(Bloomberg) -- Emerging markets such as India and Indonesia, whose populations are growing at a solid pace, stand to benefit as demographics begin to play a bigger role in investment decisions, according to Fidelity International and BlackRock Investment Institute.

The investors are focusing on the two nations in emerging Asia, thanks in part to an expected boom in infrastructure spending, which in turn bodes well for the countries' economies. Both India and Indonesia coincidentally had elections this year, showcasing to the world their ambition to transition into major economic powerhouses with their dynamic population a key strength.

The two countries stand out at a time when rapid aging has plagued peers in the region, including China. India surpassed China as the world's most populous nation in mid-2023, a historic milestone that unleashed a rush to identify potential winners in the South Asian nation's stock market.

BlackRock's analysis shows a positive relationship between a country's working-age population growth and share-price valuations, while Fidelity sees the financial sector as a key beneficiary as credit needs grow for both corporates and consumers.

“India and Indonesia's labor forces are young — with demographic dividends that far outshine some of the largest economies in the neighborhood,” said Ian Samson, a fund manager at Fidelity in Singapore. “All companies big and small require financing. This in part explains why bank stocks generally correlate with GDP growth in emerging markets.”

The Investment Implications of a World That's Fast Getting Older

Fragile-Five Days Long Gone as Funds Pile Into India, Indonesia

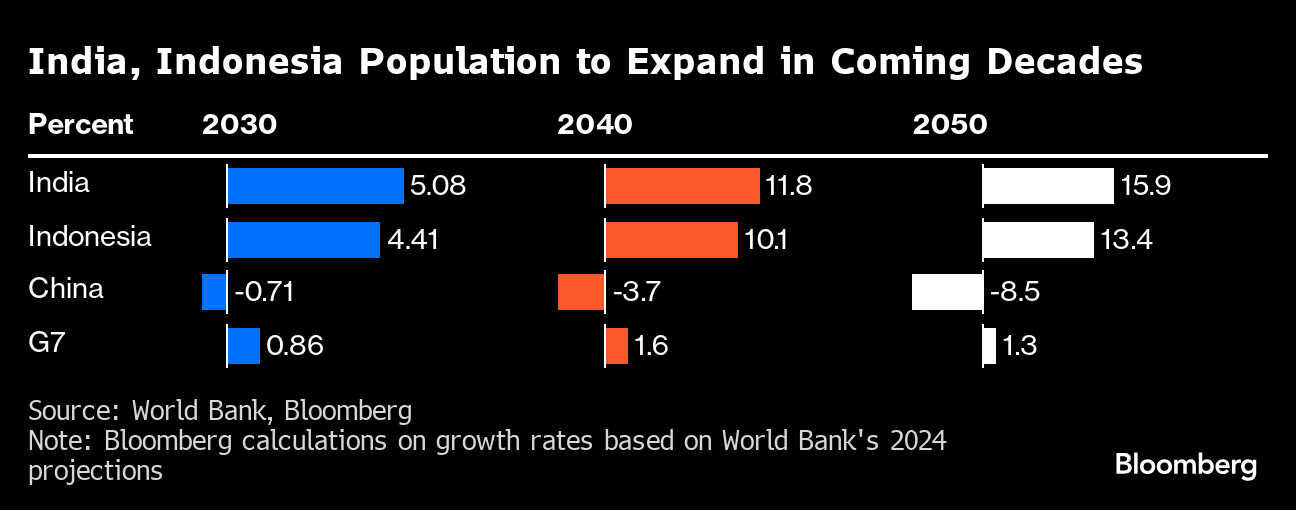

India and Indonesia are projected to see population gains of at least 10% from this year by 2040, according to data from the World Bank, while China will likely see shrinkage of nearly 4%.

A more important metric would be changes in the working-age population, defined as those between 15 and 64 years old. Even before the historic overall population decline in China, its working-age cohort had been shrinking for years, while India's is the youngest among major economies.

A faster increase in the working-age group typically translates into higher future earnings growth, BlackRock Investment Institute strategists led by Jean Boivin wrote in March, adding that migration, greater labor-force participation and automation are also factors at play.

The demographic dividend forms part of the optimism that has fueled gains in the two stock markets, alongside a slew of idiosyncratic factors including hopes for a market-supportive election outcome.

The Nifty 50 Index, which is trading at record levels, is set to notch nine-straight years of gains if the trend holds. The Jakarta Composite Index touched an all-time high in March.

