Siemens Ltd.'s shares slipped over 2% on Monday after Bank of America Global Research warned that the company is giving away a high-value segment that had been a key driver of growth. The brokerage also flagged elevated valuations, noting that the demerged entity is trading at over 52 times forward earnings — well above its 10-year average.

The comment came in a note adjusting the brokerage's target price to Rs 2,450 apiece from Rs 4,350, in line with the stock's post-demerger price realignment.

Following its demerger scheme, Siemens allotted 35.6 crore equity shares in a 1:1 ratio on April 15. The move carved out the company's energy division into a separate listed entity, Siemens Energy India Ltd., effectively halving the stock price of Siemens.

BofA retained an ‘underperform' rating, according to its note from Thursday, flagging that the now-separated energy segment had contributed 37% of order inflows, 31% of revenue and 35% of Ebitda in the fiscal year ended March 2024.

Post demerger, BofA expects Siemens to grow earnings at a slower pace — 11% compound annual growth rate through the fiscal year ending March 2027 — compared to 26% for the carved-out energy business.

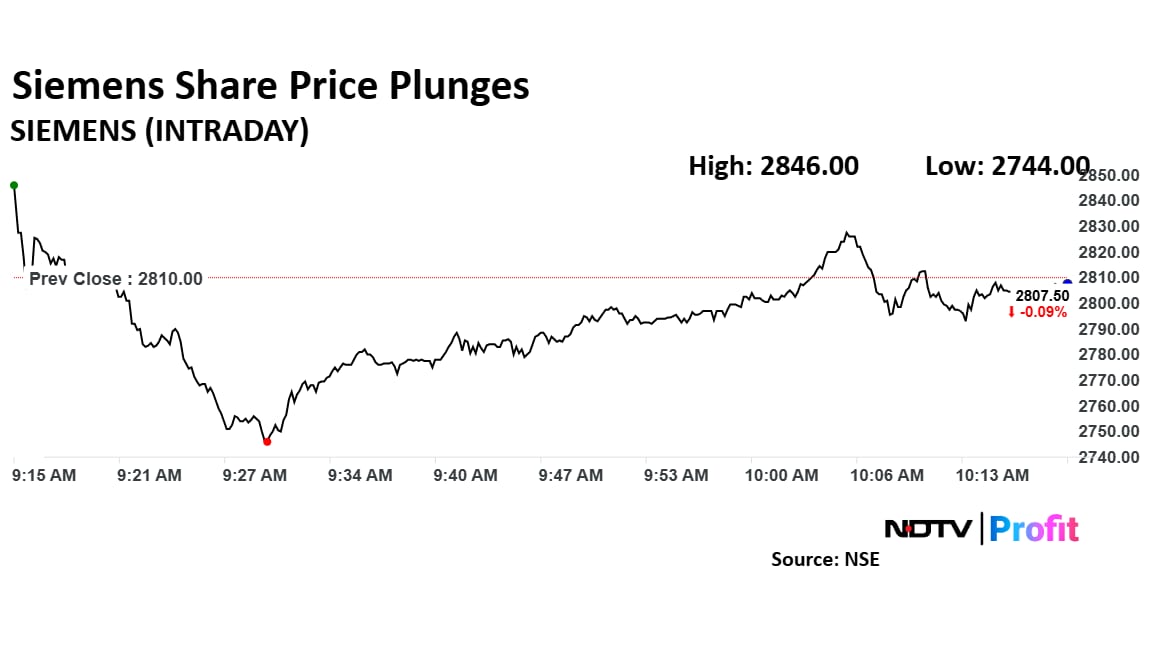

Siemens Share Price Today

Siemens stock fell as much as 2.35% during the day to Rs 2,744 apiece on the NSE. It was trading 1.05% lower at Rs 2,780.5 apiece, compared to a 0.72% advance in the benchmark Nifty 50 as of 10:19 a.m.

It has fallen 2.2% in the last 12 months and 13.77% on a year-to-date basis. The total traded volume so far in the day stood at 1.5 times its 30-day average. The relative strength index was at 58.87.

Fifteen out of the 25 analysts tracking Siemens have a 'buy' rating on the stock, five recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 3,535.41, implying an upside of 26.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.