(Bloomberg) -- Mankind Pharma Ltd. has garnered the most analyst coverage of any new Indian stock in at least 12 years, as investors rush to buy the drug and condom maker's shares following a blockbuster initial public offering in May.

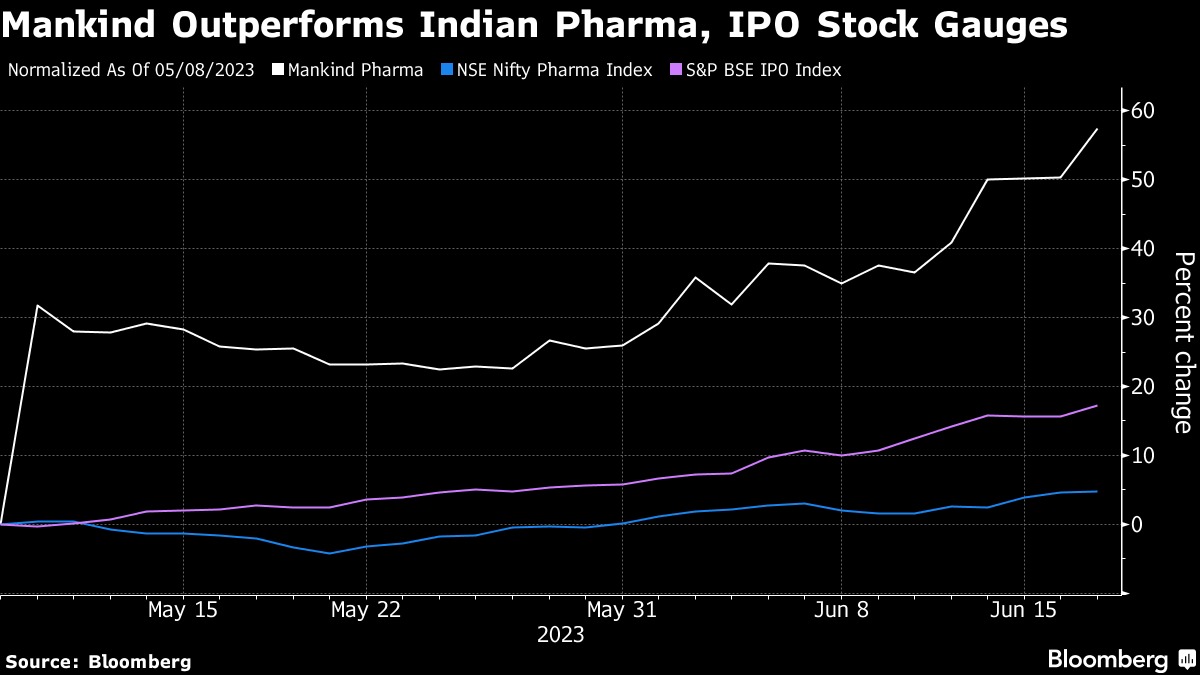

The company's stock has surged more than 60% since listing, driving its market value to about $8.5 billion. It has already drawn nine buy ratings and one hold recommendation. That's the most coverage in a similar span of time for an Indian stock that raised more than $500 million since November 2010, according to data compiled by Bloomberg.

“It is a domestic pharma company, grown organically, with solid fundamentals,” said Shrikant Akolkar, an analyst at Asian Markets Securities Pvt. “Investors love a story like that.”

Condom Maker Surges 32% on Debut in World's Most Populous Nation

Though most of the analysts covering the company recommend buying it, the consensus price target is already more than 10% below the current level amid the stock's stellar run. The shares are trading at about 54 times trailing 12-month earnings, compared with 31 times for India's benchmark pharmaceutical index. Mankind's stock jumped almost 32% in its debut.

“Everyone was waiting to buy the stock as their valuations during the listing made sense,” said Vishal Avinash Manchanda, vice president of institutional research at Systematix Group, who has the only hold rating on the stock. “But I think they are a bit stretched now.”

