.jpg?downsize=773:435)

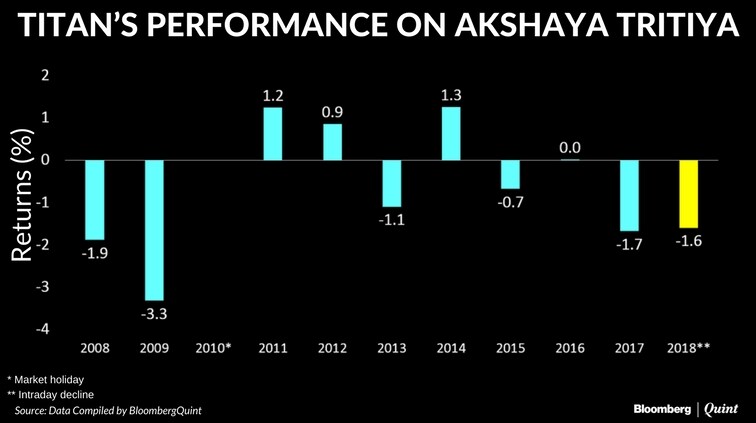

Titan Company Ltd., India's largest maker of branded jewellery, has often disappointed investors on Akshaya Tritiya.

The stock fell as much as 1.6 percent, the most in 10 days, in today's trade. In the last 11 years, it rose only thrice on the day considered auspicious to buy gold, according to data compiled by BloombergQuint.

Ahead of Akshaya Tritiya, India's gold imports fell nearly 41 percent on a yearly basis in March, according to data released by the commerce ministry on April 13. And though formalisation of the economy after the implementation of the Goods and Services Tax has helped companies like Titan, consumption has declined since the note ban.

The recent surge in prices also hurt demand. Gold has risen 7.6 percent so far this month to $1,344.19 an ounce in the global market. Spot gold on the Multi Commodity Exchange was 0.3 percent at Rs 31,192 for 10 grams at 2:15 p.m.

(Akshaya Tritiya dates are based on BSE notifications)

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.