Friday marks the ex-date and record date for the dividend payout by CMS Info Systems Ltd., making Thursday the last day for investors to purchase shares to qualify for corporate action.

CMS Info Systems had declared a special dividend of Rs 3 and a final dividend of Rs 3.25 per equity share with a face value of Rs 10, and the record date for eligibility is set for Friday, May 23.

Under the T+1 settlement mechanism, investors must ensure their purchase is completed a day before the record date. This means shares bought on Thursday, will be settled in time for shareholders' names to appear on the company's records on Friday, securing their entitlement to the dividend.

CMS Info Systems had announced the dividends on May 19. This comes after two previous dividends of Rs 3.25 per share in February 2025 and May 2024.

CMS Info Systems Q4 Highlights (Consolidated, QoQ)

CMS Info System's consolidated net profit rose 5% in the fourth quarter of the financial year, according to the financial results declared by the company.

The firm posted a bottom line of Rs 97.5 crore in the March quarter, compared to Rs 93 crore reported in the previous quarter. Revenue rose 6.5% to Rs 619 crore compared to the Rs 581 crore in the third quarter.

Revenue up 6.5% to Rs 619 crore versus Rs 581 crore.

Ebitda up 1.9% to Rs 162 crore versus Rs 159 crore.

Margin at 26.2% versus 27.4%.

Net profit up 4.8% to Rs 97.5 crore versus Rs 93 crore.

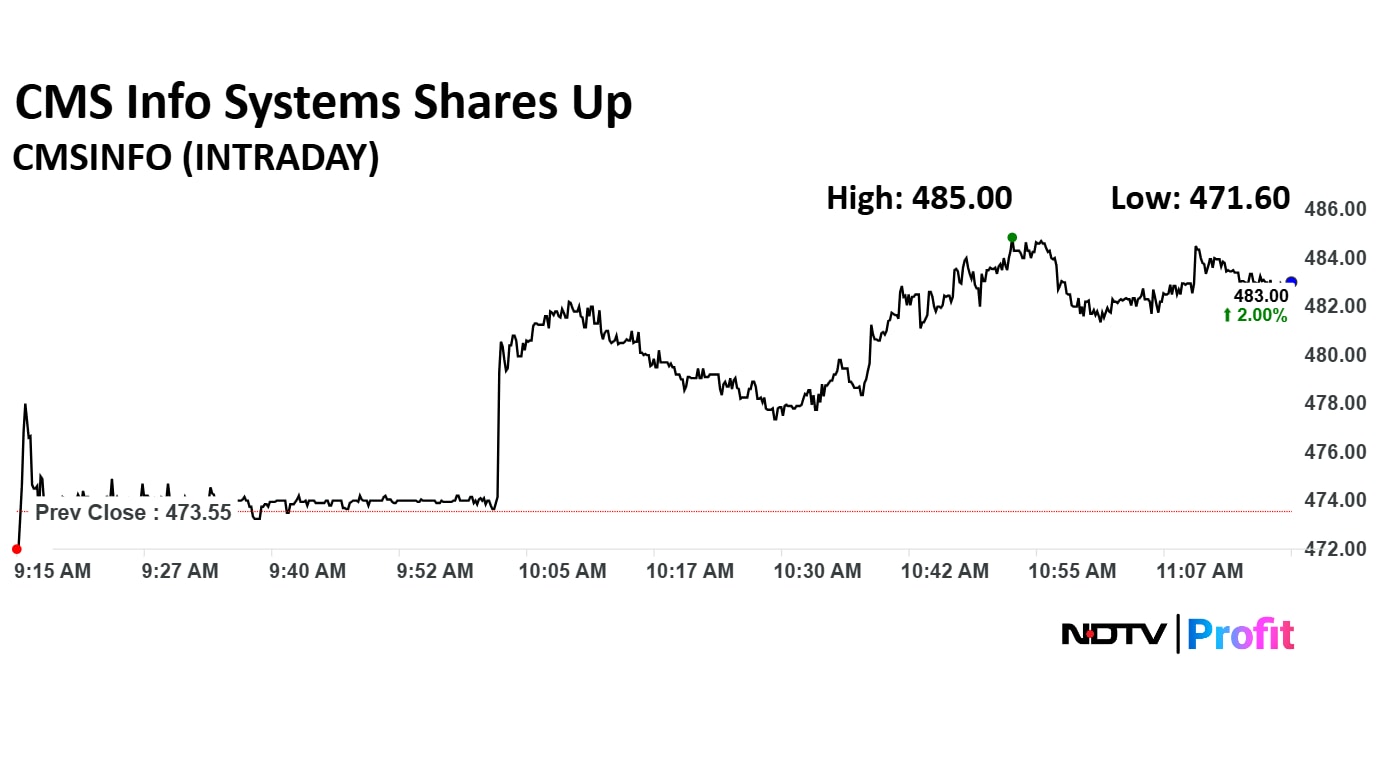

CMS Info Systems Share Price Today

The scrip rose as much as 2.42% to Rs 485 apiece. It pared gains to trade 1.96% higher at Rs 482.85 apiece, as of 11:19 a.m. This compares to a 0.87% decline in the NSE Nifty 50 Index.

It has fallen 1.62% on a year-to-date basis, but has risen 7.75% in the last 12 months. The relative strength index was at 50.73.

Out of eight analysts tracking the company, seven maintain a 'buy' rating, and one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 17.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.