- Indian stock market remained subdued despite recent government tax reforms and GST rate cuts

- TRUST Mutual Funds shifted portfolio balance from investment-heavy to equal focus on consumption

- Credit growth is seen as key indicator of corporate and household economic revival

The Indian stock market has been subdued over the last month, despite the recent tax reform push by the Modi government. The GST Council has announced rate cuts for various consumer goods and the government has indicated economic reforms.

In an environment where signs of rural demand recovery are visible and GST along with income tax cuts may add fuel in urban India, TRUST Mutual Fund's top fund manager is eyeing better prospects for the consumption space.

"From being heavily investment-weighted eight months ago, our portfolio allocation is now balanced between consumption and investment," said Mihir Vora, chief investment officer at the firm. "Structurally, we can't do away with the investment theme as the government has to maintain focus on capex, infrastructure, etc."

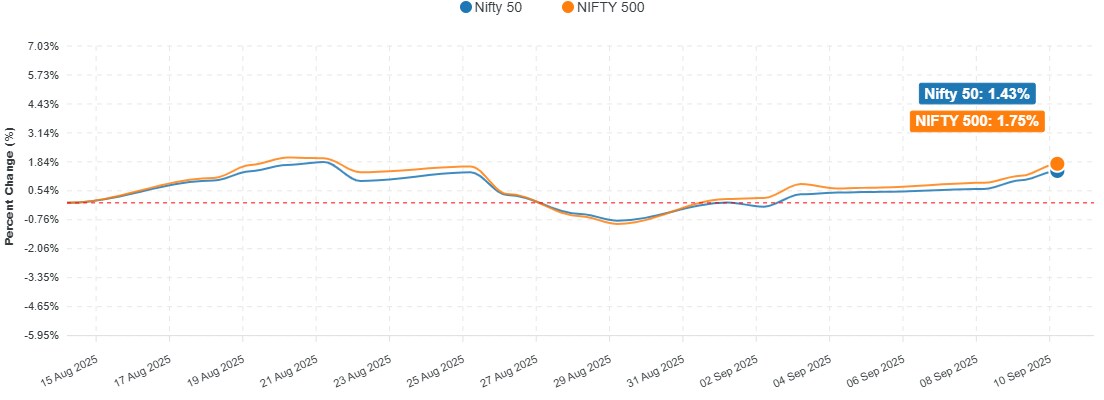

One-month performance of Nifty 50 and Nifty 500.

Indications that corporates are doing better will emerge as credit growth picks up. "Once credit growth starts showing up, it means corporates and households are now unleashing the animal spirits," he said. "We are balanced and remain overweight on both segments, but more favoured towards consumption than earlier."

According to Vora, the main driver of business growth would be the financial counter. He cited a healthy balance sheet and decent valuations in these companies. The trigger that will generate the "extra alpha" has to be credit growth.

Hunting Value

Mihir Vora said stock picking opportunities in the market lie in the small-cap and mid-cap space for the next few years. He noted that the aggregate weighted average of earnings growth of small-cap funds in the TRUST Mutual Fund portfolio exceeds 30%.

"The Nifty has counters like banking and IT, where stellar earnings growth potential is less. We need to look at the broader market," the fund manager said.

TRUST MF Flexi Cap Fund Breakdown

Based on his recent interactions with company and industry executives, Vora said manufacturing, especially in the MSME space, presents significant upside given the success of government subsidies and incentives under the PLI Scheme.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.