Share price of Hindalco Industries Ltd. rose nearly 2% in early trade on Tuesday ahead of the company's declaration of its financial performance for the final quarter of fiscal 2025.

Hindalco is expected to report a 6% rise in consolidated revenue at Rs 59,251 crore, with an estimated Ebitda of Rs 8,048 crore and a margin of 13.6%. The net profit is forecasted to be Rs 3,555 crore.

The company's wholly owned subsidiary, Novelis Inc., had recently reported its results, which were largely in line with analyst estimates. Brokerage firms Citi and BofA saw no near-term guidance on account of tariff implications, but remained constructive on the long-term story.

BofA has maintained its 'buy' rating on Hindalco, with a target price of Rs 745. The brokerage said profitability improved on the back of a better mix and pricing. Citi, too, is positive, with a 'buy' call.

Other companies releasing their results today include Gland Pharma, JK Tyre & Industries, Max Healthcare Institute, NHPC, Religare Enterprises, Sanghvi Movers, Sequent Scientific, Solar Industries India, Torrent Pharmaceuticals, Updater Services, United Spirits, Whirlpool of India and Zydus Lifesciences.

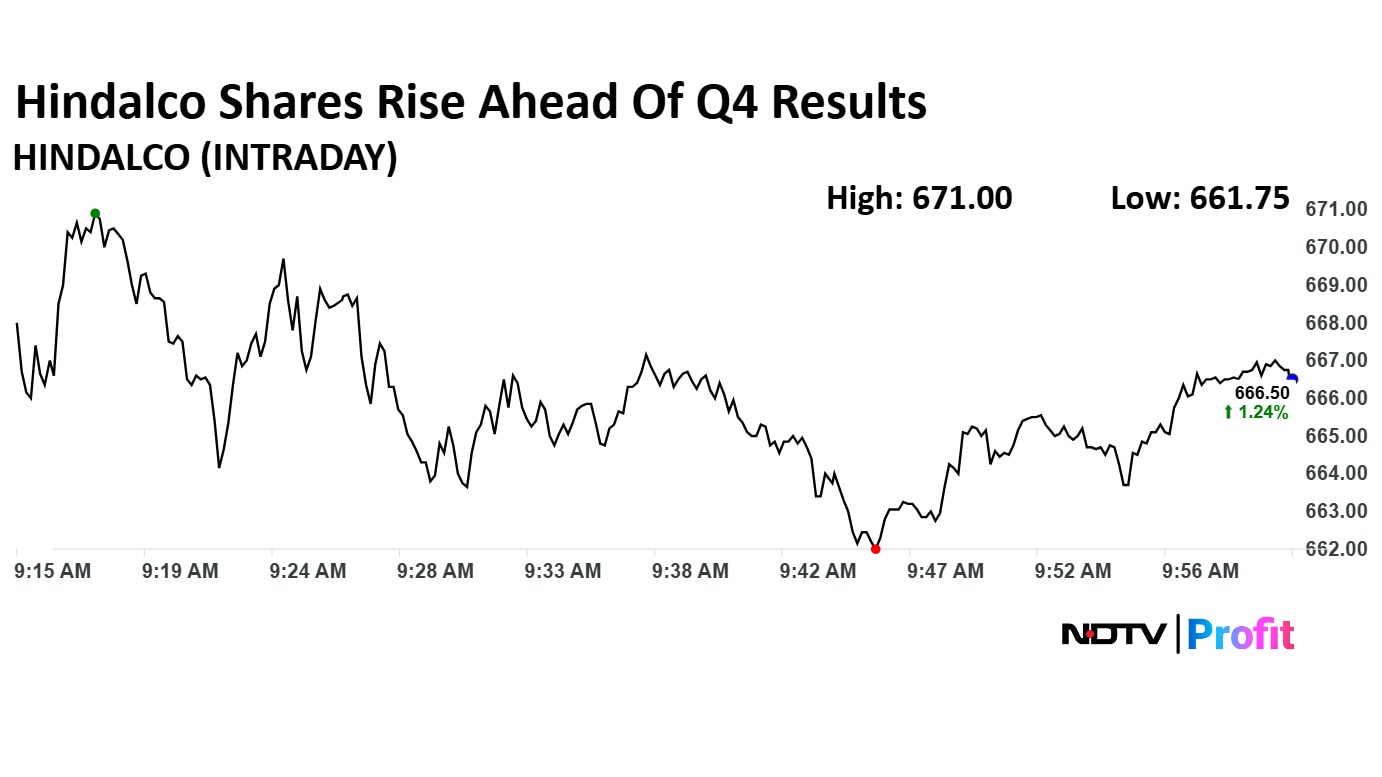

Hindalco Share Price Today

The scrip rose as much as 1.92% to Rs 671 apiece. It pared gains to trade 0.96% lower at Rs 664.70 apiece, as of 10:04 a.m. This compares to a 0.24% decline in the NSE Nifty 50.

It has risen 10.61% on a year-to-date basis and 1.72% in the last 12 months. The relative strength index was at 52.14.

Out of 30 analysts tracking the company, 27 maintain a 'buy' rating, and three suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 12.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.