India's largest feed maker Godrej Agrovet Ltd. will list on the exchanges on Monday, after raising Rs 1,157 crore in its initial public offering.

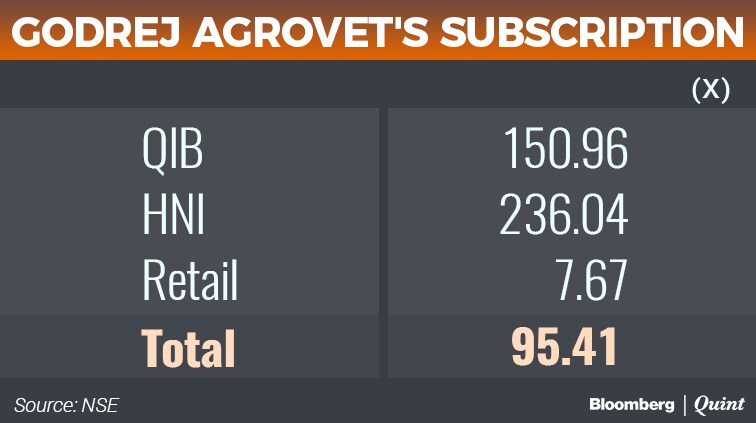

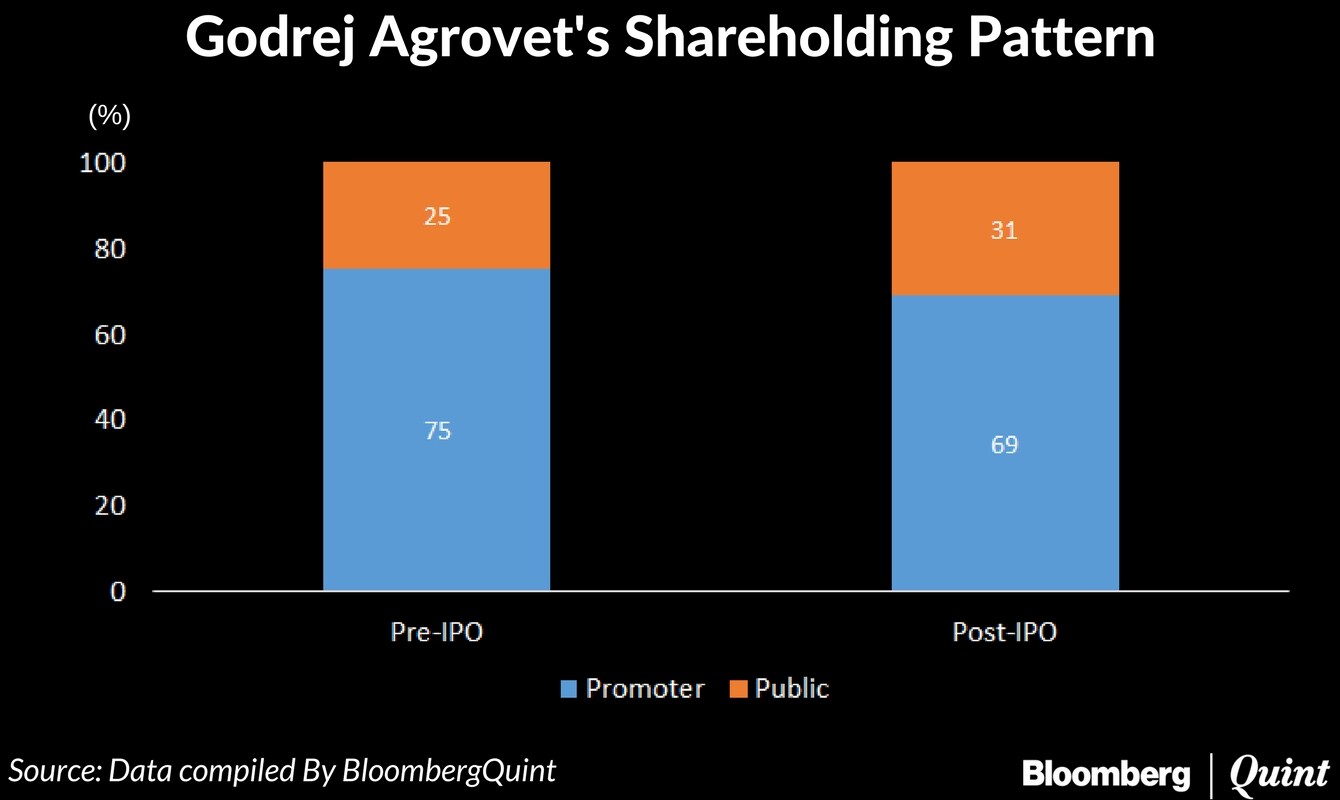

The company sold 2.5 crore shares at Rs 460 apiece in the IPO that was subscribed 95 times. The promoters and investors raised Rs 865 crore in an offer for sale. The rest came through a fresh issue.

