The share price of Jio Financial Services Ltd. is in focus following regulatory approval from the Securities and Exchange Board of India for JioBlackRock Asset Management Pvt Ltd. The company is a joint venture with BlackRock to start operations as an investment manager for their mutual fund business in India.

Shares of the company rose as high as 2.49% to Rs 298.65 apiece on Wednesday.

JioBlackRock Asset Management will capitalise on Jio Finance's extensive digital presence and knowledge of the Indian market, combined with BlackRock's global investment acumen and advanced risk management technology, according to a company press release.

Sid Swaminathan has been named Managing Director and Chief Executive Officer of the joint venture. Swaminathan has more than 20 years of experience in asset management, most recently as Head of International Index Equity at BlackRock, where he oversaw $1.25 trillion in assets under management.

"For retail investors, the offering will also be distinctive for its digital-first customer proposition. JioBlackRock Asset Management aims to launch a range of investment products, including those that apply BlackRock's industry-leading capabilities in data-driven investing, over the coming months," the company said in the release.

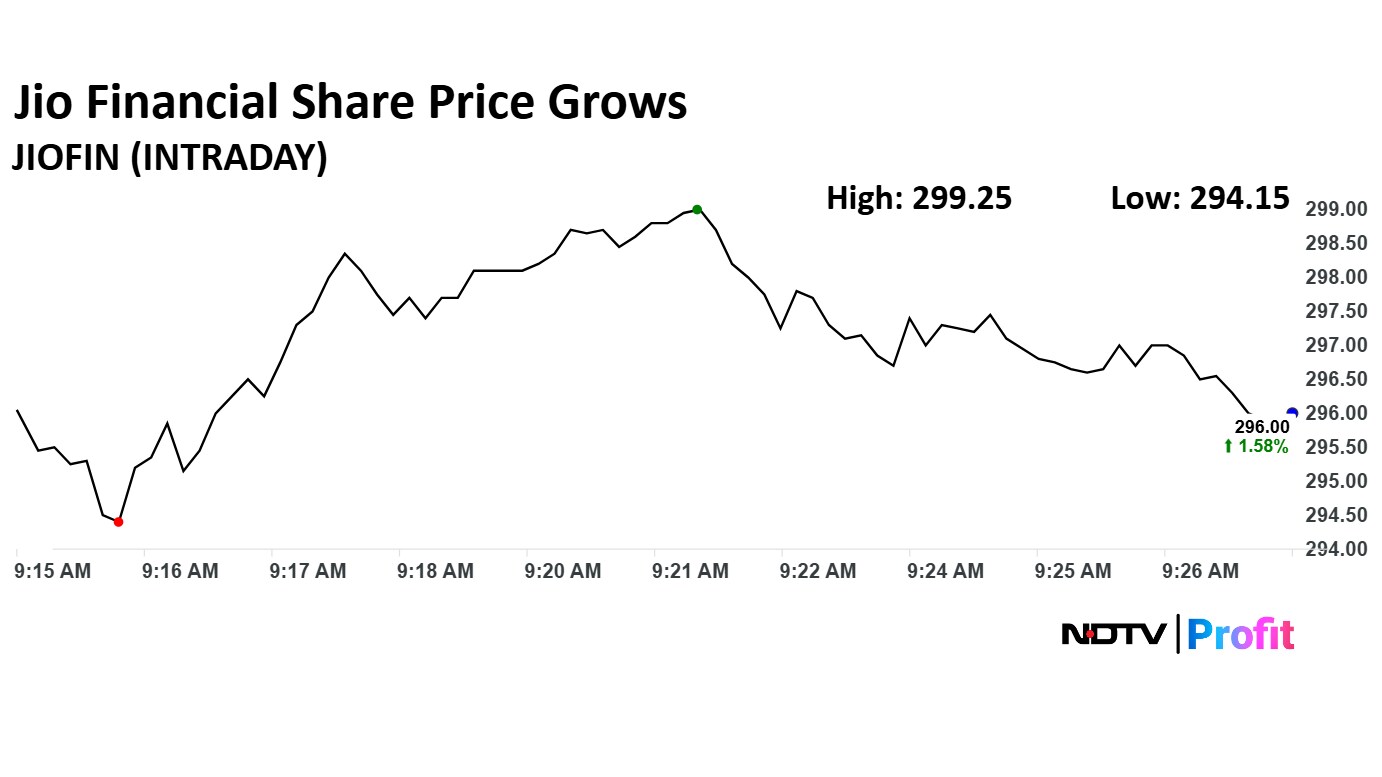

Jio Finance Share Price Today

The scrip rose as much as 2.49% to Rs 298.65 apiece, the highest level since Jan. 8, 2025. It pared gains to trade 2.39% higher at Rs 298.35 apiece, as of 09:28 a.m. This compares to a 0.12% advance in the NSE Nifty 50 Index.

It has fallen 2.44% on a year-to-date basis and 18.34% in the last 12 months. The relative strength index was at 52.23.

One analyst tracking the company recommends a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.