Shares of Godfrey Phillips India Ltd. and VST Industries Ltd. took a hit during trade on Wednesday, as a proposal is under consideration to replace compensation cess with health and green cess, as per people in the know.

Currently, cigarettes and other tobacco products have a 28% GST levy, among others. The total tax burden of the commodity stands at 53%. The compensation cess is set to expire on March 31, 2026.

A Group of Ministers on compensation cess, headed by Minister of State for Finance Pankaj Chaudhary, is looking into the future of the levy beyond March 2026.

Share price of Godfrey Phillips saw significant decline of nearly 2%, while ITC Ltd. stock was down 0.82%. VST Industries shares fell 1.21% earlier in the day but recovered from losses to trade in the positive.

VST Industries shares could also have moved as the day marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

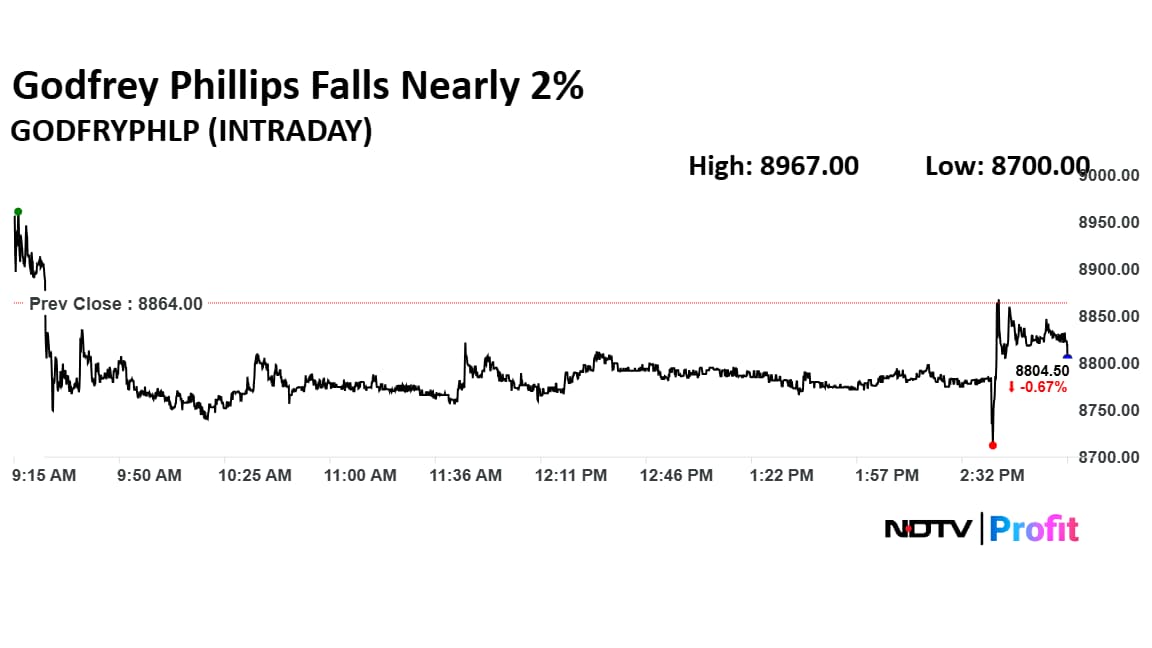

Godfrey Phillips Share Price

Godfrey Phillips stock fell as much as 1.85% during the day to Rs 8,700 apiece on the NSE. It was trading 0.42% lower at Rs 8,827 apiece, compared to a 0.33% decline in the benchmark Nifty 50 as of 3:05 p.m.

It has risen 109.03% in the last 12 months and 68.90% year-to-date. Total traded volume so far in the day stood at 1.7 times its 30-day average. The relative strength index was at 78.59.

The only analyst tracking the company has a 'sell' rating on the stock, according to Bloomberg data.