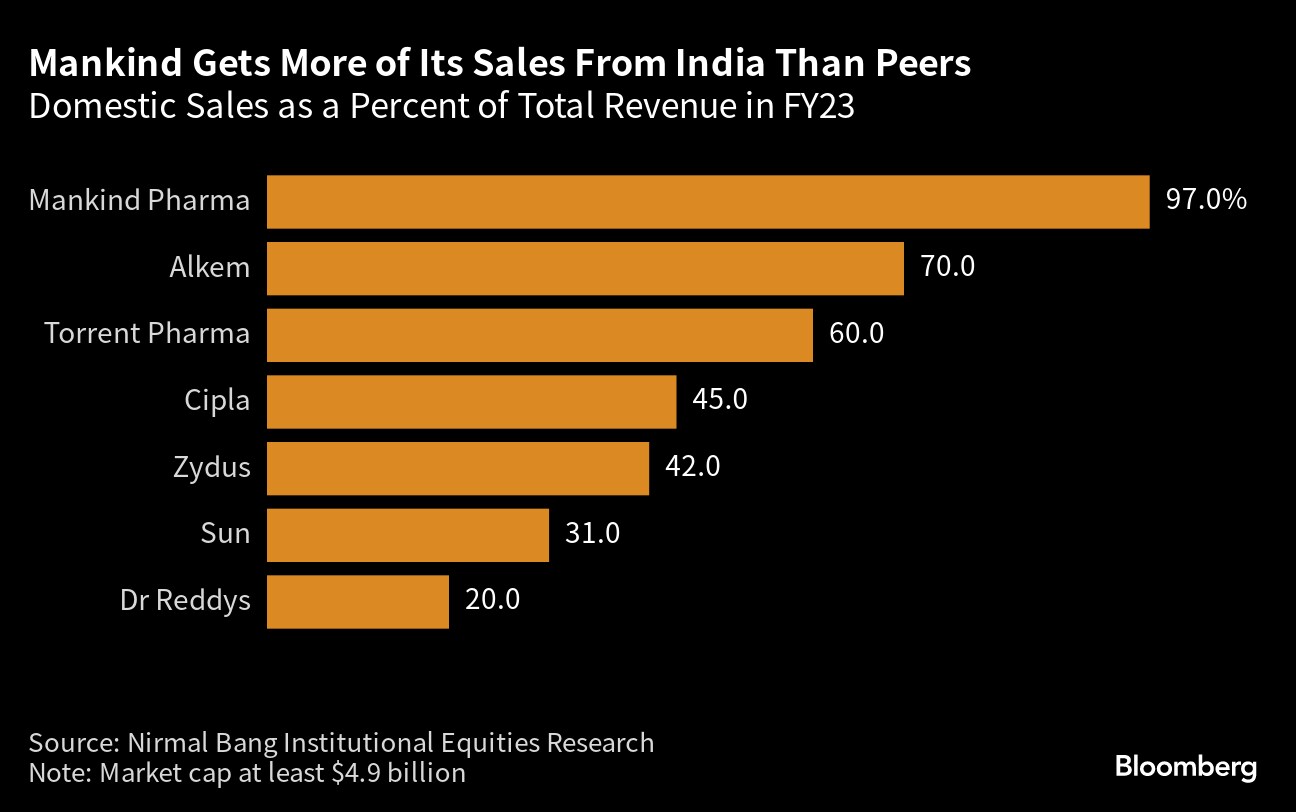

In its favor, Mankind has name recognition among Indian consumers and investors due to its popular line of consumer products. Akolkar also notes it has minimal reliance on exports, shielding it from some issues faced by exporting peers. US inspectors have recently uncovered wide-ranging problems at factories run by Indian pharmaceutical firms.

Mankind gets 97% of its sales from India, the highest percentage among the nation's drugmakers of a similar size or larger. About 8% of its domestic sales is from consumer healthcare products, including condoms, for which it has the largest market share in the nation of 1.4 billion people.

In addition to winning over analysts, the stock continues to gain backing from institutional investors. SBI Funds Management and Nippon Life India Asset Management are among firms that bought Mankind shares in May.

--With assistance from Filipe Pacheco and Chiranjivi Chakraborty.

(Updates price-related data throughout; adds funds buying stock in last paragraph)

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.