InterGlobe Aviation Ltd. share price fell during early trade on Thursday after promoters offloaded equity via a block deal.

Co-founder Rakesh Gangwal and the Chinkerpoo Family Trust will together offload up to 1.21 crore shares, representing 3.1% stake in the company that operates flights under the name IndiGo, according to the term sheet accessed by NDTV Profit. The stake is worth Rs 7,027.7 crore.

The offer price for the issue has been set at Rs 5,808 per share, indicating a 4% discount to the previous closing price.

Multinational investment banks Goldman Sachs, JPMorgan and Morgan Stanley are the managers of the deal.

As of June, the promoters together owned 7.8% stake in the company. While Gangwal owned 4.73% stake, Chinkerpoo Family Trust, with Shobha Gangwal and JP Morgan Trust Company of Delaware as the trustee, held 3.08% stake in the company.

Gangwal and the promoter entity offloaded up to a 3.4% stake in May. Rakesh Gangwal resigned from the board of directors of InterGlobe Aviation in February 2022 and had said he would gradually reduce his equity stake over the next five years.

Since then, he has mopped up Rs 45,300 crore from stake sale. The residual stake — 4.78% — of Gangwal Group is valued at Rs 11,169 crore.

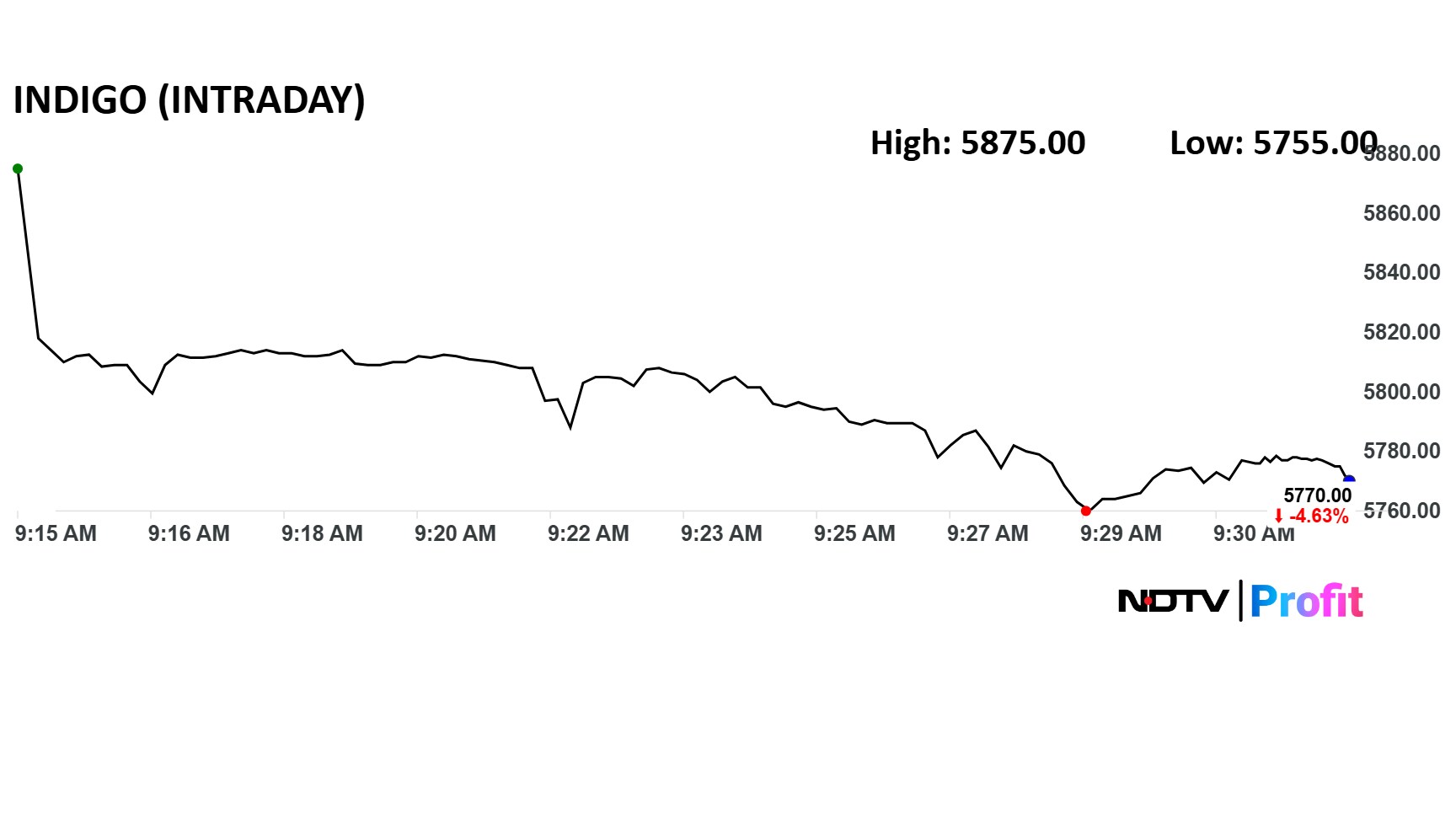

IndiGo Share Price

IndiGo shares fell as much as 4.9% to Rs 5,755 apiece on the NSE.

IndiGo shares fell as much as 4.9% to Rs 5,755 apiece on the NSE, compared to a decline of 0.7% in the benchmark Nifty 50. The total traded volume stood at 18.8 times the 30-day average with a turnover of Rs 8,334 crore. Over 1.4 crore shares changed hands. The relative strength index was 58.

The stock has risen 19% in the last 12 months and 27% year-to-date.

Out of the 25 analysts tracking the company, 20 maintain a 'buy' rating, three recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average of 12-month consensus price target is Rs 6,349.83.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.