03_06_24.jpg?downsize=773:435)

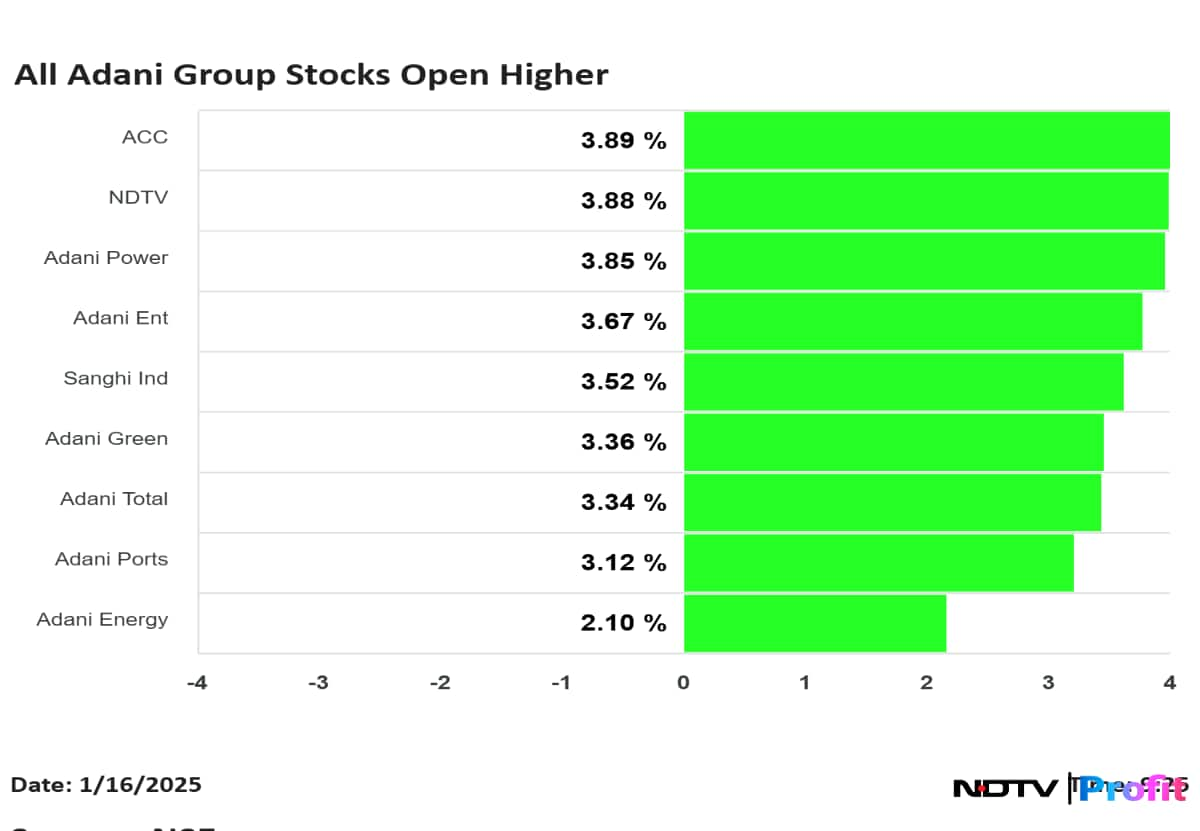

Shares of Adani Group companies surged in early trading on Thursday, with notable gains in Adani Power Ltd. and Adani Green Energy Ltd. The rally continued a positive momentum seen earlier this week, marking a strong performance across the conglomerate's stocks.

The ten listed stocks under the conglomerate added Rs 51,100.62 crore to investors' wealth, taking the market capitalisation between them to Rs 12.79 lakh crore.

Earlier, Nate Anderson, the chief of Hindenburg Research announced that he's disbanding his firm.

Adani Power led the charge, gaining nearly 9% to Rs 598.40 per share, with trading volume spiking to 14 times its 30-day average. The stock's rise comes as investors appear to be responding favorably to the company's growing momentum.

Adani Green Energy also experienced strong gains, climbing nearly 9% to Rs 1,127 per share. The stock's relative strength index stood at 52, indicating balanced momentum. Both Adani Power and Adani Green benefitted from bullish sentiment surrounding the Adani Group, with shares of Adani Ports & Special Economic Zone Ltd. also advancing by 5.41%.

The rally in Adani Green's stock is particularly significant as the company reported impressive growth in its operational capacity. For the nine months ending in December, Adani Green's operational capacity grew 37% year-on-year, reaching 11,609 MW. The company added 2,693 MW in solar capacity and 438 MW in wind power during the period. Additionally, energy sales rose 23%, totaling 20,108 million units.

Adani Green's strong performance was also supported by solid operational metrics. Its solar portfolio recorded a capacity utilization factor (CUF) of 23.5%, and the wind portfolio's CUF stood at 29.2%. The hybrid portfolio's CUF reached an impressive 39.8%, with high plant availability across the board.

Shares of Adani Enterprises Ltd., the group's flagship company, also rose by over 7% to Rs 2,570 per share, with analysts maintaining a positive outlook. Four analysts on Bloomberg continue to recommend a "buy" rating for the stock, reflecting the market's optimism surrounding the group's prospects.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.