Shares of LTIMindtree Ltd. are in the spotlight on Thursday as they will turn ex-dividend tomorrow, following the company's announcement of dividend for its shareholders. The share price initially declined by 1.26% before recovering to trade 1.14% higher.

The company announced Rs 45 dividend per share in its fourth quarter earnings report.

A dividend is often regarded as a form of passive income, representing a portion of a company's profits shared with shareholders as a reward for their investment.

According to data available on the Bombay Stock Exchange, LTIMindtree shares are slated to trade ex-dividend on Friday, May 23, 2025. The ex-date refers to the day a stock begins trading without entitlement to the dividend, meaning investors must own the stock before this date to receive the payout. The eligible shareholders are finalised based on the company's records as of the record date.

The ex-dividend date is crucial for investors as it determines who will receive the dividend. Those who purchase the stock on or after the ex-date will not be eligible for the upcoming dividend payout.

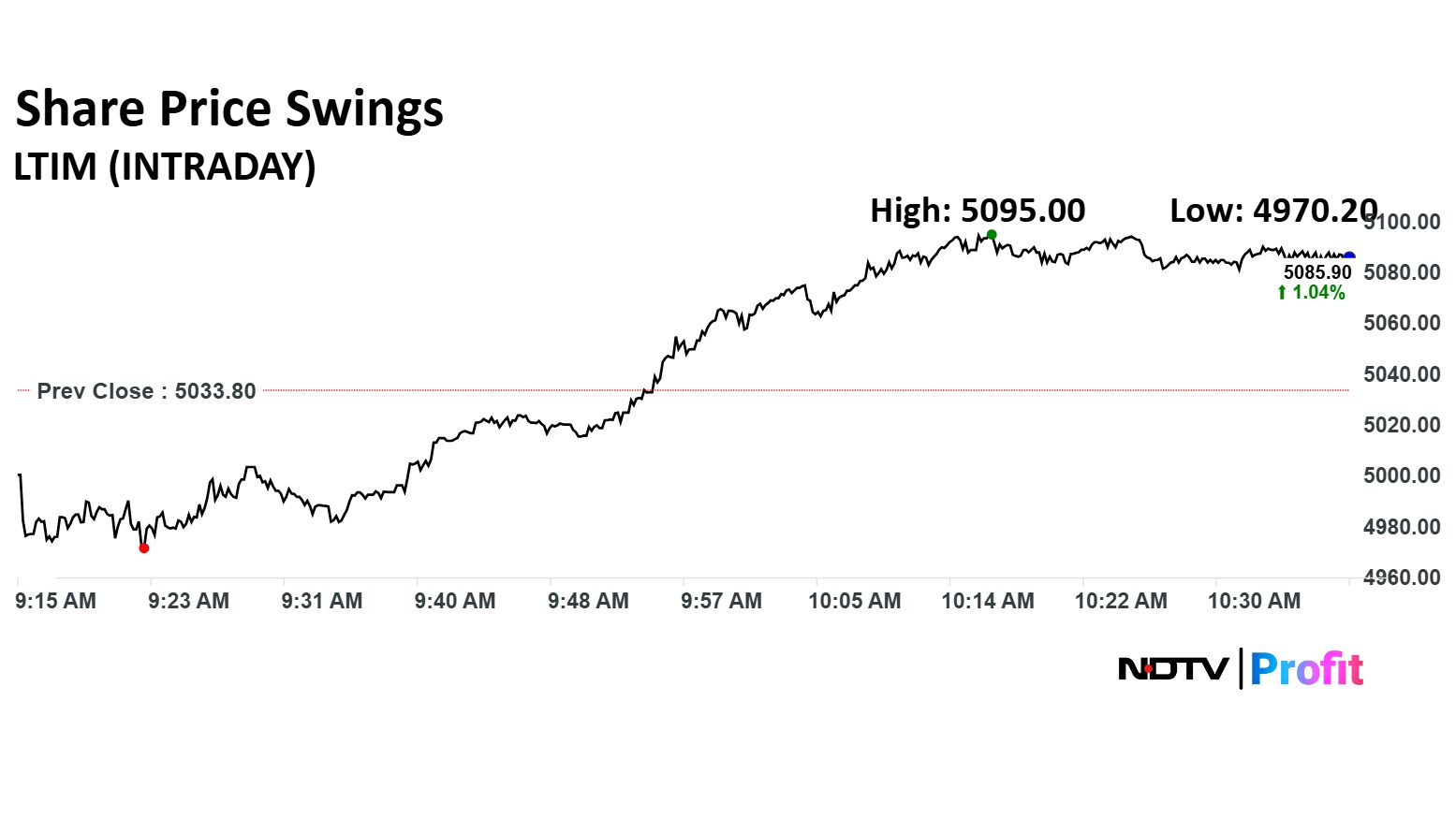

LTIMindtree Share Price Today

The scrip fell as much as 1.26% to Rs 4,970 apiece. It later recovered losses to trade 1.10% higher at Rs 5,089 apiece, as of 10:36 a.m. This compares to a 0.80% decline in the NSE Nifty 50.

It has risen 6.56% in the last 12 months. Total traded volume so far in the day stood at 0.29 times its 30-day average. The relative strength index was at 70.

Out of 42 analysts tracking the company, 24 maintain a 'buy' rating, 11 recommend a 'hold' and seven suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.