Mamaearth parent Honasa Consumer Ltd.'s share price soared by over 17%, hitting a six-month high following the announcement of its fourth-quarter financial results.

For the quarter ended March 31, 2025, Honasa Consumer reported a 13.3% increase in revenue, reaching Rs 533.5 crore compared to Rs 471 crore in the same period last year. This figure also surpassed Bloomberg's estimate of Rs 512 crore, highlighting the company's robust sales growth and market presence.

However, the company's earnings before interest, taxes, depreciation, and amortisation declined by 17.6% to Rs 27.1 crore, down from Rs 32.9 crore year-on-year. Despite this drop, the Ebitda figure exceeded Bloomberg's estimate of Rs 17.6 crore. The Ebitda margin contracted to 5.1% from 7%, but still performed better than the estimated 3.4%.

Honasa Consumer's net profit also saw a decline, falling by 17.8% to Rs 25 crore from Rs 30.4 crore in the corresponding quarter of the previous fiscal. This result, however, was higher than Bloomberg's estimate of Rs 16 crore, indicating better-than-expected profitability.

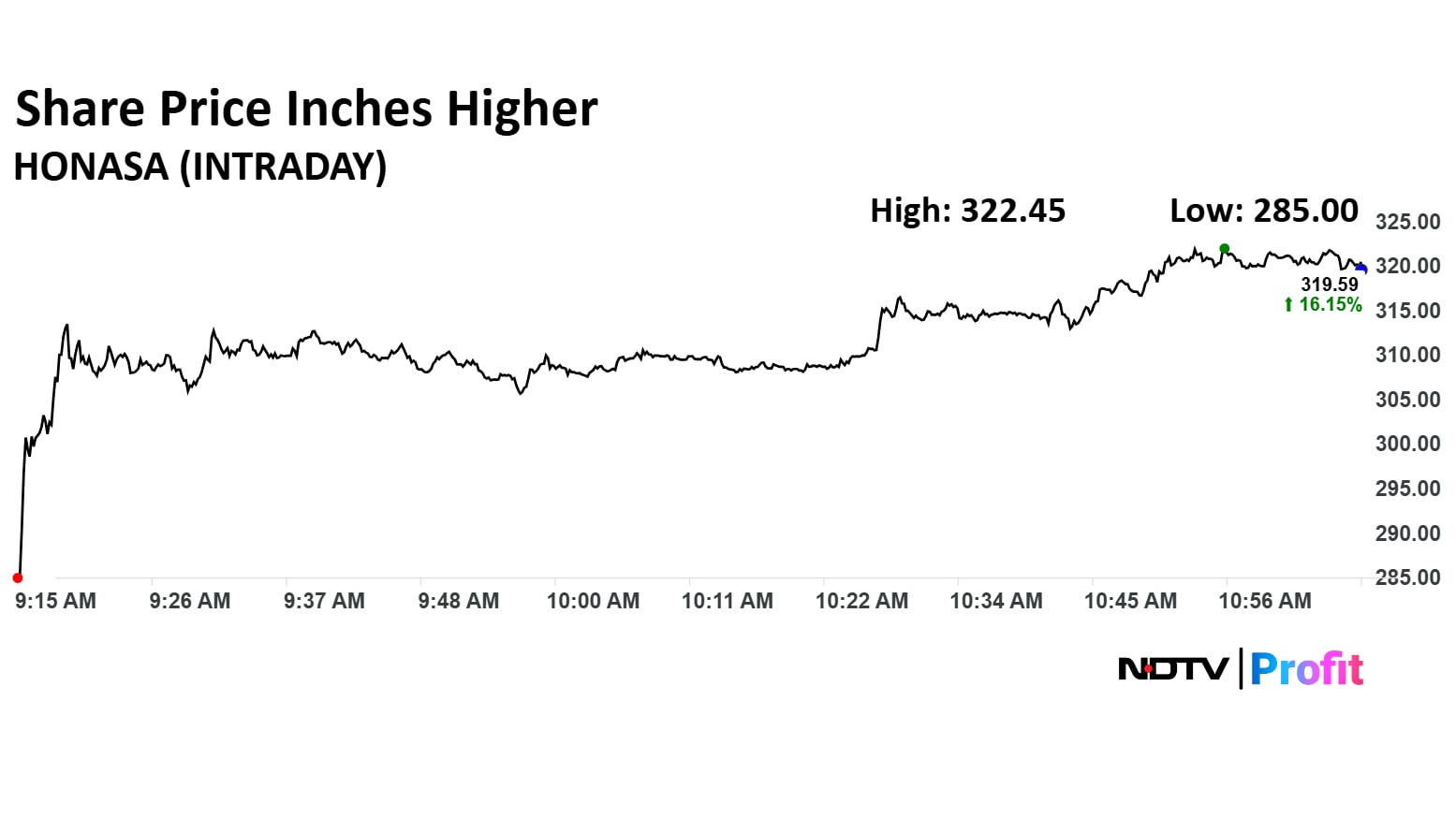

Honasa Share Price

The scrip rose as much as 17.19% to Rs 322.45 apiece. It pared gains to trade 16.91% higher at Rs 321.69 apiece, as of 11:06 a.m. This compares to a 0.69% advance in the NSE Nifty 50.

It has fallen 23.11% in the last 12 months. Total traded volume so far in the day stood at 50 times its 30-day average. The relative strength index was at 86.

Out of 12 analysts tracking the company, six maintain a 'buy' rating, two recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 8.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.