Birlasoft Ltd. shares tumbled early on Wednesday as its third quarter results did not provide a promising outlook.

Macquarie and Nomura cited concerns about revenue, margin recovery and lay offs, further signalling weak revenue growth in the fourth quarter.

Weak Revenue Outlook

Nomura cut its target price to Rs 560 from Rs 590 earlier, on account of the company needing to improve predictability of its revenue growth profile.

It noted that the operational efficiencies and forex movements had helped Birlasoft recoup sequential headwinds on margins. It also highlighted a weak environment growth that displayed low growth and delay in margin recovery.

Despite the fact that deal wins were up 66% led by renewals, the higher number of layoffs continued in January 2025. Nomura cited green shoots in discretionary spends in the BFSI sector, but they also noted that there was a one project ramp-down in healthcare and manufacturing. Nomura expects muted revenue growth in the fourth quarter.

Counting On New Deals

Macquarie maintained its 'outperform' rating despite the third quarter revenue being below estimates. The pass-through revenue of the company declined, while their offshore revenue proportion increased.

The brokerage noted that its Banking and Financial Services Insurance segment grew, but the Ebitsa was expected to improve more than it did. For the fourth quarter, Macquarie expected strong deal signings, including new marquee manufacturing logo in Europe.

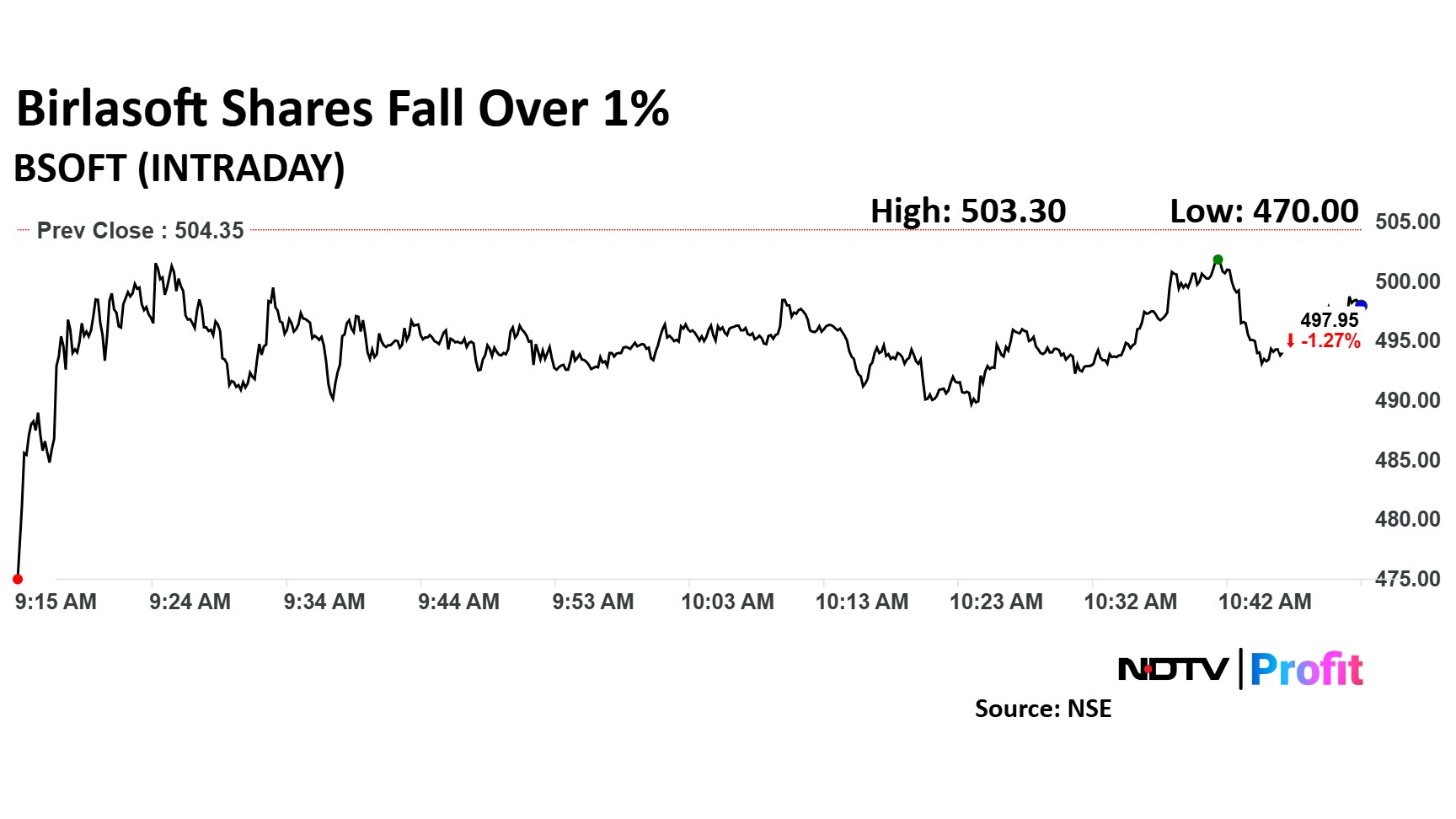

Birlasoft Share Price

Birlasoft stock fell as much as 6.81% during the day to Rs 470 apiece on the NSE. It was trading 1.20% lower at Rs 498.30 apiece, compared to a 0.60% decline in the benchmark Nifty 50 as of 10:51 a.m.

The stock was down 39.66% in the last 12 months. Total traded volume so far in the day stood at 9.6 times its 30-day average. The relative strength index was at 34.16.

Eight out of 16 analysts tracking the company have a 'buy' rating on the stock, six recommend a 'hold' and two suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 581.8, implying a upside of 16.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.