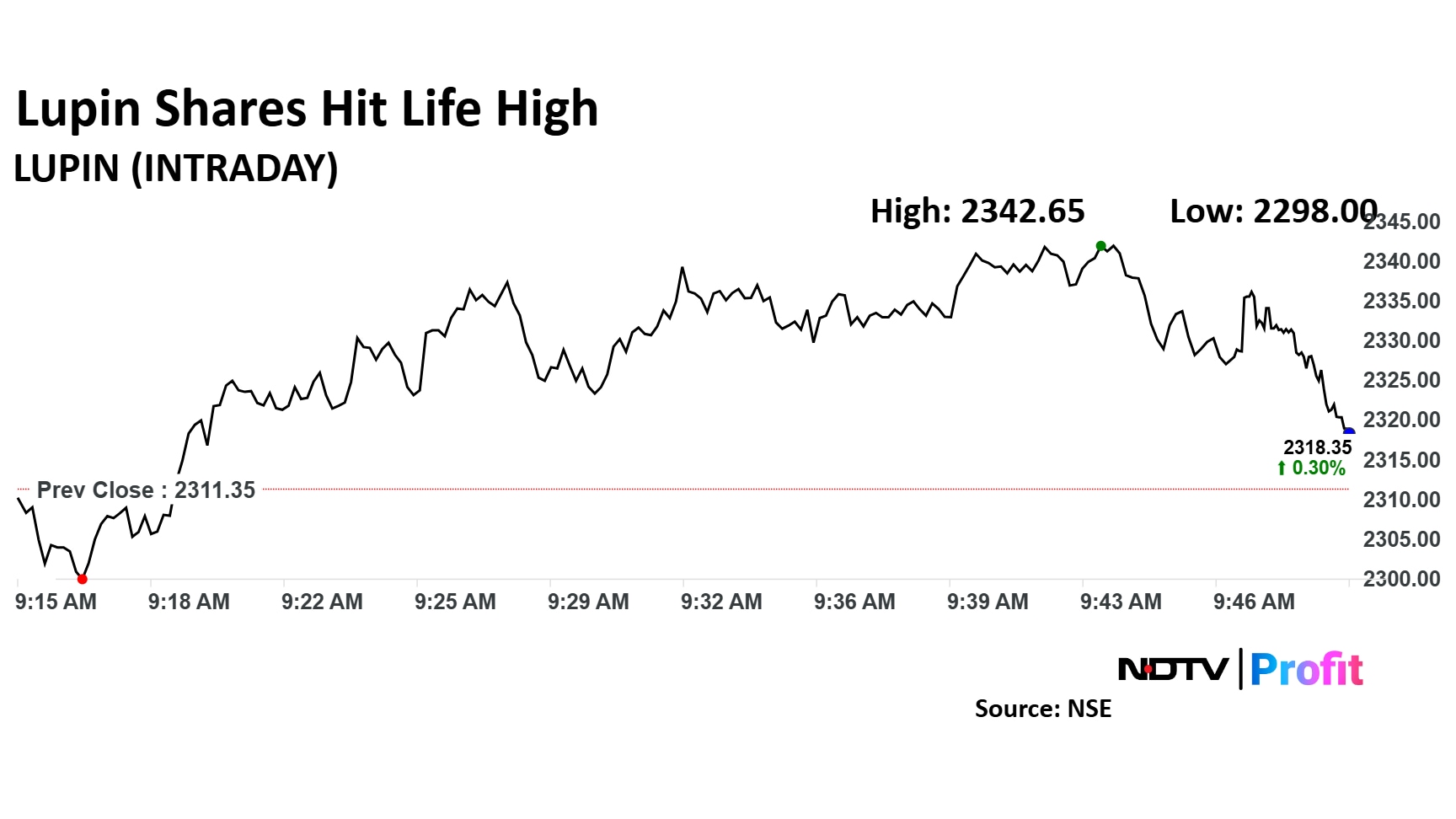

Shares of Lupin Ltd. surged by 1.34% on Tuesday, reaching all-time high after the company announced the acquisition of Huminsulin in India from Eli Lilly and Co. The acquisition is a move towards enhancing Lupin's diabetes portfolio, although the financial terms of the deal were not disclosed. Lupin had previously marketed Huminsulin products, including Huminsulin R, Huminsulin NPH, and other variants, through distribution agreements with Eli Lilly India.

Nilesh Gupta, Managing Director of Lupin, emphasised that this acquisition aligns with the company's commitment to expanding its diabetes treatment offerings and improving affordable healthcare access for patients in India.

The Huminsulin series of products is used for the treatment of type 1 and type 2 diabetes mellitus to improve blood sugar control in both adults and children.

Insulin is the primary compound used in type 1 diabetes management and often becomes essential over time in type 2 diabetes as the condition progresses.

The company said that there is a significant Indian population affected with diabetes for both type 1 and type 2 diabetes mellitus, where insulin human is prescribed for management along with other related therapies.

The scrip rose as much as 1.34% to 2,342.25 apiece. It pared gains to trade 1.12% higher at Rs 2,337.30 apiece, as of 09:44 a.m. This compares to a 0.49% decline in the NSE Nifty 50 index.

It has risen 78.03% in the last 12 months. Total traded volume so far in the day stood at 5.1 times its 30-day average. The relative strength index was at 73.

Out of 37 analysts tracking the company, 20 maintain a 'buy' rating, 10 recommend a 'hold,' and seven suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 3%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.