Colgate-Palmolive (India) Ltd. shares rose over 3% on Thursday after analysts remained optimistic with JPMorgan upgrading it to 'overweight' on potential earnings growth from newer verticals.

Management's narrative at the investor day was confident, highlighting category development and marketing initiatives that should support the market share gains, analysts at JPMorgan said in a note dated Nov. 28.

The brokerage has a target price of Rs 3,400 per share, implying 13% upside from the previous close.

The accelerated pace of premium products being sold and aggressive health positioning, high pricing power and superior gross margin profile are among key positives, JPMorgan said. We see a lot to like in Colgate's emerging growth model.”

Increasing intent for portfolio diversification in the coming year by leveraging a wide global portfolio adds to future growth options, it said.

Analysts at Jefferies said that the company has initiated an interesting initiative that utilised artificial intelligence for dental screening. "Oral care per capita opportunity is high."

The brokerage however highlighted that the consumption trends with weakening urban and flattening rural. Jefferies rated 'buy' with a target price of Rs 3,570 per share, a 21% upside from the previous close.

Citi Research believes that driving consumer behaviour change could be a tall ask for the company. Driving consumer behaviour change would require sustained investments over the long term, it said.

Citi expects the near-term earnings growth to moderate. It retained 'sell' with a target price of Rs 3,000 per share, a downside of 0.3% from the previous close.

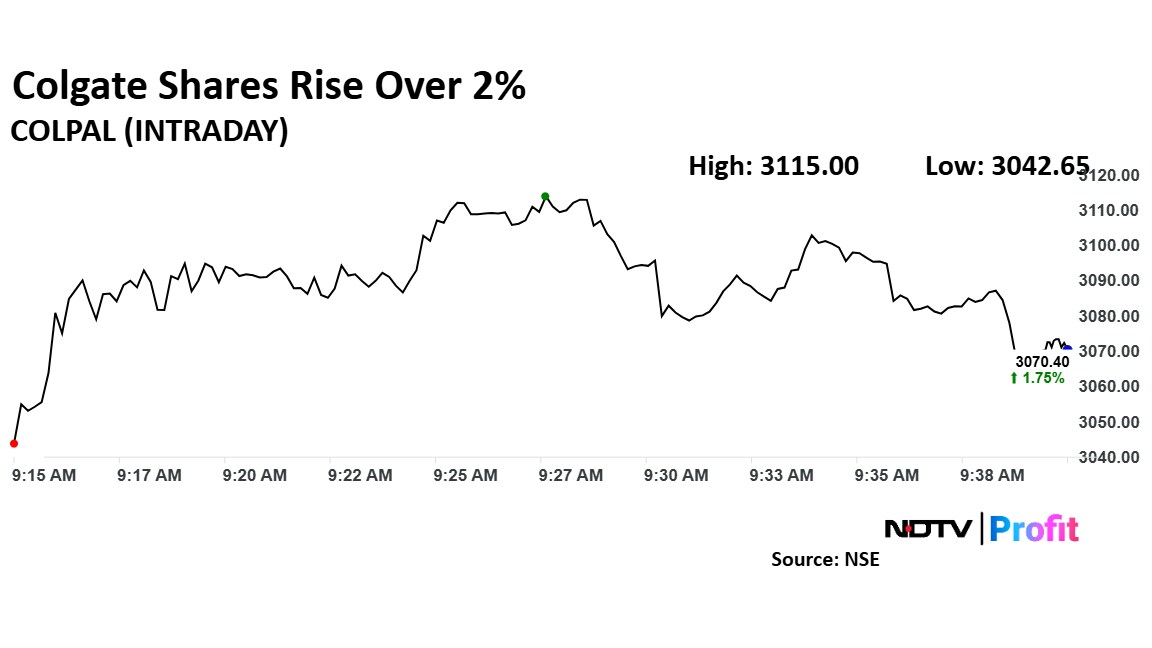

Colgate's stock rose as much as 3.23% during the day to Rs 3,115 apiece on the NSE. It was trading 1.79% higher at Rs 3,071 apiece, compared to a 0.01% advance in the benchmark Nifty 50 as of 09:42 a.m.

It has risen 40% during the last 12 months and has advanced by 21% on a year-to-date basis. The total traded volume so far in the day stood at 5.6 times its 30-day average. The relative strength index was at 54.

Eight out of the 34 analysts tracking the company have a 'buy' rating on the stock, 13 suggest a 'hold' and another 13 have a 'sell', according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 2.8%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.