Structural Reforms

Analysts note that structural reforms to reduce regulatory red tape, enhance job market flexibility and facilitate foreign investment are essential for economies to capitalize on the demographic tailwind.

“Ultimately, the growth equation is employment times productivity,” said Fidelity's Samson. “The solid structural reforms we have seen in both India and Indonesia will allow for sufficient job creation to benefit from the demographic dividend.”

While there's been some progress, more needs to be done. Indonesia's President-elect Prabowo Subianto, who takes office in October, aims to achieve 8% annual economic GDP growth despite the nation's track record that falls far below that.

Investors are watching whether state governments in India will follow through with implementing labor, land and other policy changes that have been passed at the national level. Should Prime Minister Narendra Modi's party win a slimmer majority in the polls, his plans for more extensive reforms will face hurdles and financial market volatility may rise.

Read: India's Markets Brace for Selloff as Modi's Poll Goals in Doubt

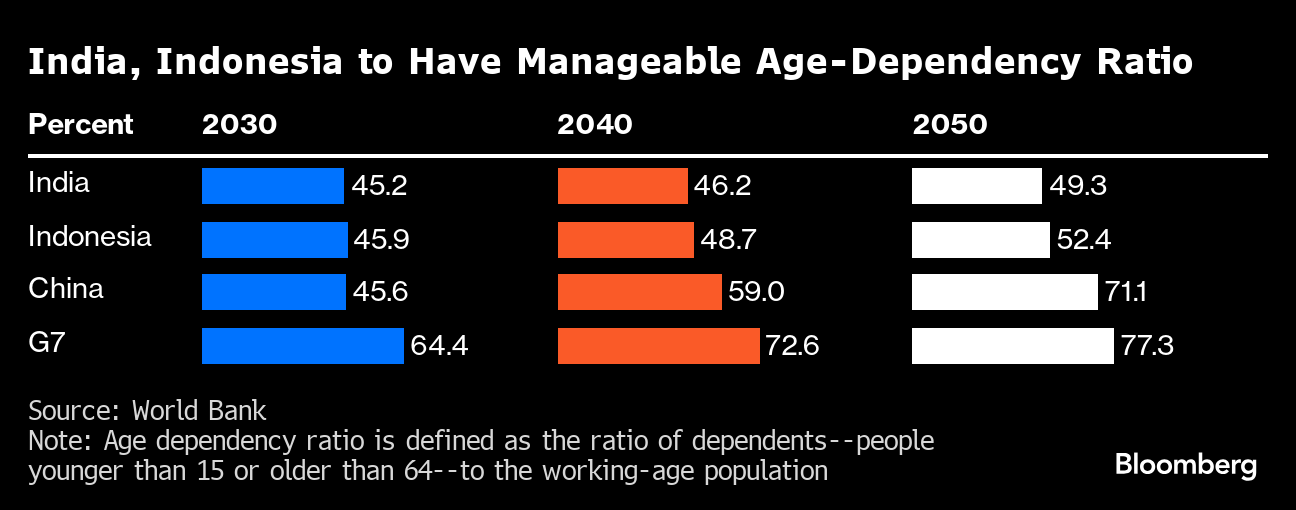

For investors of sovereign debt, the age-dependency ratio — which shows the ratio of those considered too old or too young to work — and fiscal burden are among metrics to consider for long-term investment.

Global funds have poured $5.5 billion into India's bonds this year on index-inclusion prospects, according to data compiled by Bloomberg. Investors took comfort that India's interim budget announced in February focused on infrastructure spending, instead of populist policies ahead of the general election that began in April.

In comparison, international investors have pulled out $1.8 billion from Indonesia's notes as the incoming administration's pledges to boost spending raised concern about fiscal health.

“Aging population increases the cost of healthcare and pensions, with developed-market economies having more comprehensive social benefits as compared to most EM economies,” said Sanjay Shah, a director of fixed income at HSBC Global Asset Management. “In EM economies, the burden of pension plans may be more staggered and less fixed benefit oriented,” thereby reducing the state funding burden, Shah said.

What to Watch

- China will release May manufacturing and non-manufacturing PMI figures, as investors wait for solid signs of a recovery

- South Africa's financial markets are brimming with optimism ahead of a general election on May 29. The nation's central bank will announce a rate decision on Thursday

- Bank of Israel is expected to hold rates at 4.50% on Monday

- Taiwan and the Czech Republic will publish first quarter GDP data, while Brazil and Poland will release their latest inflation statistics

--With assistance from John Cheng and Zijia Song.

(Updates with India election progress in 14th paragraph)

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.