Shares of Asian Paints Ltd. saw a slight decline, while Grasim Industries shares were trading flat during early trade on Wednesday after the Competition Commission of India launched a formal investigation against the former on Tuesday.

This was after allegations of abuse of its dominant position in the decorative paints markets. The move comes after a complaint by the Birla Opus Paints division of Grasim Industries Ltd., the flagship company of the Aditya Birla conglomerate, the CCI said in a release on its website.

In its 16-page order, the commission said it found prima facie evidence that Asian Paints might have violated Sections 4(2)(a)(i), 4(2)(c), and 4(2)(d) of the Competition Act, including unfair trade practices, denial of market access and imposition of supplementary obligations on dealers.

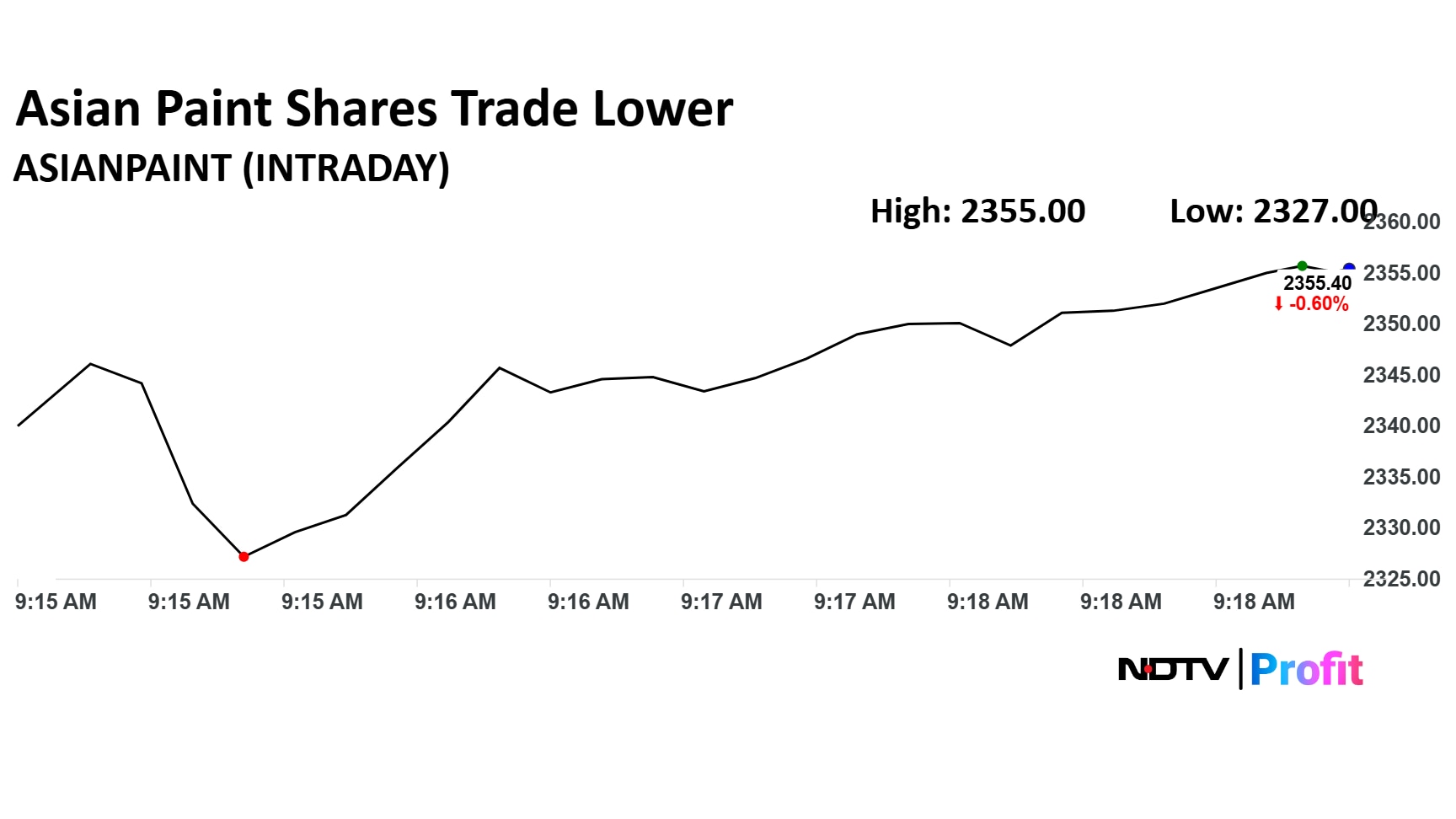

Asian Paints Share Price

Asian Paints stock fell as much as 1.79% during early trade to Rs 2,317 apiece on the NSE. It was trading 0.80% lower at Rs 2,350 apiece, compared to a 0.18% advance in the benchmark Nifty 50 as of 9:20 a.m.

