(Bloomberg) -- Bank of America Corp. is holding on to its bullish view on the Indian rupee even as a gauge of future market volatility rises amid elections in the country.

“Indian rupee's implied volatility and skew in options markets have begun to reflect,” some risks from elections, strategists including Claudio Piron wrote in a note. Still, the rupee has stayed in a narrow range, with realized volatility near multi-decade lows, signaling expectations the central bank will shield the currency from sharp moves after the election results, they wrote.

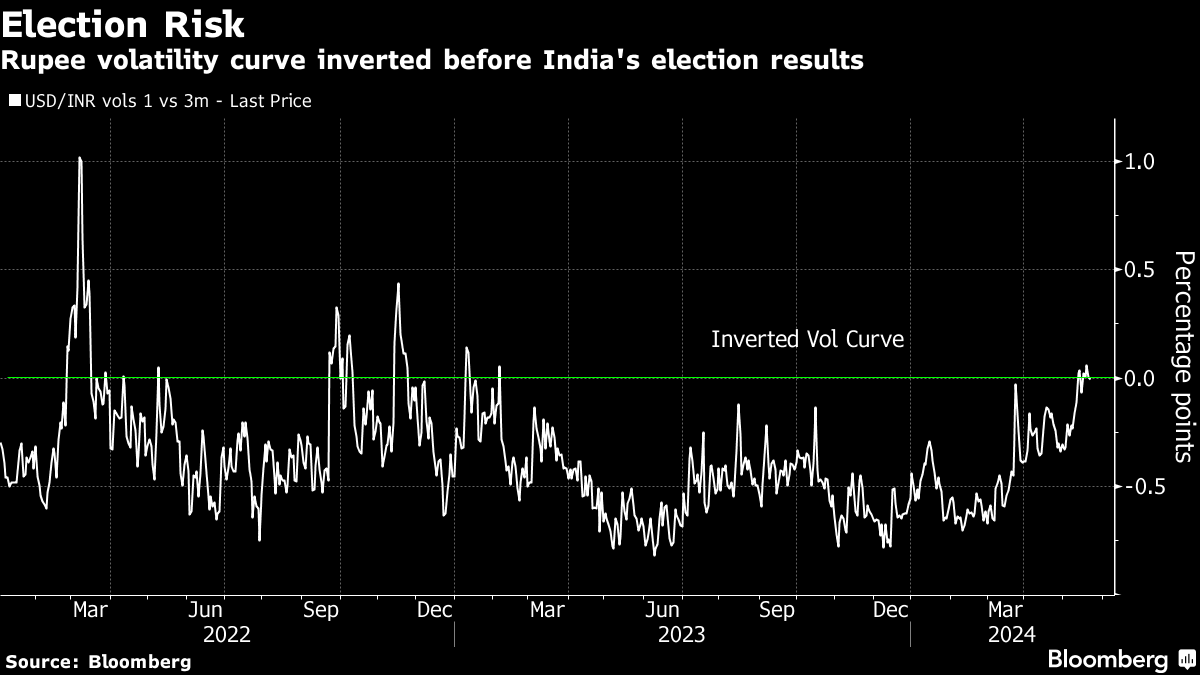

Implied volatility in the one-month part of the dollar-rupee options curve crossed levels seen in the three-month maturity, inverting the curve. Volatility in the shorter tenor has risen steadily since the elections kicked off last month.

A lower-than-expected voter turnout in India's elections has led to some consternation about the prospects of Prime Minister Narendra Modi's Bharatiya Janata Party which is widely expected to win a third successive term. Election results are due on June 4.

The rupee inched up 0.1% to 83.22 per dollar on Wednesday, the highest since April 10. BofA sees scope for the RBI to let the rupee appreciate by 1%-1.5% to signal a positive market reaction if the election results point toward a stable government.

The bank has expressed this view with a so-called one-touch downside option on USD/INR with 82.5/USD strike, it said. One-touch options require the underlying asset to reach a specific price level within a predetermined timeframe.

--With assistance from Malavika Kaur Makol, Mark Cranfield and Ronojoy Mazumdar.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.