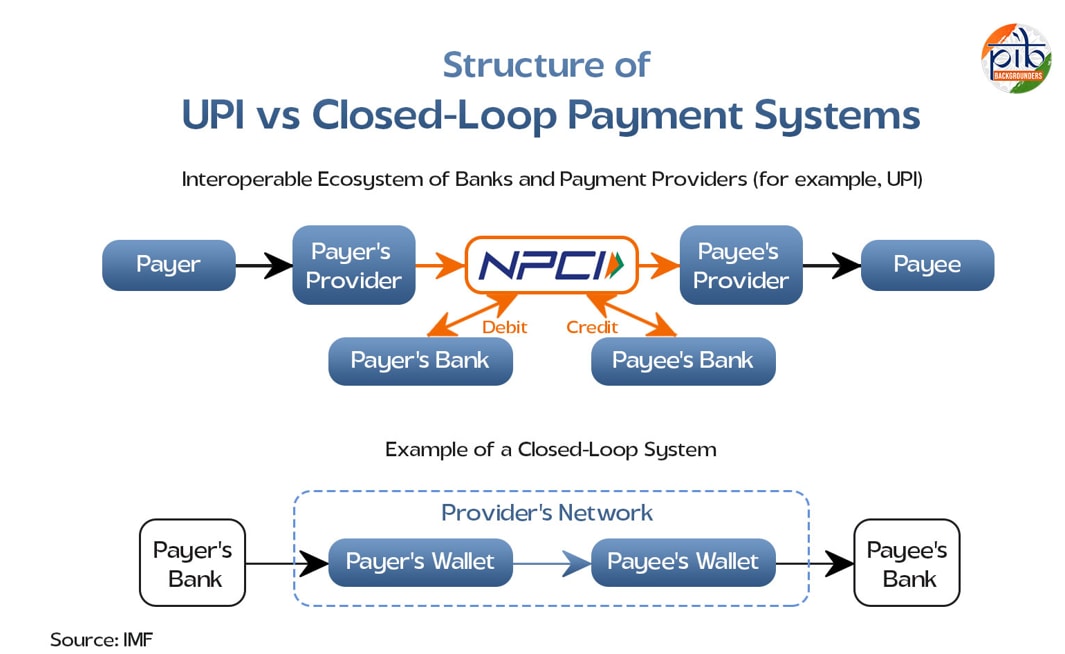

India has emerged as the global leader in fast payments, according to a note by the International Monetary Fund, "Growing Retail Digital Payments: The Value of Interoperability. At the heart of this transformation is the Unified Payments Interface, better known as UPI.

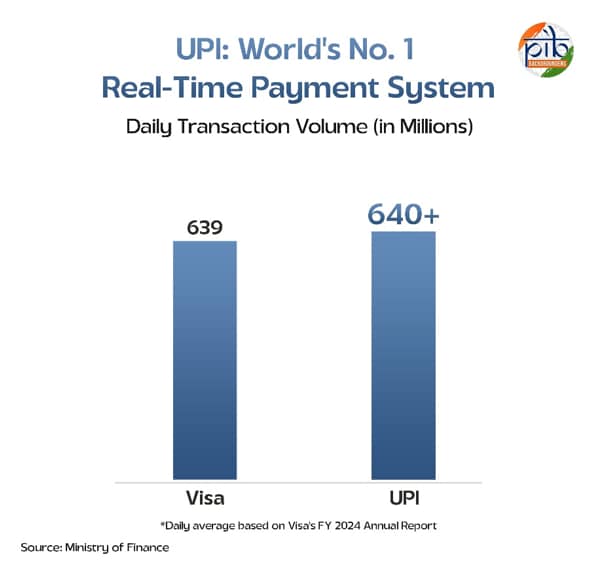

India's Unified Payments Interface is also now the world's number one real-time payment system. It has surpassed Visa to take the lead in processing daily transactions, according to a backgrounder by the Indian government. UPI handles more than 640 million transactions every day, compared to Visa's 639 million. This scale is extraordinary, especially when you consider that UPI achieved it in just nine years, the note states.

UPI now accounts for almost 50% of transactions globally, given it is an open and interoperable system built for speed and simplicity.

Since its launch in 2016 by the National Payments Corporation of India, UPI has changed how people send and receive money in the country.

It brings all your bank accounts together in one mobile app. You can transfer money instantly, pay merchants, or send funds to friends with just a few taps. Its appeal lies in its speed and ease of use.

It allows people to send and receive money even if they use different banks or apps. For this to happen, all parts of the system must follow common rules. These include technical standards, so the software works together, clear ways to interpret shared information, and agreed rights and responsibilities for everyone involved.

This shift has taken India away from cash and card-based payments and pushed it towards a digital-first economy. Millions of individuals and small businesses now rely on UPI for safe and low-cost transactions. By making payments quick and accessible, UPI has become a powerful tool for financial inclusion.

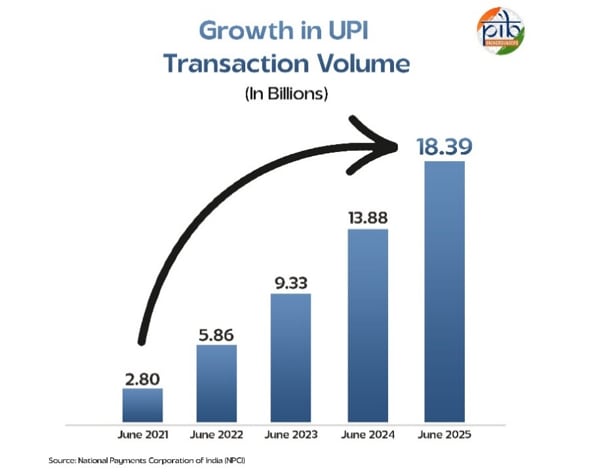

Today, UPI processes over 18 billion transactions every month in India.

UPI In Figures

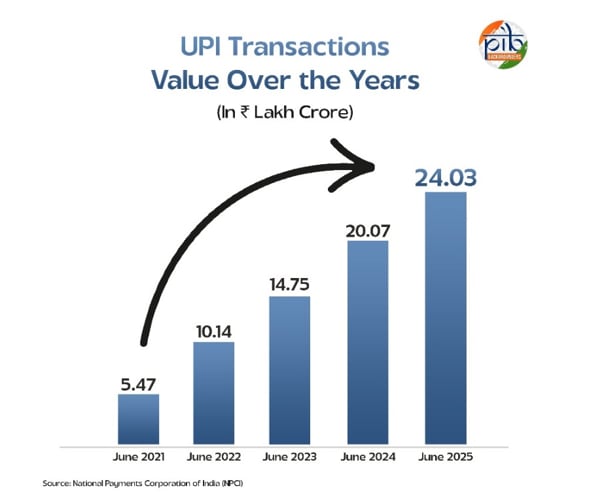

In June 2025 alone, it handled over Rs 24.03 lakh crore in payments. This was spread across 18.39 billion transactions. Compared to the same month last year, when there were 13.88 billion transactions, the growth is clear. There is an increase of about 32% in just one year.

The UPI system now serves 491 million individuals and 65 million merchants. It connects 675 banks on a single platform, allowing people to make payments easily without worrying about which bank they use.

Today, UPI accounts for 85% of all digital transactions in India.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.