Shares of Brigade Enterprises Ltd. rose over 6% on Tuesday, after the company acquired land in Bengaluru for a premium residential project. The project has a gross development value of Rs 950 crore. In addition, the stock was trading at high volume.

The real estate developer acquired a land parcel of 4.4 acres in Whitefield, East Bengaluru, the company said in an exchange filing on Monday. The residential project will offer a mix of spacious apartments.

“This project will not only enhance our portfolio but also offer an exceptional living experience for our customers. Strategically, this land parcel aligns perfectly with our vision for premium residential development. The deal underlines our commitment to growth, innovation, and redefining luxury living in Bengaluru,” said Pavitra Shankar, managing director of Brigade Enterprises.

The firm's consolidated net profit jumped more than three-fold in the third quarter of the current financial year to Rs 236.2 crore, in comparison to Rs 73.5 crore in the year-ago period.

Revenue from operations rose 25% to Rs 1,463.9 crore in the October–December period from Rs 1,173.8 crore clocked during the same quarter last year.

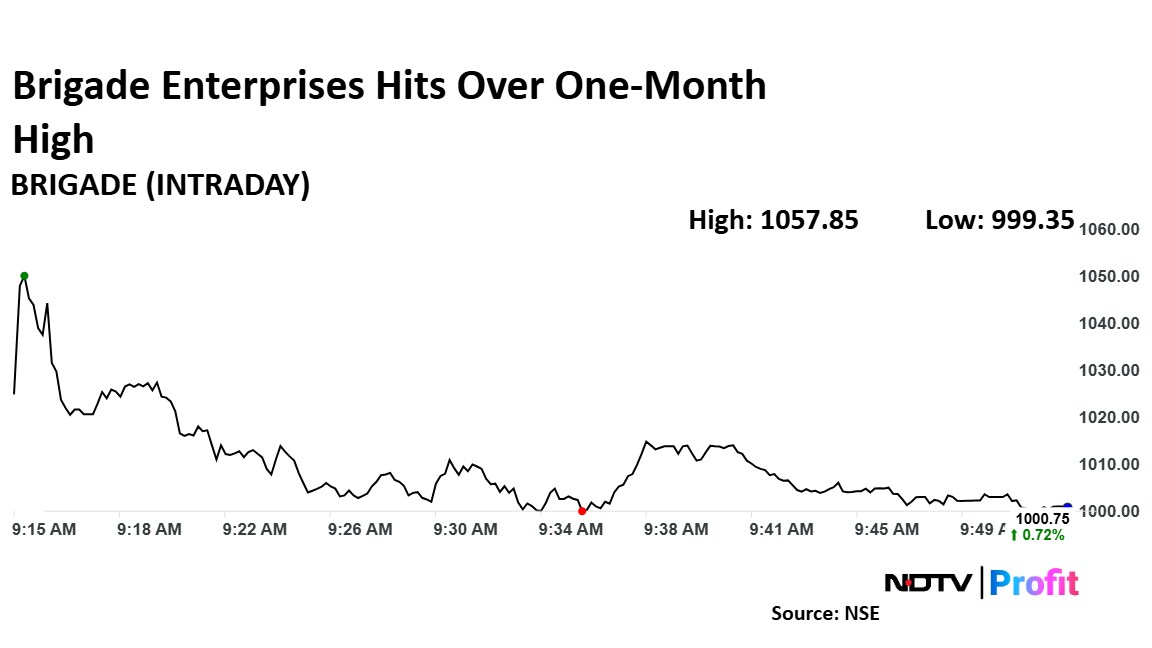

Brigade Enterprises Share Price Rise

Shares of Brigade Enterprises rose as much as 6.47% to Rs 1,057.85 apiece, the highest level since Feb. 13. It pared gains to trade 1.07% higher at Rs 1,004.25 apiece, as of 9:48 a.m. This compares to a 0.60% advance in the NSE Nifty 50.

The stock has risen 10.31% in the last 12 months and fallen 19.04% year-to-date. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 54.

All 13 analysts tracking the company maintain a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 42.4%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.