Aurobindo Pharma Ltd.'s share price logging 14.6% fall in the last six months has driven Investec to initiate a 'fast long' on the stock, as it sees a depreciating rupee scenario to benefit, given its revenue has the highest contribution from exports among peers.

Also, upcoming PenG ramp-up, normalising Eugia sales and a stable/improving US generics pricing would lead to improving mix and drive margin expansion going forward, the brokerage said.

It has a target price of Rs 1,930 per share and forecasts total return of 65.9%. The recent fall in the share price is unwarranted, underperforming Nifty 50 by 9% in last six months, driving up the P/E discount to peers to 50% from 30-35%.

Sharp fall in PenG prices (although prices have already corrected) and possible significant reversal in USD-INR trends are risks, according to the brokerage.

'Fast' is Investec's new research report format for high conviction short-term analyst ideas. The core justification remains centered on the 12-month fundamental research valuation, but shorter-term catalysts are given additional weighting in establishing a three to six-month investment case, rather than its default 12-month recommendation framework.

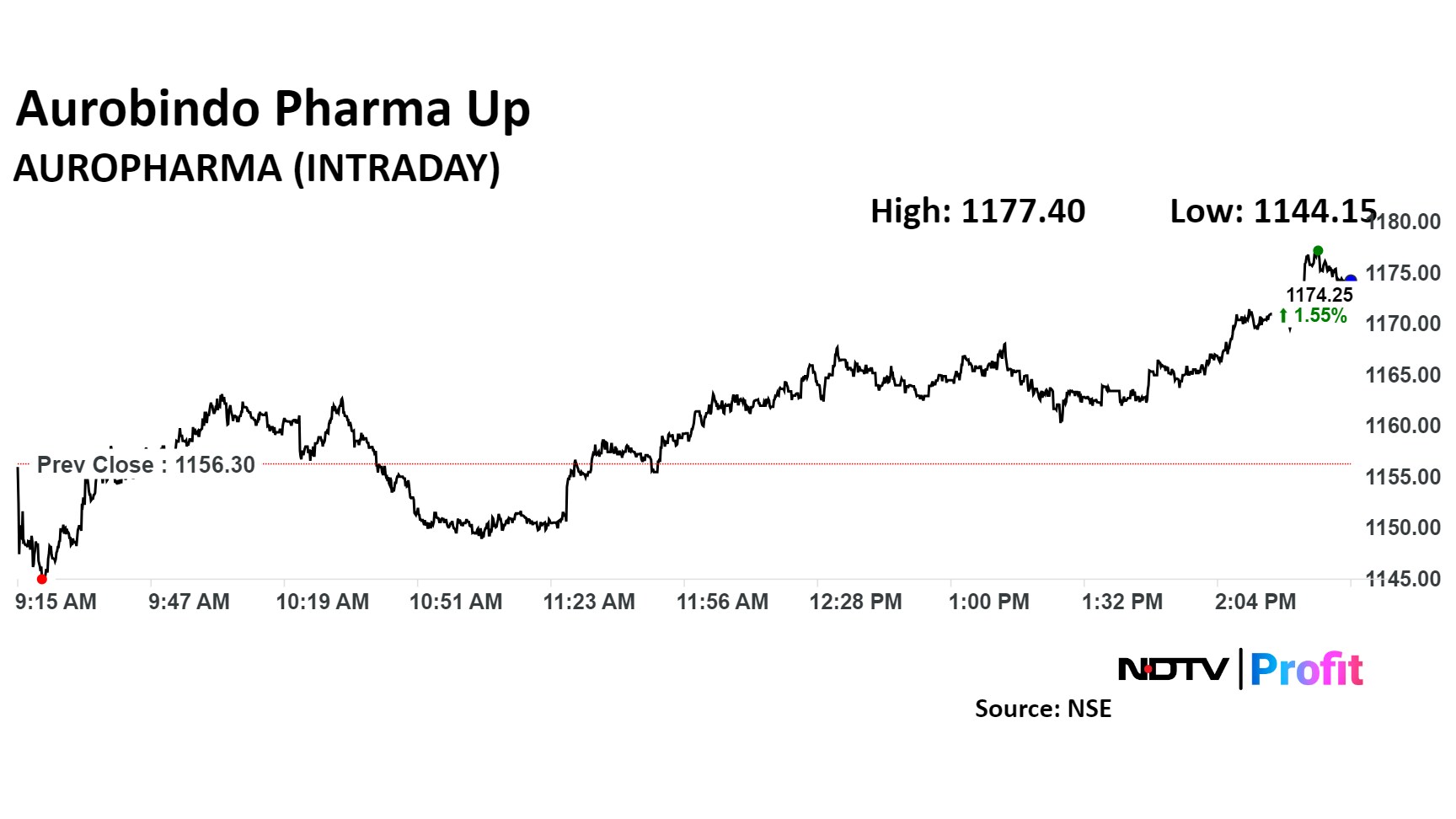

Aurobindo Pharma Share Price

Shares of Aurobindo Pharma rose as much as 1.82% to Rs 1,177.40 apiece, the highest level since Jan. 15. It pared some gains to trade 1.7% higher at Rs 1,176.25 apiece, as of 2:38 p.m. This compares to a 0.4% decline in the NSE Nifty 50.

The stock has risen 2.2% in the last 12 months. Total traded volume so far in the day stood at 0.32 times its 30-day average. The relative strength index was at 37.2.

Out of 29 analysts tracking the company, 20 maintain a 'buy' rating, five recommend a 'hold' and four suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 29.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.