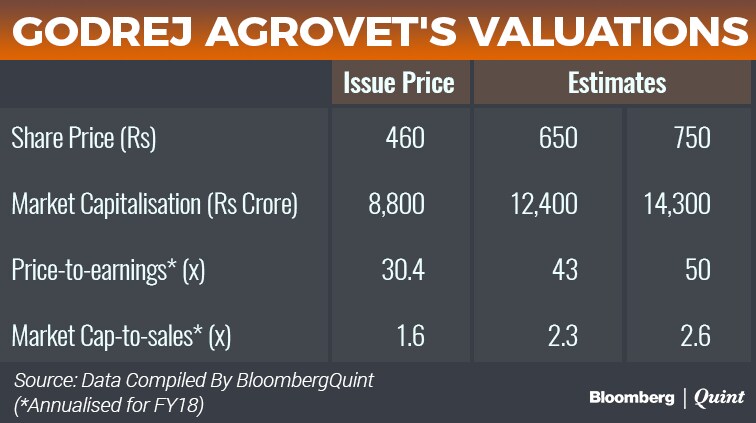

Qualified institutional buyers and high net-worth individuals put in bids for 150.96 and 263.04 times the shares on offer, respectively. The portion reserved for retail buyers was subscribed 7.67 times. At the issue price, Godrej Agrovet commands a market capitalisation of more than Rs 8,800 crore, according to BloombergQuint's calculations.

Financial Highlights

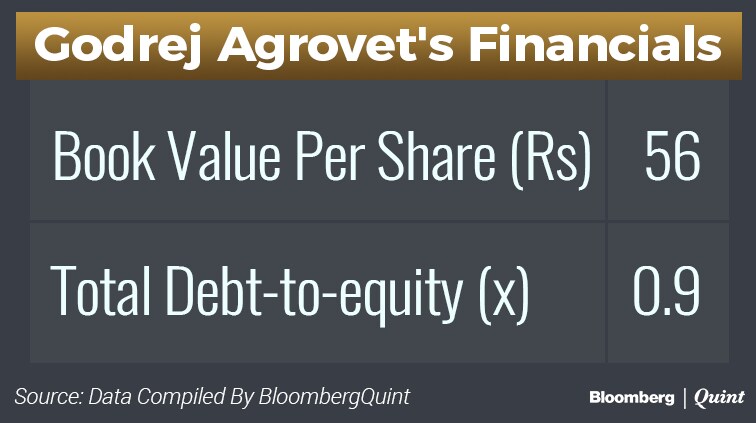

- Godrej Agrovet's net worth stood at Rs 1,073 crore for the quarter ended June. As of August 31, its total consolidated debt stood at Rs 990 crore. After the initial share sale, its total debt-to-equity ratio will fall to 0.7 times.

- The company's revenue rose at a compounded annual growth rate of 15.5 percent and net profit increased at 26.7 percent over five years to March. Revenue and net profit for the quarter ended June stood at Rs 1,363 crore and Rs 72.5 crore, respectively.

- Earnings before interest, tax and depreciation and amortisation grew at a CAGR of 22.6 percent, while the EBITDA margins have stayed in the range of 7 percent to 9 percent in the last five years.

- For the quarter ended June, EBITDA and EBITDA margin stood at Rs 124 crore and 9.3 percent, respectively.

- The cash conversion cycle for the company improved from 25 to 15 days in five years to March. It's an indicator of overall health of a company and signals how fast it can generate cash.

