(Bloomberg) -- Gold held an earlier decline after US consumer price data came in line with expectations, keeping the focus on stresses in the US banking system.

The consumer price index rose 6% in February from a year earlier, matching the median economist estimate. The dollar was little changed after the print.

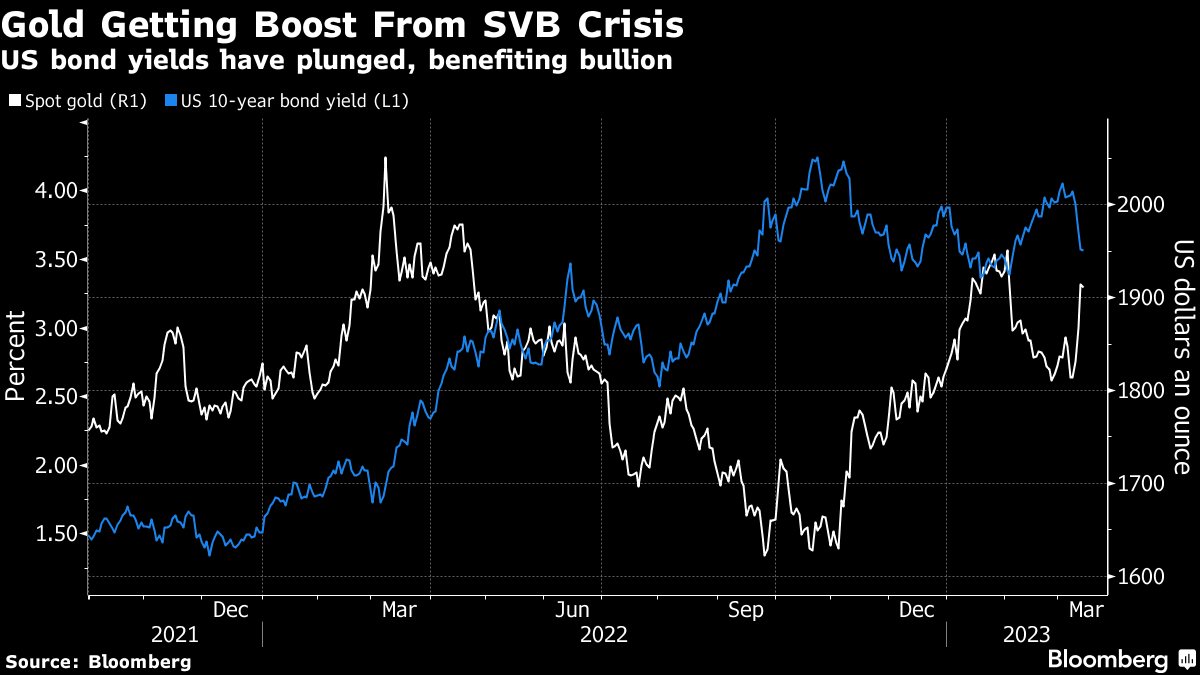

The metal is still holding above $1,900 an ounce following a more than 5% surge over the previous three sessions on the failure of Silicon Valley Bank, combined with a drop in Treasury yields. Concerns about financial stability in the US spurred demand for havens and drastically cut expectations for monetary tightening.

Focus will now shift to the Federal Reserve's meeting next week, which will be crucial in determining the longer-term outlook for gold. Swaps markets are betting on just 25 basis points of rate hikes over the next two meetings, shifting to cuts later in the year.

It's a massive change from expectations for more large rate rises from the central bank to cool inflation, which weighed heavily on gold last month.

Spot gold declined 0.2% to $1,909.23 an ounce as of 12:48 p.m. in London. Bloomberg Dollar Spot Index lost 0.1%. Silver fell after surging 6.2% on Monday. Platinum slid and palladium steadied.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.