Fertiliser stocks witnessed strong gains on Tuesday, driven by optimism around a better-than-expected monsoon and expectations of a strong Kharif sowing season.

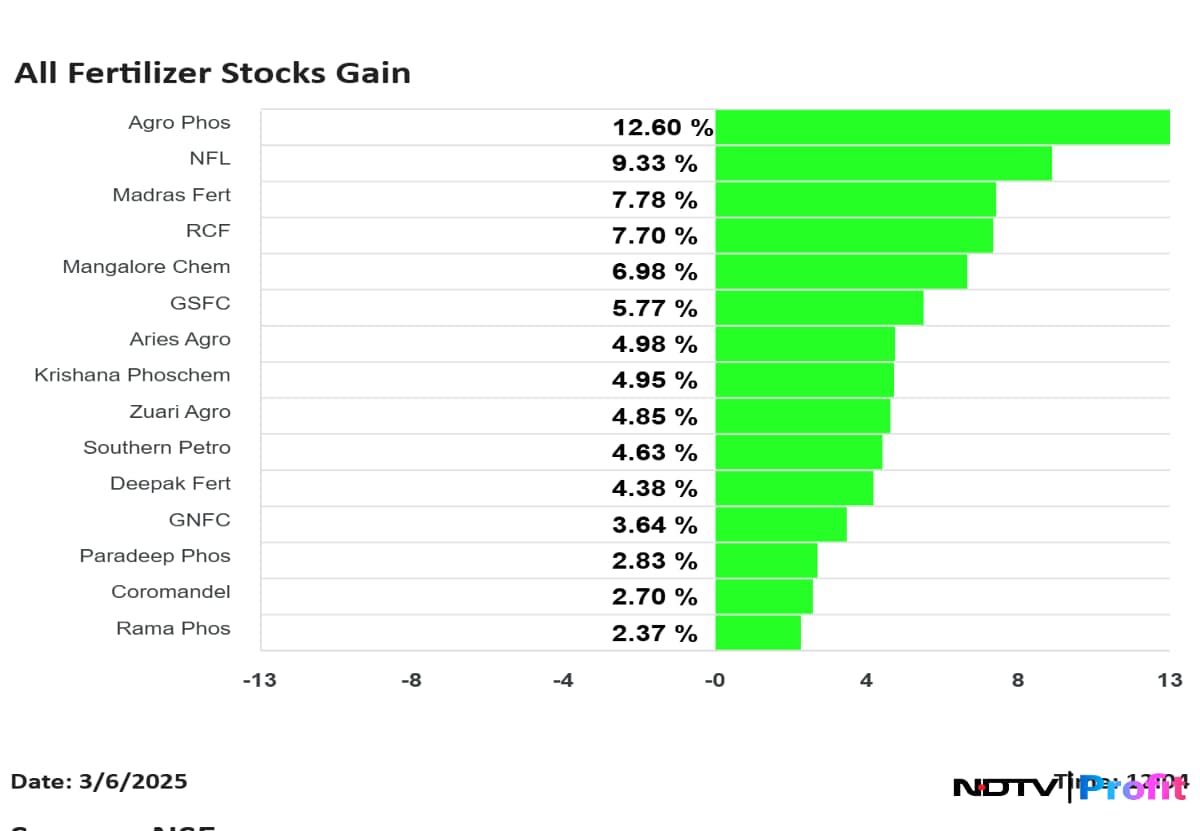

The rally was led by Agro Phosphate Ltd., which surged 19.93%, followed by Mangalore Chemicals and Fertilizers Ltd. (10.59%) and National Fertilizers Ltd. (10.41%).

Other top gainers included Madras Fertilizers Ltd. (8.54%), Rashtriya Chemicals & Fertilizers Ltd. (9.01%), Deepak Fertilisers Ltd. (7.74%), Khaitan Chemicals Ltd. (5.00%), GSFC (5.45%), Zuari Agro Ltd. (5.65%), and Aries Agro Ltd. (7.46%).

Why The Fertilizer Sector Is Buzzing

Investor sentiment has improved on account of early monsoon forecasts, easing inflation, and positive signals for the upcoming Kharif season. Fertiliser inventory was down 25% year-on-year as of April 2025, sparking concerns about supply shortfalls, which could boost demand in financial year 2026. Moreover, valuations across the sector remain attractive.

FY25 Vs FY24 Growth Snapshot

Deepak Fertilisers: Revenue rose 18%, Ebitda was up 13% and net profit doubled.

Paradeep Phosphates: Revenue was up 19%, Ebitda was up 87%, while net profit was up 5.5 times.

Coromandel International: Revenue grew 9%, Ebitda was up 8% and net profit rose 25%.

National Fertilizers: Revenue fell 16%, Ebitda was down 3%, and net profit grew 23%.

Company Outlooks

Deepak Fertilisers: Growth to be driven by specialty chemicals and upcoming nitric acid and TAN plants at Dahej and Gopalpur (H2FY26).

Paradeep Phosphates: Margins set to improve with new sulphuric acid capacity; Ebitda per ton guidance of Rs 4,500–5,000.

Coromandel: Entering a margin-accretive expansion phase.

GSFC: Financial year 2026 volumes to improve on better utilisation at its Sikka unit and favourable monsoon trends.

Caution Ahead

Despite the rally, Prashant Biyani, vice president at Elara Securities, warns that rising prices of raw materials like rock phosphate and sulphur may pressure margins. He doesn't expect the rally to last for long.

A 15% surge in global DAP prices since the subsidy announcement could offset government support, making DAP less profitable. He notes that stocks like Coromandel, Paradeep, and Chambal have already run up and do not fully reflect the risks to profitability.

Switch To Agrochemicals?

Biyani suggests that investors consider rotating into domestic agrochemical stocks such as Dhanuka Agritech, Bayer Cropscience, Sumitomo Chemical, Rallis India, and Insecticides India. With a normal monsoon, agrochemical volumes could surge sharply over the next 3–4 months, especially after a weak first half of financial year 2025 base.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.