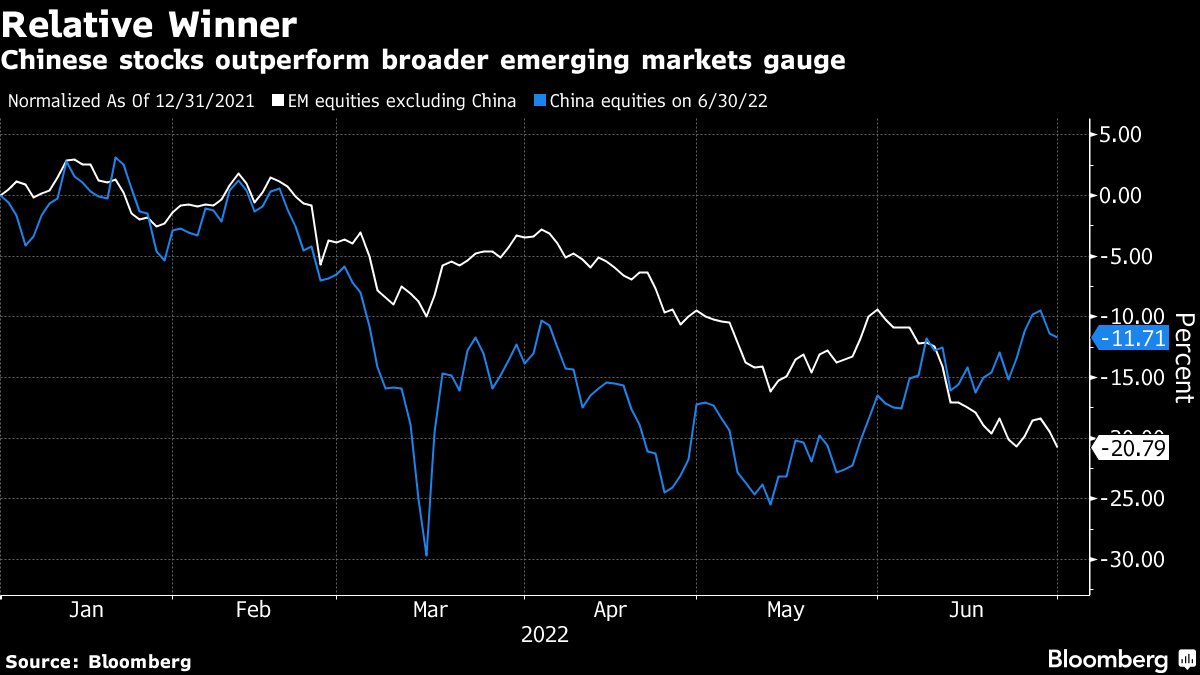

(Bloomberg) -- Chinese equities will be a bright spot as the fear of a global recession sends shares from the rest of the developing world spiraling, according to Goldman Sachs Group Inc.

Emerging-market stocks could dive another 8% to 15% if the US tumbles into a recession, according to an analysis of previous selloffs. That leaves a pocket of opportunity in the MSCI Inc. gauge of Chinese shares, which could get a boost from improving macroeconomic indicators, said strategists Caesar Maasry and Jolene Zhong in a Friday report.

“Despite market concerns regarding a potential US recession, we expect Chinese equities to remain driven by domestic activity and to be uncorrelated with the rest of the EM complex, at least in the short-term,” they wrote.

MSCI's key emerging-market index has declined about 19% so far this year as investors juggle concern about rampant inflation and the central bank measures to combat it.

Those losses are short of the average 26% decline typically seen when the S&P 500 Index drops at least 10%, according to Goldman Sachs. The S&P 500 is down about 20% from its peak in January, the threshold for a bear market.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.