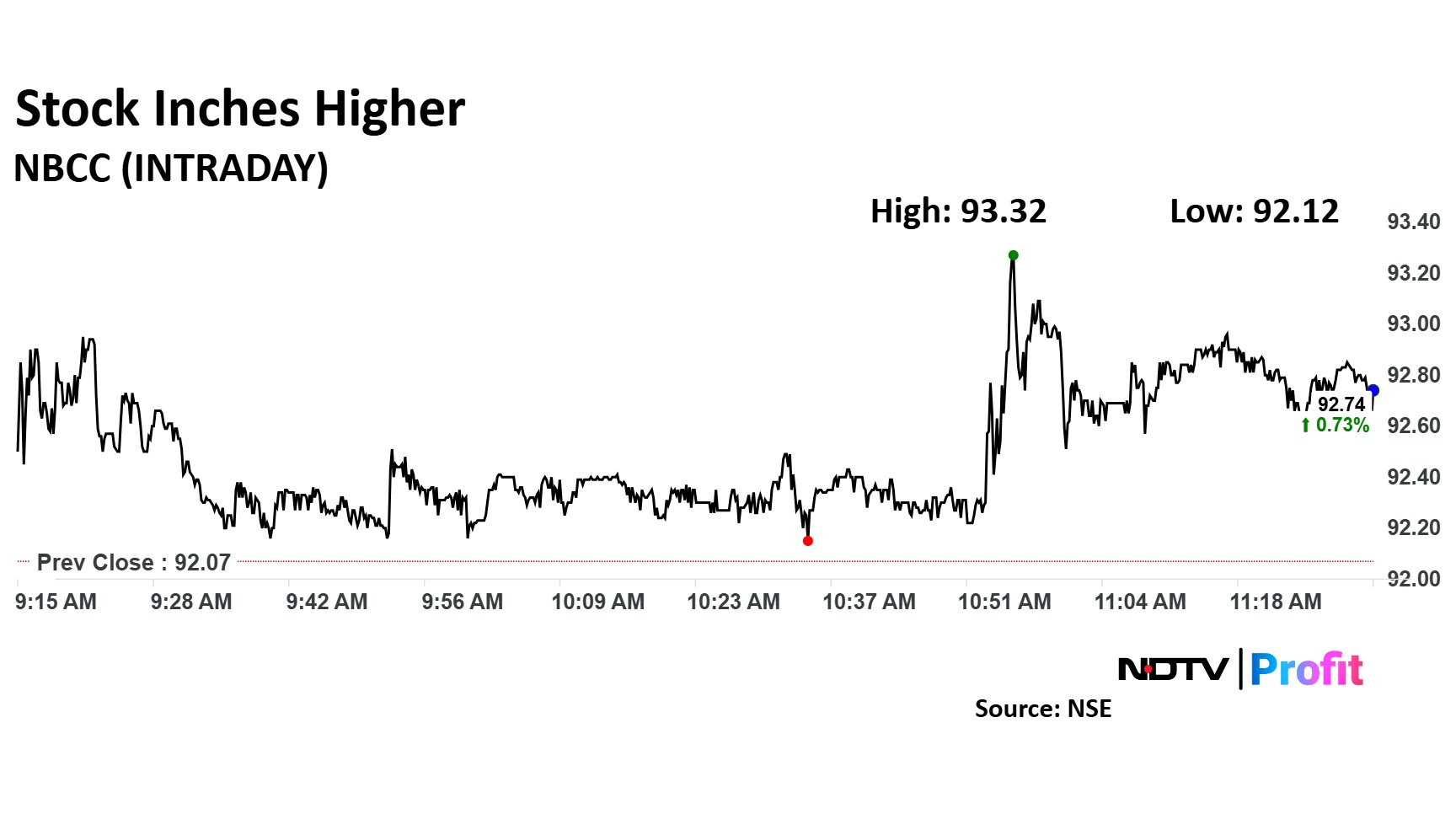

The scrip rose as much as 0.95% to Rs 92.98 apiece. It pared gains to trade 0.70% higher at Rs 92.73 apiece, as of 11:36 a.m. This compares to a 0.50% advance in the NSE Nifty 50 Index.

It has risen 73.98% in the last 12 months. Total traded volume so far in the day stood at 0.3 times its 30-day average. The relative strength index was at 37.8.

Out of four analysts tracking the company, two maintain a 'buy' rating, zero recommend a 'hold,' and two suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 43.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.