Shares of Juniper Hotels Ltd. surged to a nearly-three month high on Thursday as CLSA initiated coverage on the luxury hotel development and ownership company. The brokerage has initiated an 'outperform' rating on the stock of the largest owner of Hyatt-affiliated rooms in India with a target price of Rs 430, which indicates a 12% potential upside over the current market price.

Highlighting the company's strategic position in the hospitality industry, CLSA cited Juniper Hotel's strong growth potential, high entry barriers, and advantageous market share in the country's booming hotel sector.

The company holds an estimated 19% market share in Hyatt-operated rooms in India, and a 38.76% equity stake in its joint venture with Hyatt.

CLSA points to JHL's three-pronged strategy for expansion:

Upgrading Existing Assets: Adding new ballrooms, premiumising facilities, and refurbishing spaces at its Mumbai and Delhi properties.

Accretive Acquisitions: Leveraging agreements and acquiring strategic third-party assets, including a recent purchase in Bangalore.

New Opportunities: Exploring mixed-use developments, including commercial and retail spaces, on its existing land banks.

Sector Tailwinds

The Indian hospitality industry is projected to grow at a 10.4% compound annual growth rate between fiscals 2024 and 2029, outpacing the anticipated supply growth of 9.0% CAGR during the same period.

CLSA sees JHL as well-positioned to capitalise on this demand, driven by the rise in domestic and inbound travel, weddings, MICE (Meetings, Incentives, Conferences, Exhibitions), and other events.

Financial Outlook And Risks

CLSA forecasts a 16% Ebitda CAGR for the hotel chain from fiscal 2025 to 2027, citing improvements in occupancy and room rates at flagship properties like the Grand Hyatt Mumbai and Andaz Hotel Delhi. The brokerage values JHL at 21 times the Ebitda for fiscal 2026, comparable to peers like Chalet Hotels, and expects sustained growth beyond fiscal 2027 through brownfield expansions and operational enhancements.

Despite its bullish stance, CLSA flags potential risks such as geographic concentration, the cyclical nature of the industry, and challenges related to related-party transactions.

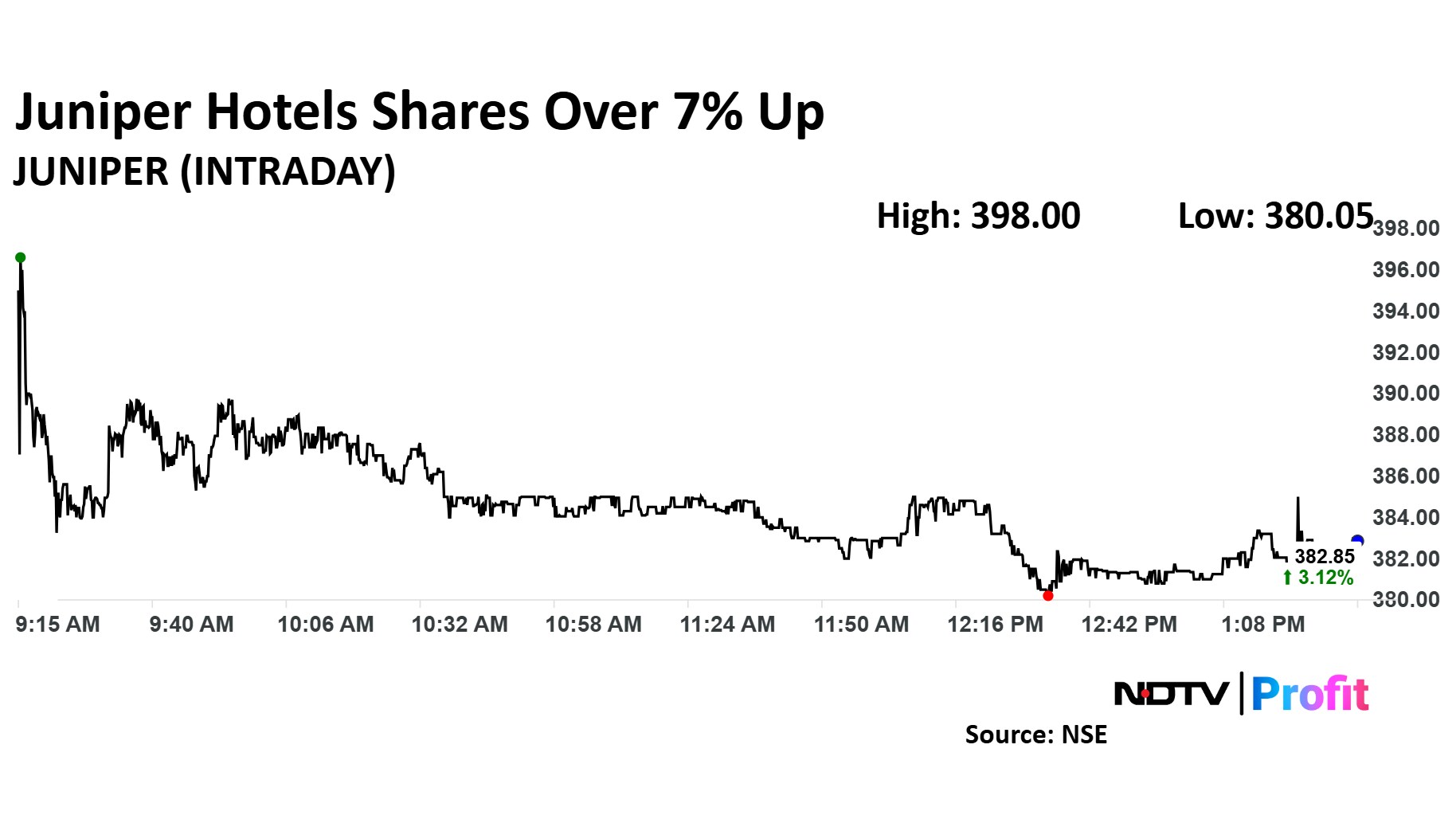

Juniper Hotels Share Price Today

Juniper Hotels share price rose as much as 7.21% to Rs 398 apiece, the highest level since Sep. 12, 2024. It pared gains to trade 2.92% higher at Rs 382.10 apiece, as of 01:28 p.m. This compares to a 0.65% advance in the NSE Nifty 50 Index.

It has fallen 4.73% on a year-to-date basis. Total traded volume so far in the day stood at 5.1 times its 30-day average. The relative strength index was at 67.54.

Two analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.