The number of Indians who made high-value transactions but didn't file tax returns fell by half in 2017 as the government increased monitoring of financial data.

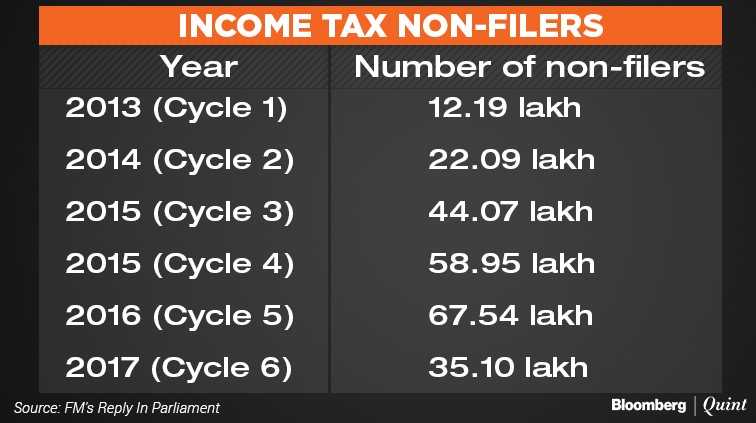

About 35 lakh people failed to file tax returns in 2017 versus 67.54 lakh a year ago, Finance Minister Arun Jaitley informed Parliament today.

The Income Tax Department set up a Non-Filer Monitoring System that collects and analyses data received from statements of financial transactions, tax deduction at source, and tax collection at source to identify individuals or entities that made high value financial transactions but didn't file returns.

There is nothing unusual in the fall in the number of non-filers, Rahul Jain, partner-direct taxes at Nangia & Co Chartered Accountants, told BloombergQuint. “Since people receive notices from the Income Tax Department after making high-value transactions, they generally tend to file returns because they know they are under the taxman's radar.”

Over 1.72 crore returns were filed by the persons identified in different monitoring cycles and self-assessment tax of about Rs 26,425 crore was paid by them up to December, Jaitley said.

The department has set up a Compliance Management Cell for sending letters and capturing responses from non-filers. Notices for filing returns are issued in appropriate cases, Jaitley said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.