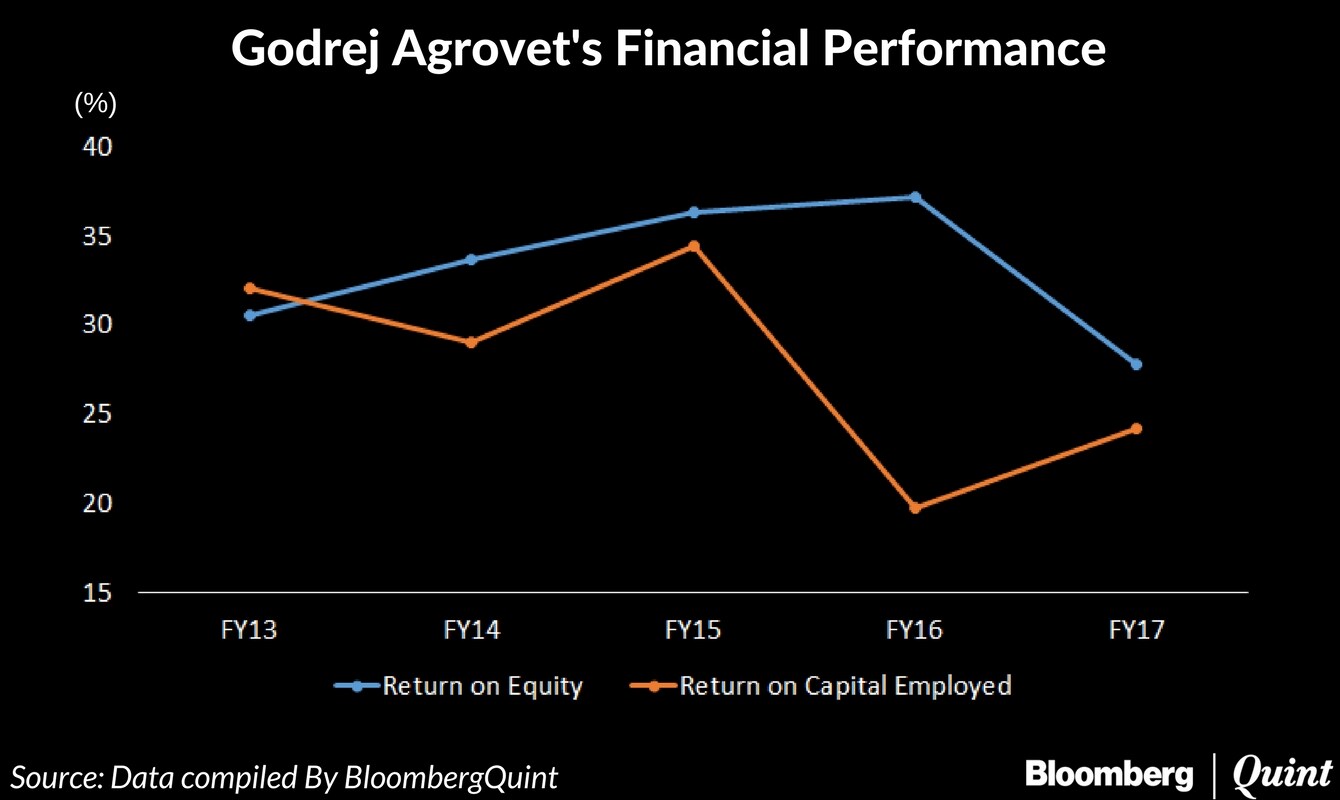

- Return on equity and capital employed remained more less stable except for the year to March when the company funded its acquisitions.

Peers And Valuations

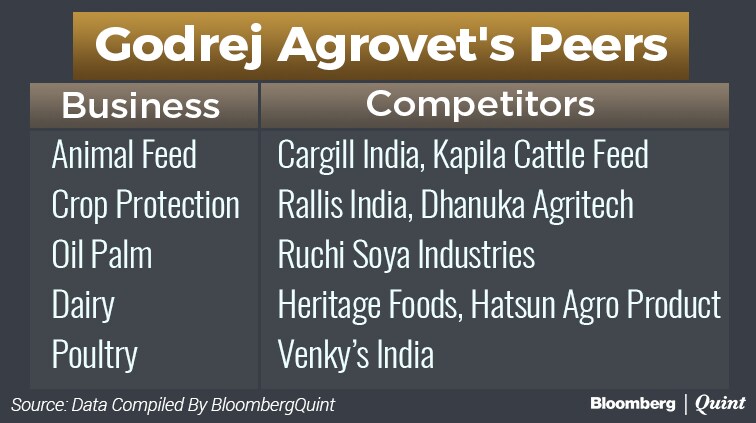

Godrej Agrovet has no direct listed peers. Its different business verticals compete with private and public companies.

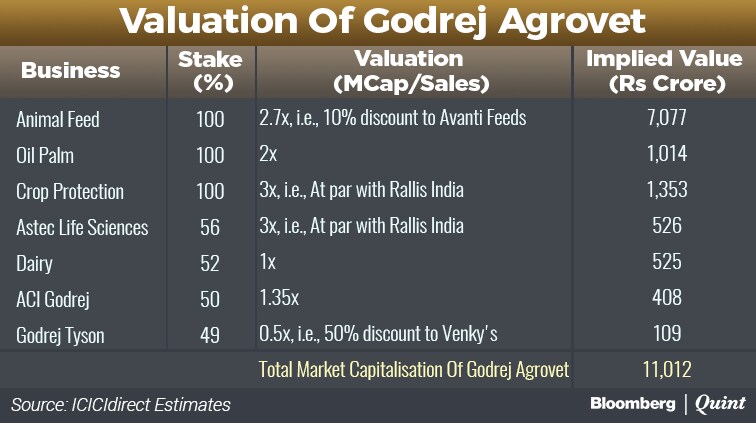

ICICI Direct values Godrej Agrovet at Rs 575 per share, implying a potential upside of 25 percent from Rs 460, the upper end of the price band.

Shareholding Pattern

Promoter Godrej Industries Ltd. sold shares worth Rs 300 crore, bringing its holding down to 69 percent.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.