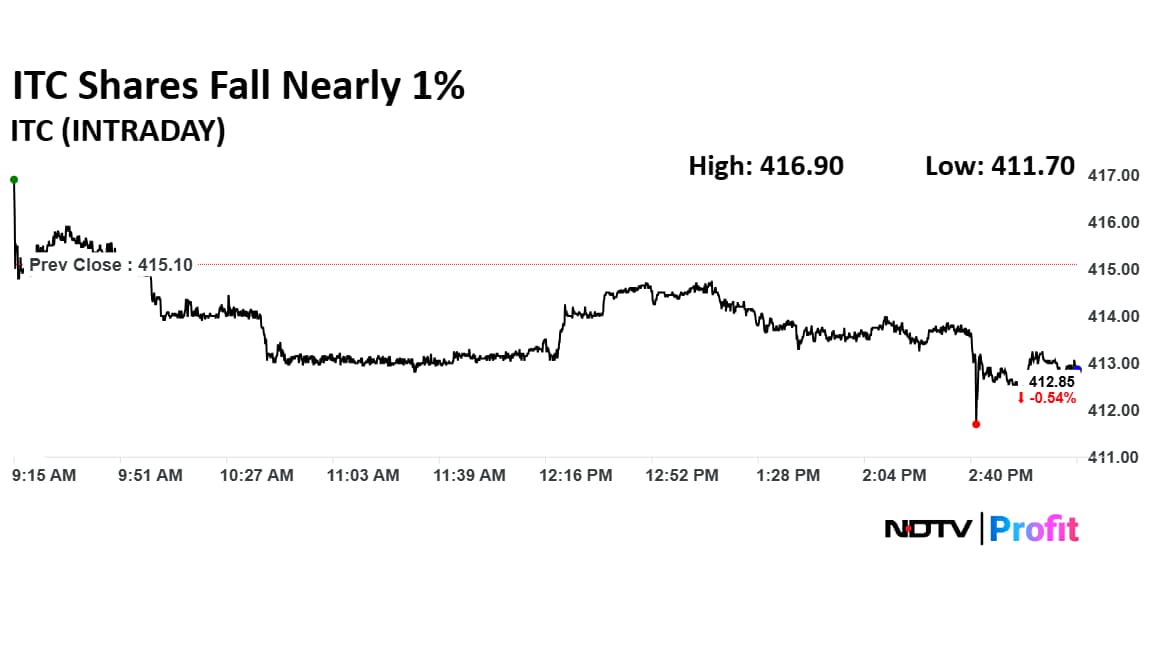

ITC Share Price

ITC stock was trading 0.82% lower at Rs 411.70 apiece, compared to a 0.30% decline in the benchmark Nifty 50 as of 3:11 p.m.

It has fallen 3% in the last 12 months and 14.66% year-to-date. The relative strength index was at 42.18.

Thirty seven out of 40 analysts tracking the company have a 'buy' rating on the stock, two recommend a 'hold' and one suggests a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 498.35, implying an upside of 20.9% from its last closing.

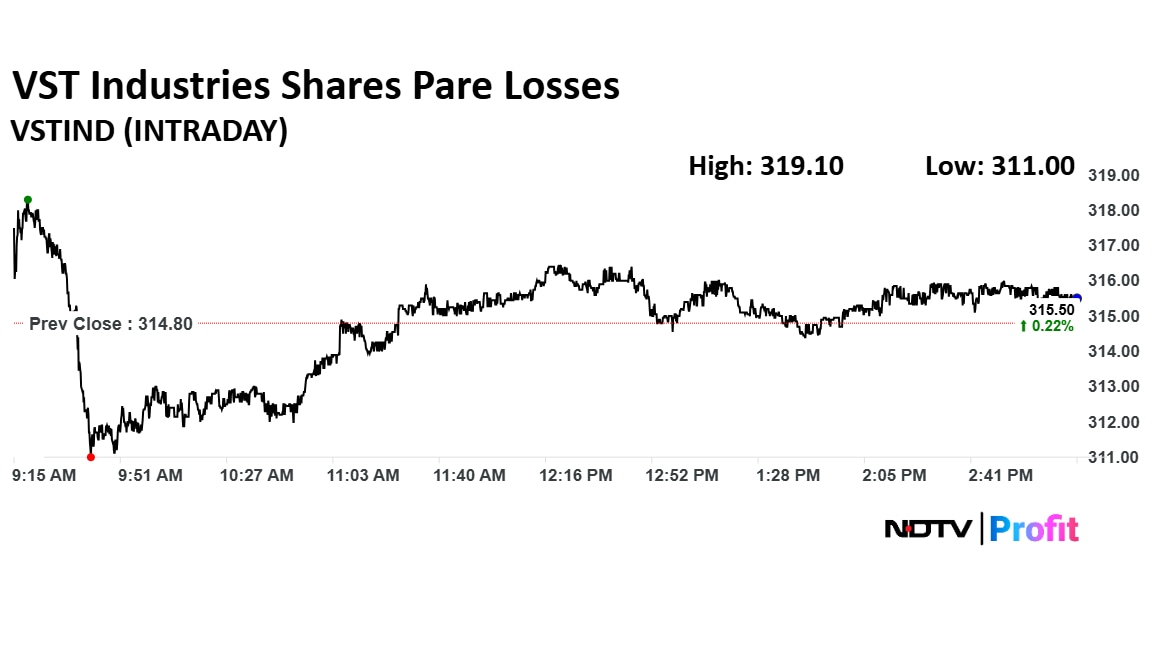

VST Industries Share Price

VST shares fell as much as 1.21% during the day to Rs 311 apiece on the NSE. It was trading 0.90% higher at Rs 315.70 apiece, compared to a 0.29% decline in the benchmark Nifty 50 as of 3:08 p.m.

The stock has fallen 14.78% in the last 12 months and 6.13% year-to-date. The total traded volume so far in the day stood at 1.8 times its 30-day average. The relative strength index was at 73.07.

Out of two analysts tracking the company, one maintains a 'buy' rating while one has a 'sell' rating, according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.