Following a muted earnings performance by the Indian information technology pack in the fourth quarter, the near-term demand outlook remains under pressure, according to Jefferies. Yet, this may be an opportune time to earn returns in the long term.

Amid steep spending cuts by the clients, Indian technology companies may witness profitability pressures, even as consensus revenue estimates for top clients of IT firms—on an aggregate basis—remain broadly unchanged year to date, the brokerage said in a May 17 note.

"Barring HCL Tech Ltd., aggregate CY23 PAT margin estimates for clients of all firms have seen cuts, with the steepest cuts for Infosys Ltd., followed by Tech Mahindra Ltd., Wipro Ltd., and Tata Consultancy Services Ltd.," Jefferies said.

But a comparison of change in revenue growth expectations for IT firms and their top clients in FY24/CY23 vs FY23/CY22 suggests that Coforge Ltd., Wipro and LTIMindtree Ltd. are at a greater risk of negative surprises on FY24 growth, according to the note.

However, current levels offer a good chance to earn reasonable long-term returns, as the environment normalises, according to Quantum Mutual Fund.

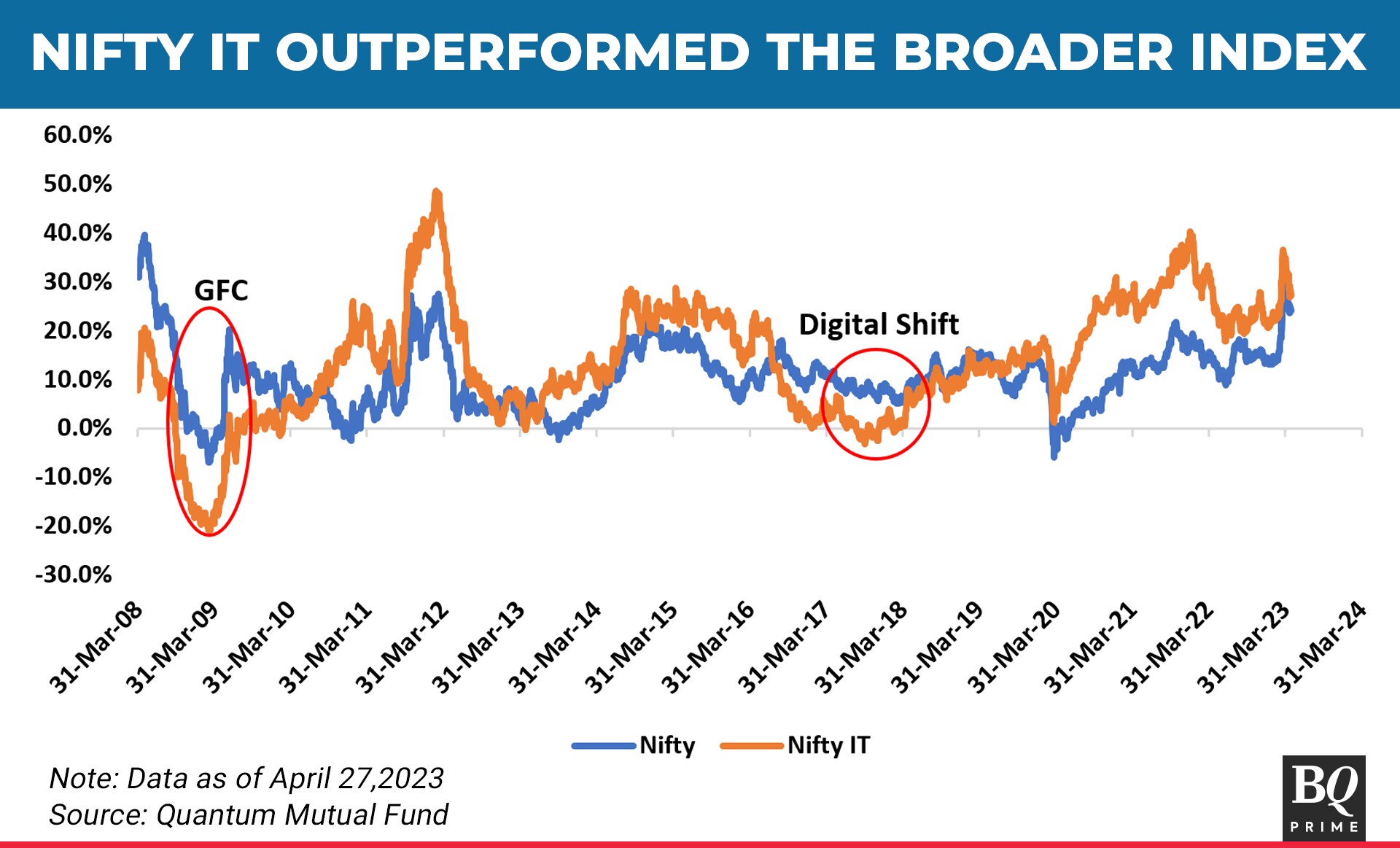

The current environment looks "better" seen from the context of the period after the global financial crisis in 2009, and the growth slowdown during CY17-19 amid digital adoption, it said.

Despite an expected downturn in demand for IT services, after the global financial crisis, pent-up demand picked up "significantly in the subsequent quarters, triggering a rally in IT stocks", Quantum Mutual Fund said.

Between 2017-19, IT companies went through a rough patch during the advent of digital adoption. The popular belief was a permanent slowdown in growth rates, due to falling maintenance spend following cloud adoption and automation, it said.

"While Indian IT firms slowed down during the initial phase of digital adoption, they picked up significantly in the subsequent period, as the implementation stage kicked in. Rising U.S. protectionism was another factor that impacted Indian IT companies in the same period. Indian firms overcame by opening more near-shore centers and ramping up local hiring," Quantum Mutual Fund said in its note.

Historically, Nifty IT has outperformed broader markets, barring periods of disruption. The average three-year rolling Compound Annual Growth Rate of Nifty IT since FY09 stands at 13.7%, as compared with the Nifty's 10.4%.

Technology spend is likely to increase in the long term, it said. "Low penetration of Indian IT services leaves ample room for reasonable growth in the coming decades."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.