Earnings forecasts for three-fifths of Indian companies were lowered as they missed estimates because of higher commodity costs.

Till Dec. 4, earnings per share forecasts were reduced for 168 of the 269 companies tracked by at least 10 analysts, according to Bloomberg data. That came as the number of Nifty 50 companies failing to meet forecasts rose to its highest in at least five quarters.

Companies across sectors saw EPS cuts, except for information technology. The export-driven sector was aided by the weakening rupee.

EPS estimates were reduced by more than 50 percent for 18 stocks, with telecom cement and hospital companies witnessing the deepest cuts.

Here are the stocks with biggest cuts in EPS estimates:

Reasons

- Bharti Airtel: Continued pricing pressure weighed on the company's margin.

- Fortis Healthcare: Contraction in hospital business, muted performance of diagnostic unit and large one-offs that led to losses.

- Healthcare Global: Losses in the first half of financial year 2019 due to higher interest costs and foreign exchange losses.

- Tata Communications: Subdued performance of its data segment owing to consolidation in the telecom industry and losses in growth and innovative services business led to cuts in EPS.

- InterGlobe Aviation: Higher crude prices, a weaker rupee and lower ticket prices in the first half.

- Cement Companies: Double whammy of lower cement prices and higher costs.

- Sadbhav Engineering, Tata Motors, Strides Pharma, HT Media: Muted half yearly performance.

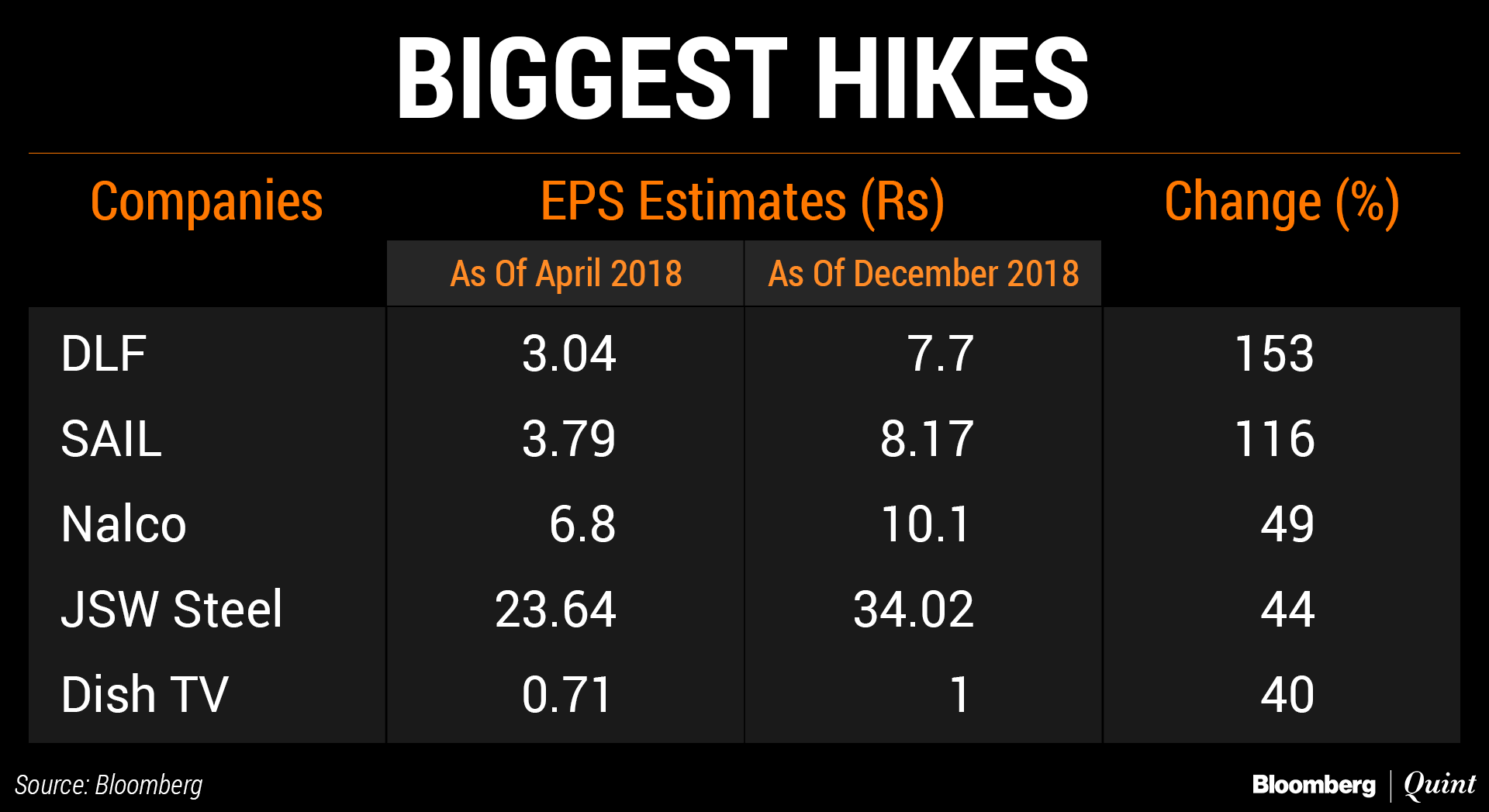

Here are the stocks with biggest hikes in EPS estimates:

Reasons

- DLF: Better-than-estimated revenue and net profit due to adoption of new accounting standards.

- Steel Producers: Higher steel prices.

- Nalco: Higher alumina volumes and prices.

- Dish TV: Uptick in average revenue per user and lower costs after merger with Videocon D2H.

Watch the video here

(The reasons for upgrades and downgrades have been compiled from brokerage reports of JPMorgan, CLSA, HDFC Securities, Elara Securities, Emkay, ICICI Direct and Antique, among others)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.