Sugar stocks saw a notable surge in trade on Wednesday, following the government's decision to approve a price hike for sugar-based ethanol for the 2024-25 period.

The price of ethanol derived from C heavy molasses has been raised to Rs 57.97 per litre from Rs 56.58 per litre, the Cabinet Committee on Economic Affairs said in an official release.

The move will positively impact sugar companies that produce ethanol, as higher ethanol prices can boost their profit margins.

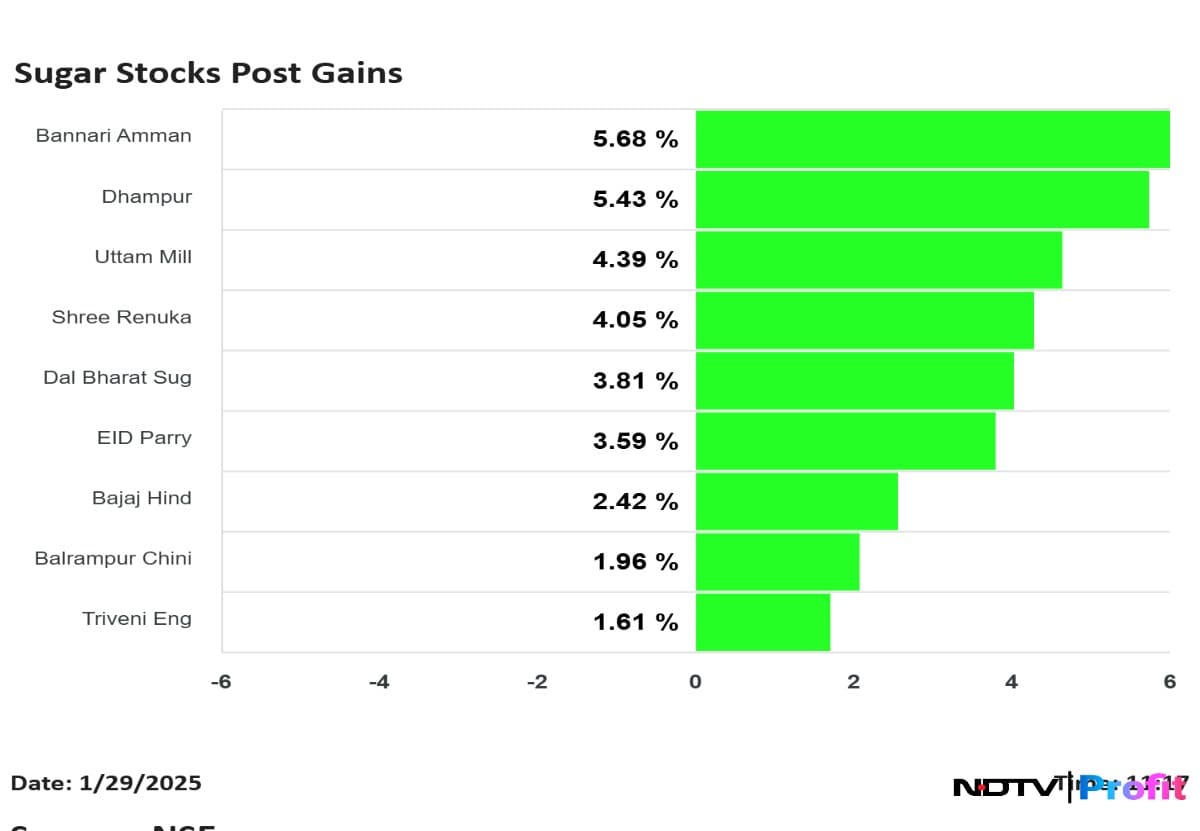

Shares of Bannari Amman Sugars Ltd., Dhampur Sugar Mills Ltd., and Shree Renuka Sugars Ltd. were among the biggest gainers.

Bannari Amman's stock rose by 4.9% to Rs 43.02, whereas Dhampur climbed 11.06% to Rs 157,90, and Shree Renuka's stock advanced by 5.95% to Rs 37.94.

Other stocks in the sector also climbed, with Uttam Sugar Mills Ltd. rising 6.13%, Dalmia Bharat Ltd. increasing 2.97%, and EID Parry India Ltd. advancing 4.05%.

While the price of ethanol derived from C heavy molasses has been raised, the rate of ethanol produced from B heavy molasses remains unchanged. Similar, sugarcane juice prices also remain unchanged.

The increase in prices of ethanol produced from C Heavy molasses will "assure sufficient availability of ethanol to meet the increased blending target", according to the government.

This move is part of the government's plan to achieve the target of 20% ethanol blending in petrol by ethanol supply year 2025-26.

As a step in this direction, oil marketing companies plan to achieve 18% blending during the ongoing ethanol supply year 2024-25, which will end on Oct. 31, the CCEA noted in the release.

Ethanol blending by public sector OMCs has increased from 38 crore litre in ESY 2013-14 to 707 crore litre "achieving average blending of 14.60% in ESY 2023-24", it stated.

Ethanol, being a key byproduct of sugar production, sees a direct impact on sugar companies' earnings when its price increases. A hike in ethanol prices boosts the profit margins of these companies, especially when sugar prices remain stable. Additionally, higher ethanol prices create an incentive for sugar producers to ramp up ethanol production, further enhancing their revenue potential.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.