Shares of Kalyan Jewellers India Ltd. soared over 9.3% on Monday, rebounding from recent declines after a clarification was issued by Motilal Oswal Asset Management Co. regarding its investments in the jewellery giant.

On Sunday, Motilal Oswal AMC responded to allegations circulating on social media, which suggested that its fund managers were involved in a bribery scheme to artificially inflate the stock price of Kalyan Jewellers. In a statement, the firm called the claims “baseless, malicious, and defamatory,” and categorically denied any wrongdoing.

“These baseless accusations are a deliberate attempt by individuals with vested interests to malign the good reputation that our firm and leadership have built over decades,” the company said.

By Friday of last week, Kalyan Jewellers' share price had plunged 12.6%. It dipped as low as 6.63% intraday on Friday, hitting a day's low of Rs 503.25 per share and closed 6.86% lower at Rs 502.2.

In the past week the stock fell in four of the five trading sessions, following a five-session losing streak last to last week.

Kalyan Jewellers started 2025 on a strong note, reaching an all-time high on Jan. 2. However, the stock was on a downward trend since then, falling in 10 of the 13 sessions this year, but it recovered some of these losses on Monday on heels of clarification issued by Motilal Oswal.

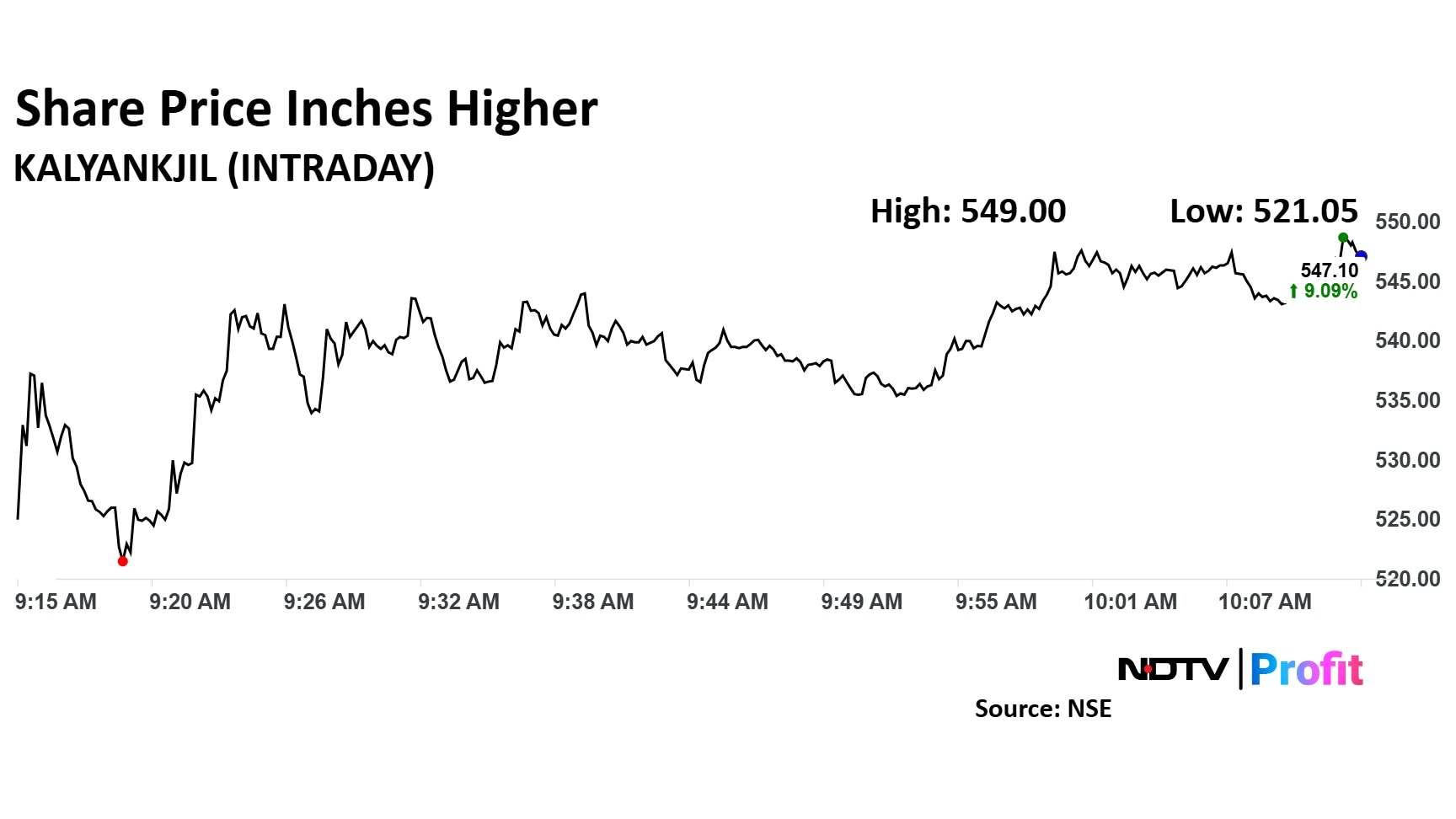

Kalyan Jewellers Share Price

Share price of Kalyan Jewellers rose as much as 9.33% to Rs 548.30 apiece. It pared gains to trade 8.87% higher at Rs 546 apiece, as of 10:06 a.m. This compares to a flat NSE Nifty 50.

The stock has risen 51.08% in the last 12 months. Total traded volume so far in the day stood at 9.3 times its 30-day average. The relative strength index was at 31.

Out of nine analysts tracking the company, eight maintain a 'buy' rating, and one suggests 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 42%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.