It has declined 19.01% in the last 12 months and 3.86% on a year-to-date basis. The relative strength index was at 60.1.

Eight out of 39 analysts tracking the company have a 'buy' rating on the stock, 10 recommend a 'hold' and 21 suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 2,311, implying a downside of 2.5%.

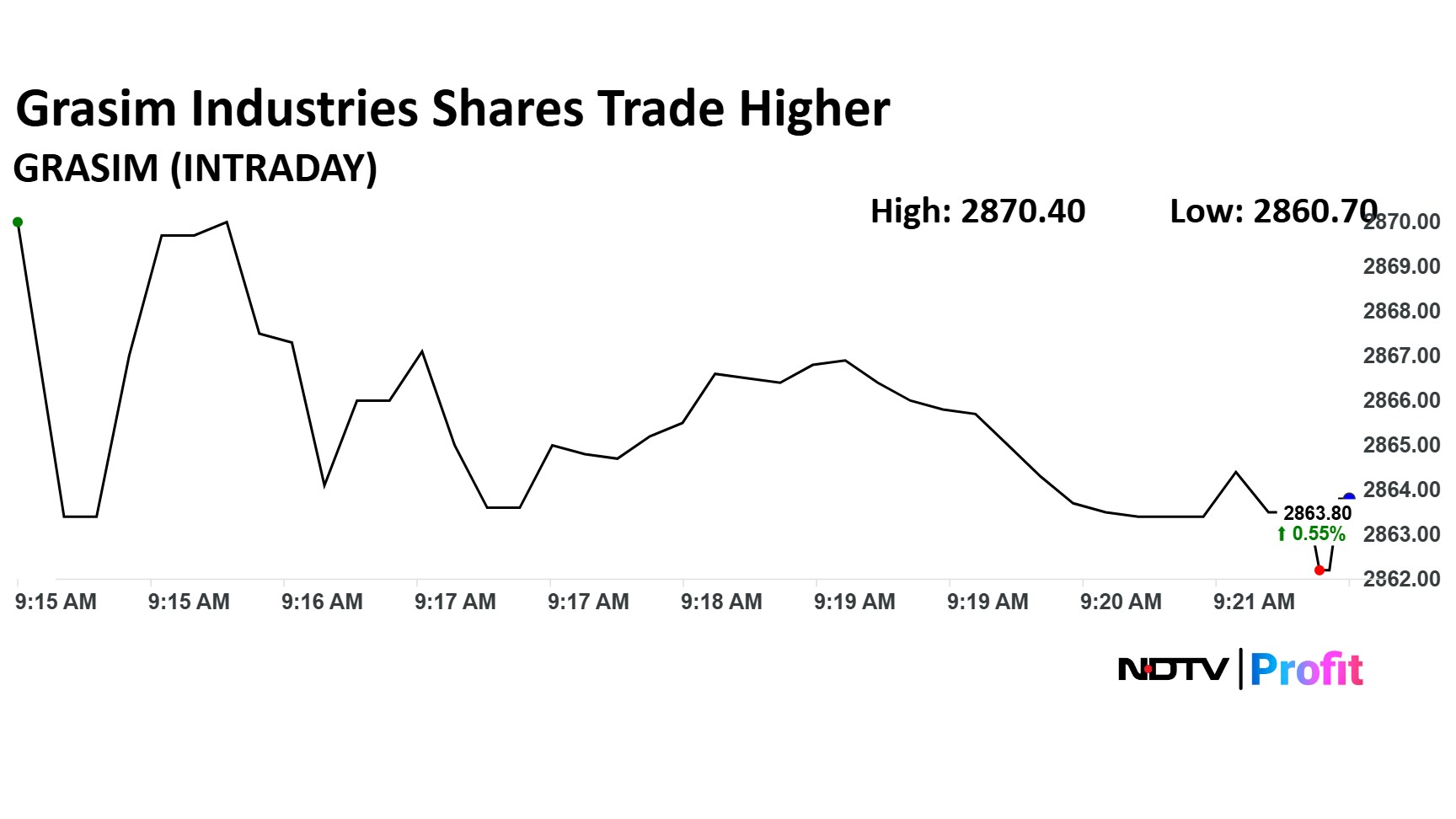

Grasim Industries Share Price

Grasim Industries stock rose as much as 0.78% during early trade to Rs 2,870 apiece on the NSE. It was trading 0.40% higher at Rs 2,859 apiece, compared to a 0.23% advance in the benchmark Nifty 50 as of 9:24 a.m.

It has risen 3.83% in the last 12 months and 16.60% on a year-to-date basis. The relative strength index was at 52.17.

Seven out of the nine analysts tracking the company have a 'buy' rating on the stock, one recommends a 'hold' and one suggests a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 3,146, implying a upside of 10.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.