(Bloomberg) -- The analyst who kicked off scrutiny of Adani Group's finances nearly a year ago by terming the conglomerate “deeply overleveraged” has upgraded his view, saying some of the Indian billionaire's firms now have better metrics.

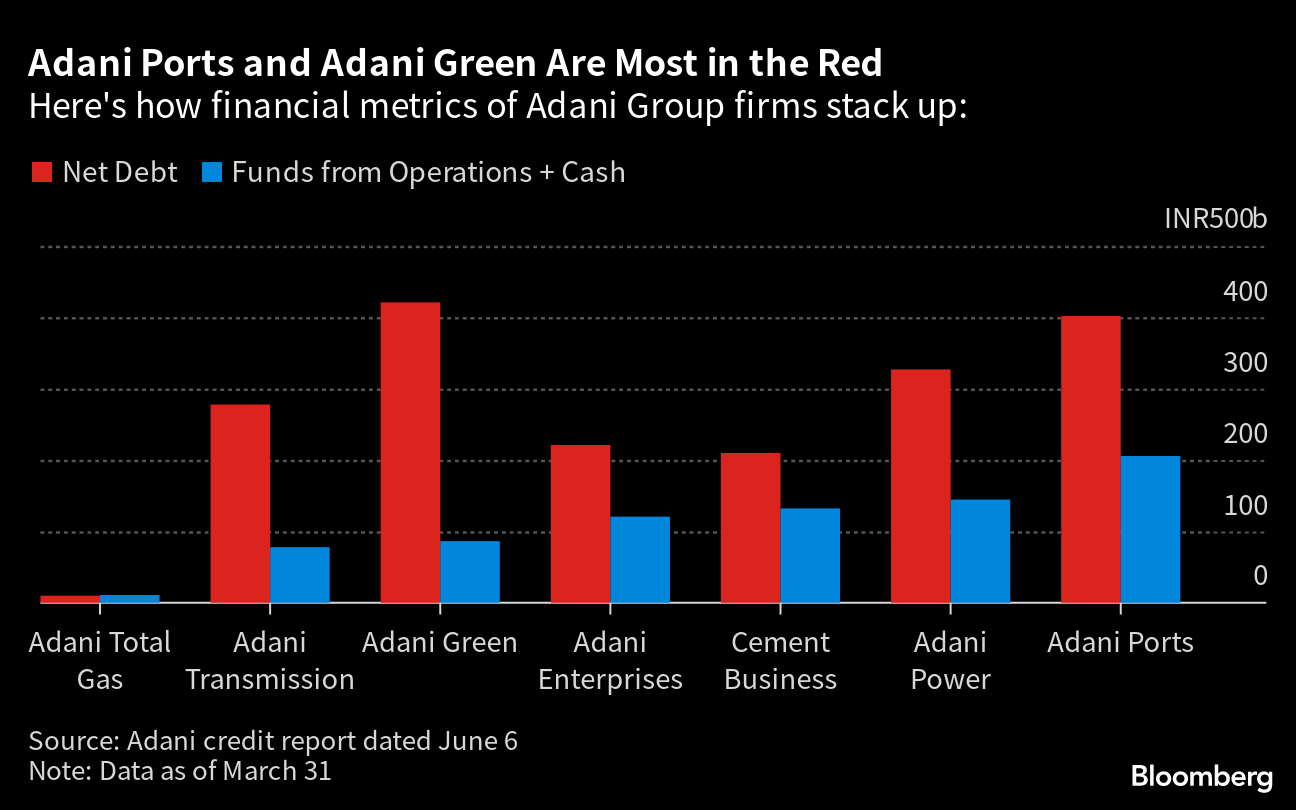

Adani Enterprises Ltd., Adani Power Ltd. and Adani Ports & Special Economic Zone Ltd. have moderate leverage, Lakshmanan R, senior research analyst at CreditSights, told Bloomberg in an email. For Adani Green Energy Ltd. and Adani Transmission Ltd. leverage is still high, he said.

“We have observed an improvement in credit metrics for a majority of the Adani Group companies in FY23 versus FY22, while a couple of them have managed to keep their credit metrics stable or seen only a modest deterioration,” the analyst at the Fitch Group unit said.

He stressed that the CreditSights figures for Adani were still “materially weaker” than those the company itself reported, due to different methodologies.

The fresh assessment comes just hours after the conglomerate published a report saying its net debt to earnings before interest, tax, depreciation and amortization had improved to 3.27 times at the end of March compared with 3.81 times the year before.

Nearly 18% of its gross debt is reserved in the form of cash for liquidity cover, and both domestic and international banks continue to show confidence by disbursing new debt and rolling over existing lines, according to Adani's report, dated June 6.

Shares of 10 companies related to the group were mixed in afternoon trading in Mumbai on Tuesday. Cement firms Ambuja Cements Ltd. and ACC Ltd. were among gainers.

As for the group's dollar bonds, 11 of the 15 outstanding climbed, according to data compiled by Bloomberg.

Scrutiny of the conglomerate's finances intensified in January after US short seller Hindenburg Research accused it of inflating revenues and manipulating stock prices. Adani has repeatedly denied both Hindenburg's allegations and the assessment by CreditSights.

Indian companies typically treat April to March as a financial year for corporate disclosures such as earnings.

Despite the improving debt metrics, Lakshmanan R said risks remained.

“We are also wary of the Group's lingering corporate governance headwinds,” he said. The research firm also sees “some execution risks to the Group's external fundraising plans that could pose debt refinancing risks for select upcoming debt maturities.”

--With assistance from Ashutosh Joshi.

More stories like this are available on bloomberg.com

©2023 Bloomberg L.P.

Disclaimer: Adani Enterprises is in the process of acquiring a 49% stake in Quintillion Business Media Ltd., the owner of BQ Prime.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.