061020.jpeg?downsize=773:435)

RBL Bank Ltd. on Tuesday clarified on media reports about Emirates NBD eyeing a controlling stake in the Mumbai-based private Indian lender.

The bank said it is on a growth trajectory and routinely explores opportunities aimed at enhancing shareholder value. However, such discussions do not warrant a disclosure under SEBI rules at this stage, a stock exchange filing said.

"We adhere to the highest standards of governance and disclosures, and will keep the stock exchanges informed of any material events as required under regulations," it said.

Dubai-based Emirates NBD will acquire around 60% stake in RBL Bank for approximately $3 billion, the persons privy to the development told NDTV Profit on Monday, adding that the transaction is expected to be announced soon.

According to sources in the know, this will be done entirely using the fresh equity issuance route, meaning that the entire capital will be directly infused into the bank. The transaction will be conducted through the Indian wholly-owned subsidiary of Emirates NBD, after which it will be merged into RBL Bank. This is the first such transaction being worked on in India.

While the Reserve Bank of India has not budged on its 26% voting rights cap in this deal, it will likely allow Emirates NBD to acquire and keep its majority stake in RBL Bank. Considering its dispersed ownership, Emirates NBD is confident that no major resolutions can be passed without the Dubai-based lender saying so.

Notably, the board will meet on Oct. 18 to consider and approve the financial results for the period ended Sept. 30, 2025.

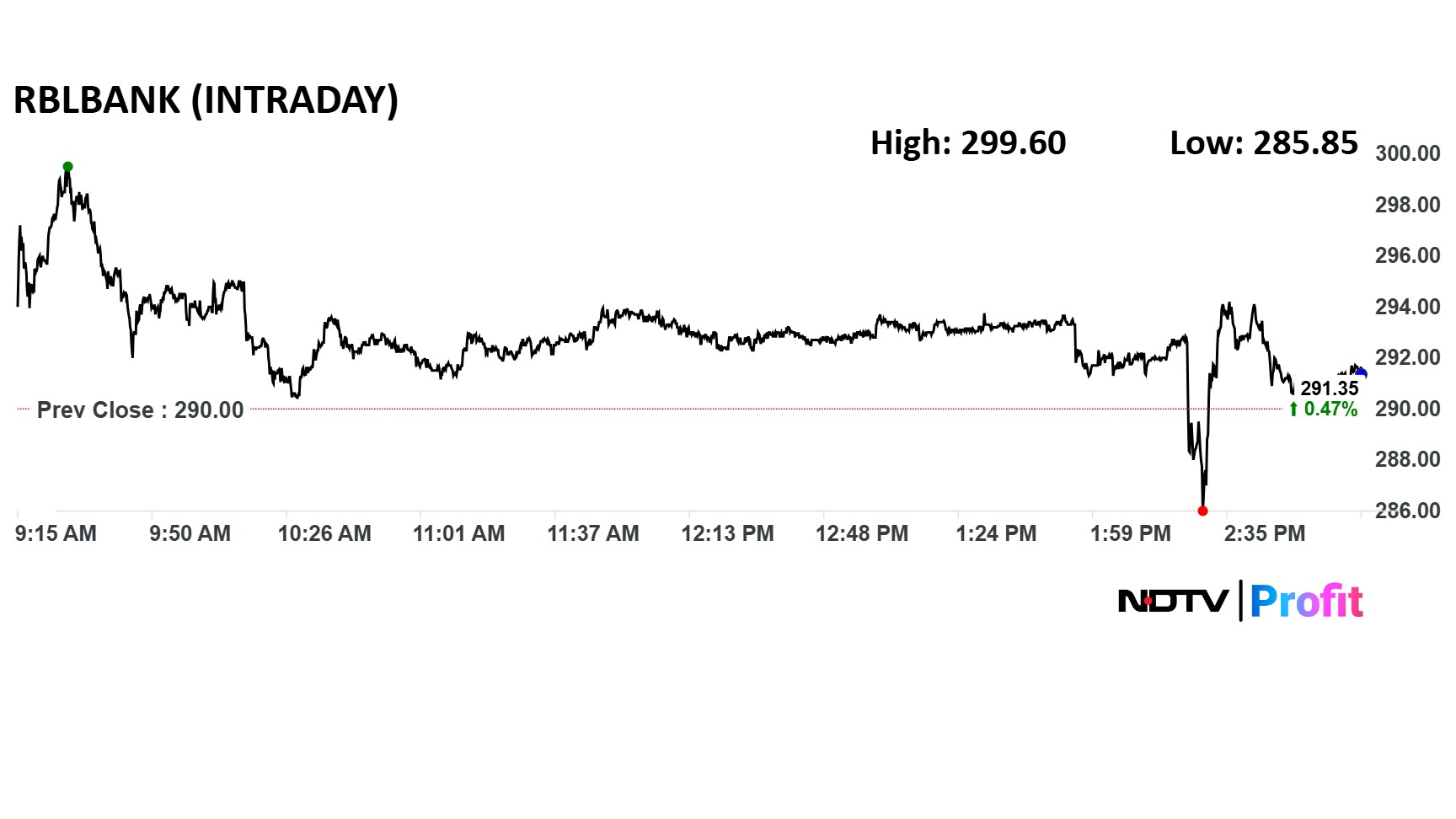

RBL Bank shares rose during early trading hours on Tuesday, before giving up gains. The stock has risen 42% in the last 12 months and 86% on a year-to-date basis.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.