SBI Cards & Payment Services Ltd.'s share prices rose over 5% after Nuvama and Nomura upgraded the stock's rating to a 'buy'. The upgrade is attributed to improving credit cost outlook and benefit from potential interest rate cuts. The stock previously had a 'reduce' rating.

Nuvama increased its target price to Rs 850 from Rs 620 per share. This implies a potential upside of 17.5% over Friday's close of Rs 723. Nomura, too, raised its rating to 'buy' with a target price of Rs 825, seeing a 17.4% return potential over Thursday's close.

The brokerage cited asset quality improvement and potential rate cut-driven re-rating likely in near term. Over the past two years, the company has consistently missed earnings expectations due to rising credit costs and limited signs of a turnaround.

Credit costs peaked in the second quarter of fiscal 2025 and are expected to remain stable in the third quarter, Nuvama said. It should start improving in the January-March period.

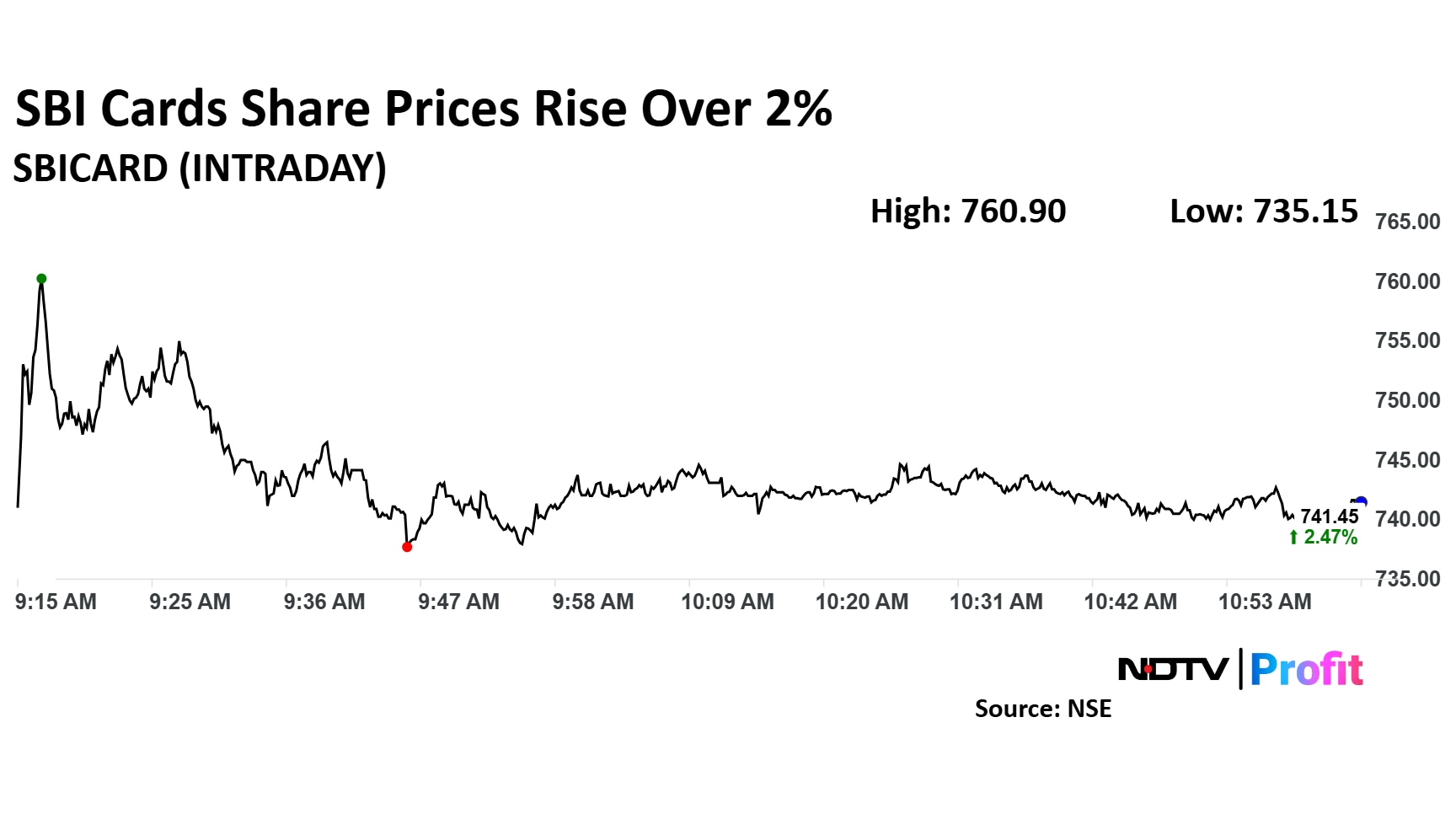

SBI Cards Share Price Today

SBI Cards stock rose as much as 5.16% during the day to Rs 760 apiece on the NSE. It was trading 2.47% higher at Rs 741.45 apiece, compared to a 0.67% decline in the benchmark Nifty 50 as of 10:53 a.m.

It has fallen 3.25% in the last 12 months. Total traded volume so far in the day stood at 13 times its 30-day average. The relative strength index was at 65.23.

Seven of the 27 analysts tracking the company have a 'buy' rating on the stock, nine recommend a 'hold' and 11 suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 705.88, implying a downside of 4.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.