India's largest telecom company Bharti Airtel Ltd. sold 10.3 percent stake in its telecom infrastructure arm Bharti Infratel Ltd. for Rs 6,194 crore to pare debt.

A consortium led by private equity investor Kohlberg Kravis & Roberts (KKR) and pension fund Canada Pension Plan Investment Board (CPPIB) acquired 19 crore shares at Rs 325 apiece, the company said in a statement.

Indian mobile carriers have either consolidated their operations or divested non-core businesses to take on Mukesh Ambani's Reliance Jio Infocomm Ltd., which has disrupted the market with its free services.

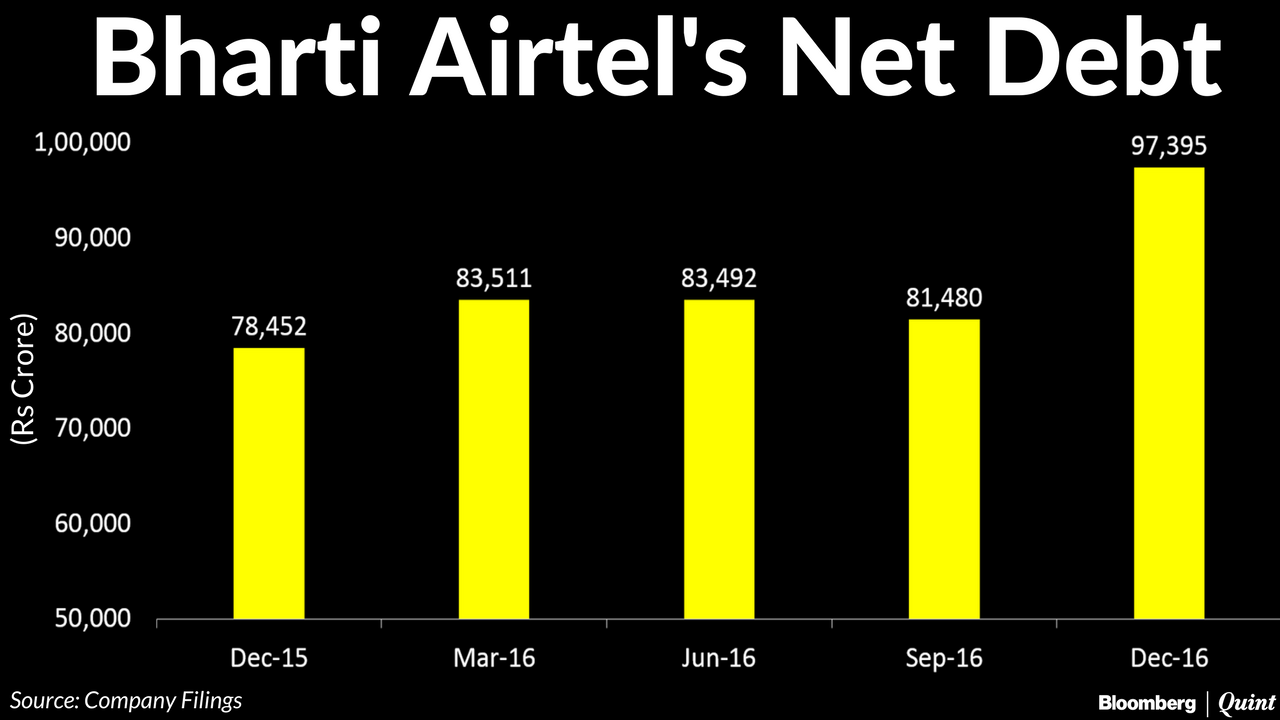

Bharti Airtel's net debt rose to Rs 97,395 crore as it acquired spectrum in the quarter ended December 31 last year. At three times its earnings before interest, tax and depreciation and amortisation (EBITDA), the debt is lower than that of Idea Cellular Ltd.

Consolidation In Telecom

Bharti Airtel recently acquired Telenor India's operations and Tikona Digital Networks' 4G business to bolster its spectrum. Both the deals will add debt to Bharti Airtel's books.

Vodafone India Ltd. and Idea Cellular Ltd. agreed to merge, while Vodafone will also divest partially or wholly its 42 percent stake in Indus Towers, a joint venture between Bharti Infratel, Idea Cellular and Vodafone India. Idea Cellular too sold part of its stake in Indus Towers to private equity investor Providence Equity. Reliance Communications Ltd. will merge its wireless division with Aircel and has signed a binding agreement to sell a majority stake in its tower assets to Canada's Brookfield Asset Management Inc. for Rs 11,000 crore to pare debt.

Bharti Airtel on March 15 scrapped its earlier plan to divest a significant stake in Bharti Infratel, and decided to transfer 21.63 percent shares to Nettle Infrastructure Investment Ltd., its wholly owned subsidiary.

This will be KKR's second investment in Bharti Infratel. Funds managed by the private equity player had invested in the tower company between 2008 and 2015. Following the deal, Bharti Airtel's holding in its tower arm will fall to 40.03 percent and that of Nettle Infrastructure will stand at 21.63 percent.

Bharti Infratel owns close to 39,000 standalone towers and another 51,000 belonging to Indus Towers. Shares of Bharti Infratel rose as much as four percent, while that of Bharti Airtel gained as much as 1.4 percent on the Bombay Stock Exchange.

Also Read: Bharti Airtel Will Acquire Tikona's 4G Business To Strengthen Pan-India Presence

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.